From ZH:

As Rabobank's Michael Every writes this morning, "nobody is going to get excited about any economic data until Thursday’s US CPI report" and he is of course correct, so instead of analyzing real-time data Wall Street has taken on to building scenarios and forecasts what to expects at 830am ET tomorrow and how the market will react to it.

Perhaps the most succinct summary of the big picture ahead of what may be the most important CPI print in years - one which could push the Fed to hike 50bps in March if we get another sizable beat - comes from BofA's trading desk which writes that we are approaching the "CPI print tomorrow with a palpable sense of 'if not terrible, Tech rips.' Felt like we are pre-trading that notion into it…so that dynamic may have been pulled forward."

To be sure, one reason for "CPI miss" optimism ahead of tomorrow's print is just mean-reversion exhaustion: as DB's Jim Reid recently noted "8 of the last 10 CPI releases have seen the monthly headline figure come in above the consensus estimate on Bloomberg" so purely statistically one would expect that Wall Street's "experts" have gotten tired of being always wrong and may well be overly aggressive ahead of tomorrow's number.

That may explain why overnight JPM trading desk writes that "increasingly, there are whispers that Thursday’s CPI will print below expectations" although it hedges that "if CPI is inline or higher, then we may see the 10Y make a run at 2.00%, or higher."

Picking up on this, JPMorgan's Head of US Cash Trading, Elan Luger writes that “the CPI print this Thursday is getting more hype than any economic data in recent memory. Though I am still not intermediate or long term bullish on markets (in a nutshell I still think if growth holds up, Fed will keep hiking; good news will be met with a more hawkish Fed and bad news is well… bad news), it does feel to me like the risk/reward is skewed to the upside for CPI.

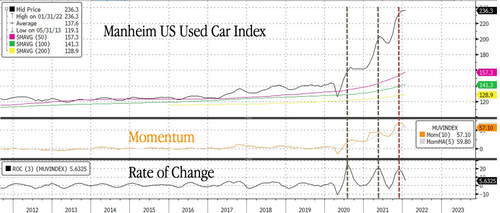

As Luger notes, after the most recent fed meeting it is clear that incoming inflation data is the only variable that matter for the Fed. "Core CPI upside has been driven primarily by rising auto and, to lesser extent, apparel and furniture prices, while transportation services costs and shelter prices growth continues to creep higher" and indeed as noted earlier, we may have hit another local maximum in used car prices...

... although we saw a similar headfake in the summer of 2021, only to see prices rocketing even higher.

Luger - as is customary for all JPM traders - takes the more optimistic view and writes that "real time data suggests used car prices have rolled over a bit. So net to me – with market expecting a hot inflation print and some signs pointing to a potential miss. I don’t think market goes down as much on higher CPI as it would go up on a miss. So tactically bullish for a few days here.”

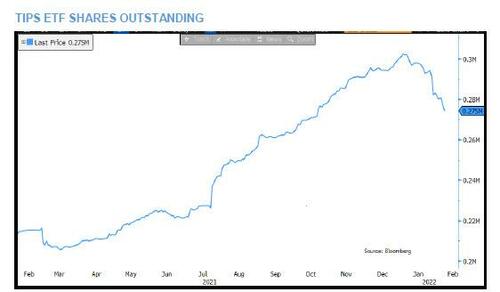

While it remains to be seen if this view is accurate, a look at recent TIPS flows suggests that both Retail and Institutional investors share the view that inflation may be peaking here...

....MUCH MORE