One month ago, just after all the Wall Street banks come out with glowing year-ahead outlooks and market forecasts, we observed a funny irony: the arrival of a new covid strain threw everyone in for a loop, one which would only get much worse a few weeks later when Biden's Build Back Better stimulus collapsed....*****.... Since then things been a little embarrassing for the likes of Goldman (and most of its peers) which promptly slashed its GDP forecast over the weekend to just 2.0% from 3.0% and from much higher earlier in the year.However, one strategist who isn't concerned about how to revise his 2022 outlook, is SocGen's in-house bear, Albert Edwards for the simple reason that he sees nothing but pain in the coming year.

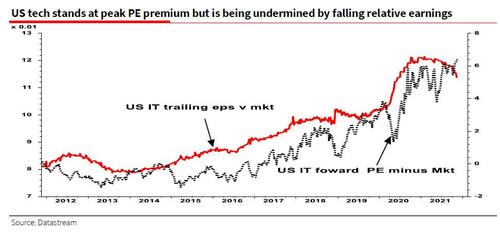

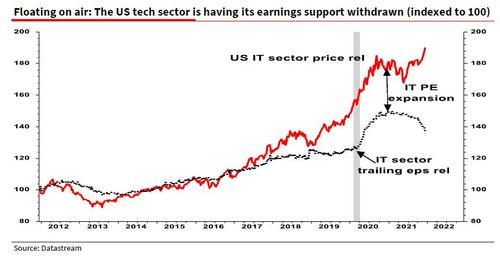

As a reminder, two weeks ago Albert penned a rather doomsday forecast about the future of the market-leading "generals", the FAAMGs, or as they are better known now, the GAMMA stocks, warning that despite the sharply declining EPS of the broader IT sector, the FAANGs continue to trade at a "nosebleed PE valuation at 30x which looks vulnerable vs the market’s 22x - the widest gap since the Nasdaq bubble." This is happening just as forward IT PEs are starting to rerate lower.

Fast forward to this week when Albert summarizes the current market state as follows: "as we end the year, markets are becoming increasingly nervous that US equities – and the US tech sector specifically – are having the rug pulled out from under them. Market internals are also giving out loud warnings. Just as in 2001, could the unraveling of the recent tech bubble trigger the Vortex of Debility that destroys all before it?"

Picking up on his recent warning, Edwards writes that the US tech sector that has so dominated this bull market in one form (the IT sector) or another (the FAANGs) "seems to be pretty invulnerable in the face of some of the major threats it is now facing. But we have seen a similar Vortex of Debility before, most recently just ahead of the Lehman bankruptcy and written up here by Paul Murphy at the FT."

How does that play into the SocGen strategist's year-ahead outlook?

Well, as he notes "it’s the time of year when strategists publish huge tomes to give their year-ahead views" but, he adds, "readers will be relieved to know that I can summarize my 2022 outlook in a few lines" and four surprises.

As the first "big surprise" of the coming year, Edwards expects that equity markets will startle most investors when they "fall sharply as US tech unravels in the first half." Presenting a slightly different chart from the one he showed two weeks ago, Edwards then addresses the elephant in the room, namely the FAAMGs again, and writes that "unsupported by earnings growth (see chart below) and with poor market breadth (see inside), it may not be higher bond yields that burst this tech bubble."

Edwards then echoes what Morgan Stanley's Mike Wilson said last week, and lays out what he believes will be the "second surprise" for next year: if an all-out equity bear market unfolds, "investors will find that while the Powell Put still exists, the strike price may be a lot lower for equities than it was at end 2018." This is almost a carbon copy of what Wilson said last week when he predicted that "the Fed put still exists but the strike price is much lower now, in our view. If we had to guess, it's down 20% rather than down 10% unless credit markets or economic data really start to wobble."

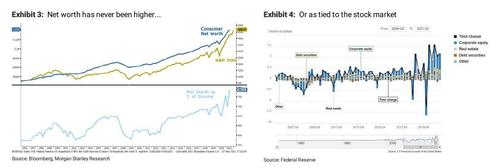

Why? Because as Edwards explains, "policymakers globally now understand that QE creates as many problems (mainly distributional) as it solves, and that fiscal policy must do more of the stimulus work." He then asks a rhetorical question: "Would the Fed really hold back if the S&P was down 30% plus? And wouldn’t that be one huge surprise for investors?." Here we disagree with Edwards: it is our view is that no matter what, the Fed will always panic when stocks are down 15-20% - after all so much of the US wealth effect and household net worth is now tied into stocks, that Powell will not dare risk an all out collapse...

... but maybe this time is truly different.

His "third surprise" may be, well, the most surprising - Edwards expects that easing supply bottlenecks combine with soggy commodity prices to drive US headline CPI inflation back well below 2% (this is also the inventory glut thesis floated by Morgan Stanley and Deutsche Bank). Hence, the SocGen skeptic expects "current inflation fears to evaporate as H1 unfolds and bond yields to decline sharply."....

....MUCH MORE

Over the years we've had some fun at Albert's expense. As noted in a 2017 post:

Every time I am asked why we post on Mr. Edwards "when he's been wrong

so often" I debate whether to explain or just give a glib answer.

The flippant rationale would be we get to go with headlines such as:

Société Générale's Albert Edwards Descends Into A Nightmare World of Dream Demons and Market Depravity

Société Générale's Albert Edwards: "Many Think I am Mad..."

Société Générale's Albert Edwards Sees Blue Skies, Sunshine, the Lame Shall Walk Again

Of course it's possible I have misinterpreted the meaning of

"the US economy is on crutches, and they are about to be kicked away"

Société Générale's Albert Edwards Has Some Troubling News He Reluctantly Shares

Société Générale's Albert Edwards Not His Usual Jolly Self (II)

Société Générale's Albert Edwards: "I Have Been Wrong – I’ve Been Too Bullish"

It May Be Time To Put Société Générale's Albert Edwards On Suicide Watch

Société Générale's Albert Edwards: Cry Havoc and Let Slip the...Ah Screw it

In other news...

Société Générale's Albert Edwards: We Are Doomed

Société Générale's Albert Edwards Not His Usual Jolly Self

"Société Générale's Albert Edwards: 'Equity Investors Are In A Vulcan Death Grip And Are About To Fall Unconscious"' (September 2010)

And many, many more.

The straight-up answer is: I can't think of anyone else who nailed the

deflationary bias in credit markets as well as he has for as long as he

has, pretty much the last 15-20 years.

And as far as equities go, absent the extraordinary measures of the

world's central banks the landscape would look very, very different.

The biggest criticism you can lay on the guy is he didn't realize what he was up against re: the powers that be.

Plus that whole Albert-in-the-bathtub period was just stupid.

You do have to be careful you don't personally get into a David

Koresh/Jim Jones-Drink-the-Kool-Aid frame of mind when gazing upon the

dark side, whether Albert or Ambrose Evans-Pritchard or Jim Chanos. I

mean it's okay to play around with melancholy:

Music For Albert Edwards. On A Cold Day. In February

In F flat minor.*

And it's raining.

Season's Greetings From Société Générale's Albert Edwards (Nov. 14, 2012)

Expect the New Year to bring nothing but disappointment....

But be attuned to when to take Mr. Edwards with utmost seriousness.

On September 5, 2008 we posted "Meltdown"-Société Générale" which linked to Albert's research note of a couple days earlier:

A good call.

On September 7, 2008 Fannie Mae and Freddie Mac were placed into conservatorship.

On September 14, 2008 Merrill Lynch agreed to be acquired by Bank of America to avoid a Reg. T shut-down when markets re-opened.

On September 15 Lehman filed their bankruptcy petition.

On September 16 AIG became a 79.9% subsidiary of the U.S. Treasury.

Within 10 more days the Nation's largest thrift, WaMu was seized and five days later Wachovia gobbled up.

Good times, good times.

So take what you can use and make dumb headlines with the rest