China, China, China.

The S&P is up 79 points, the DJIA is up another 429, bringing the two day total to 1076 points

From ZeroHedge, 07:59 AM EST:

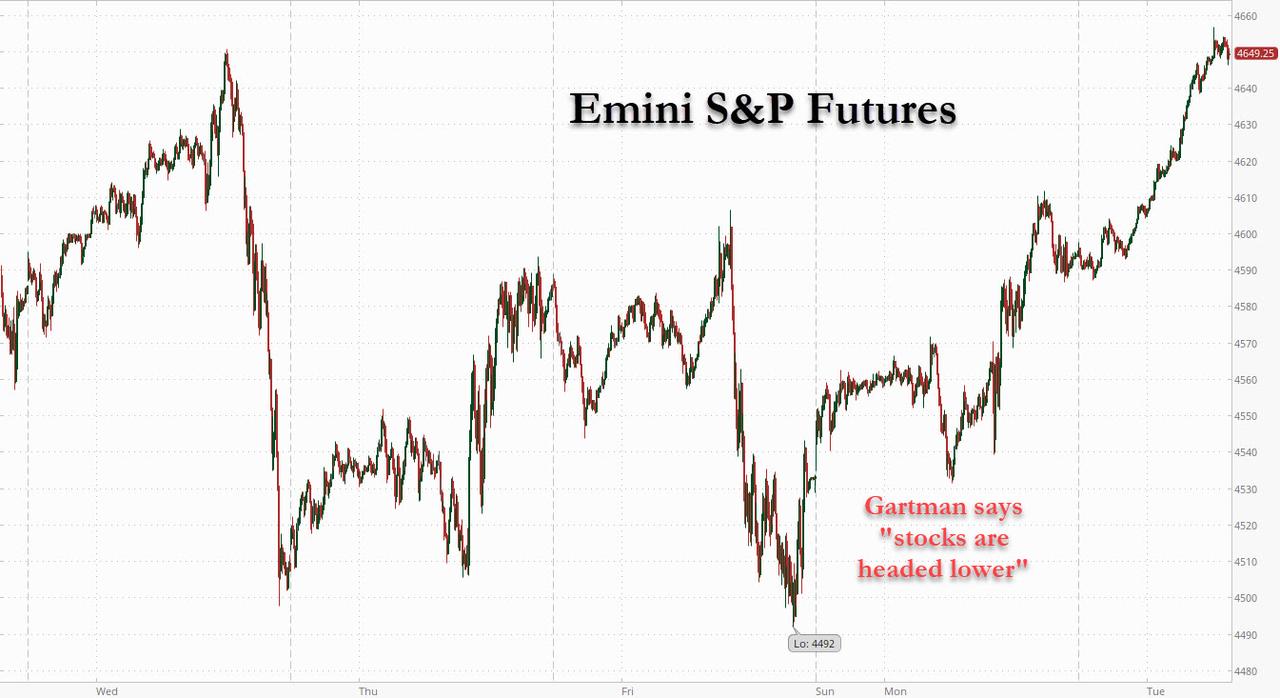

U.S. index futures rallied, led by gains for Nasdaq 100 contracts, amid waning omicron worries and a booster shot of Chinese stimulus lifted world stock markets and oil on Tuesday and left traders offloading safe-haven currencies and bonds for the second day in a row. Emini S&P futures were up 61 point to 4,650.75 or about 120 points higher then where Gartman said "stocks are headed lower" some 24 hours ago. Nasdaq futures were up 1.8% and Dow futures rose 1% in premarket trading. In fact, futures are now just 50 points away from where they were below the Black Friday Omicron panic plunge.

The FTSEurofirst 300 index was on track for its first back-to-back run of plus 1% gains since February while Asia saw record bounces from some of China's biggest firms such as Alibaba which soared by the most since its 2019 listing in Hong Kong, leading a rebound in Chinese tech stocks, as bargain hunters piled in amid improved sentiment following Beijing’s move to bolster the economy. The MSCI Asia Pacific Index climbed 1.7% while Japan’s Topix index closed 2.2% higher. The VIX dropped for a second day, sliding below 24, but remained above this year’s average.....

***

....The gains also came after China's central bank on Monday injected its second shot of stimulus since July by cutting the RRR - or the amount of cash that banks must hold in reserve. Then on Tuesday, the PBOC said that the Interest rate for relending to support rural sector and smaller firms will be cut by 0.25 percentage point, effective from today, with 3-mo, 6-mo and 1-yr relending rates will be cut to 1.7%1.9% and 2%.

After pretending it would let the economy falter for months, Beijing is finally firmly in pro-growth mode with the Politburo stating that stability is the top priority ahead of next year’s Communist Party congress. Premier Li Keqiang also said China has room for a variety of monetary policy tools after yesterday’s reserve ratio cut. As a result, the beaten down financial and property stocks were the biggest winners amid the change in tone from policy makers. In Hong Kong, Alibaba Group Holding Ltd. soared by the most since its 2019 listing. Global markets are also getting a lift from the easing policy pivot in world’s second-largest economy which we first flagged more than a weeks ago....

....MUCH MORE