Right now, what is going on in China is so massively important to markets that it makes speculations about dot-plots and other Fedstuff almost a sideshow.

From ZeroHedge:

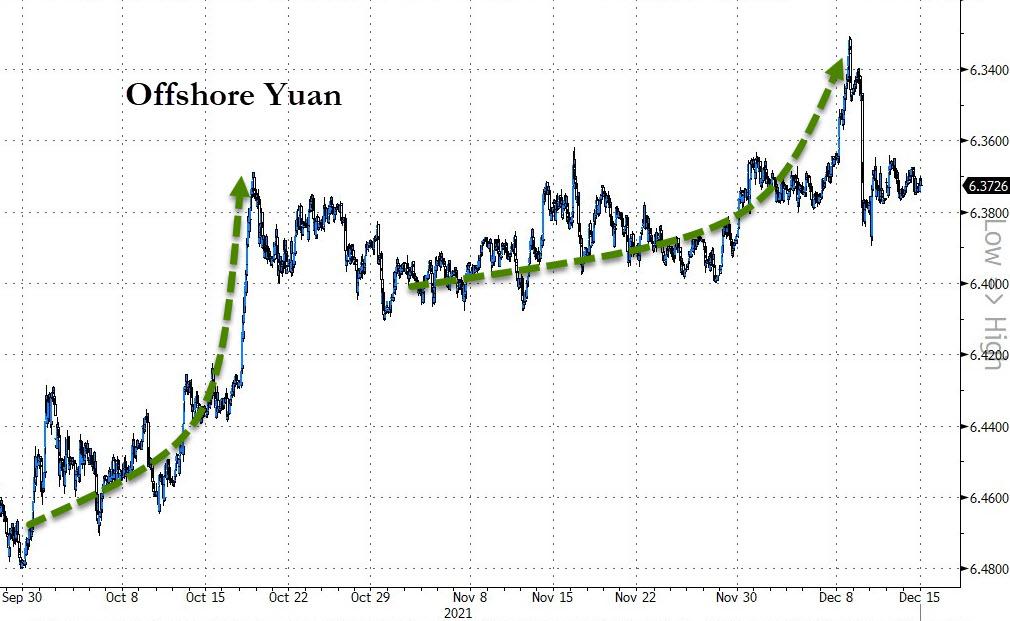

After a bruising couple of strong yuan months, that saw some efforts at devaluation in early December, expectations are for China's avalanche of macro data to continue to show the Chinese economy sliding tonight.

Source: Bloomberg

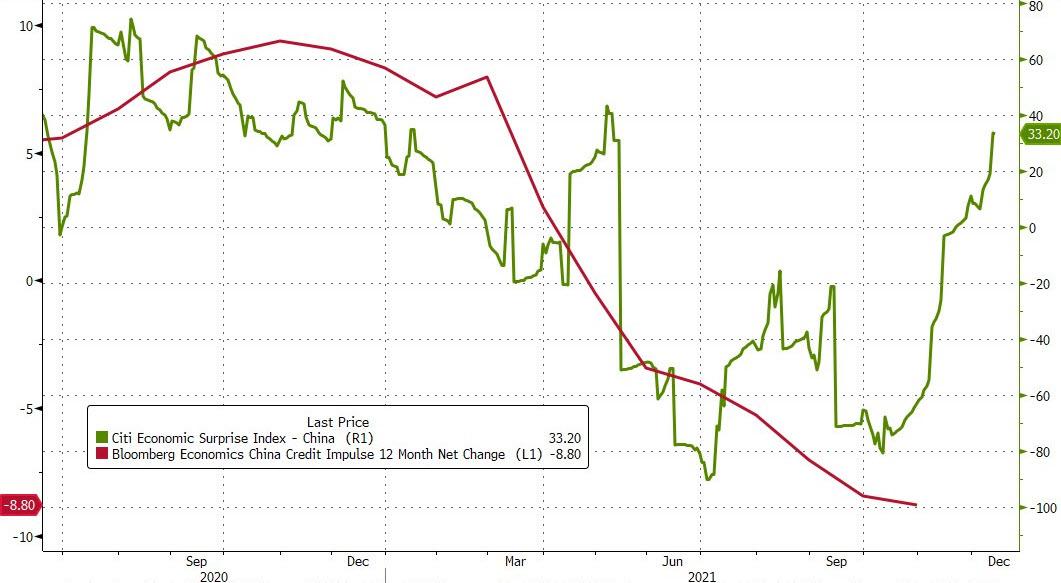

China' macro data has most recently surprised to the upside, notably decoupling from the collapse in China's credit impulse...

Source: Bloomberg

Analysts were very mixed about tonight's data but everything missed expectations:

China Industrial Production YTD +10.1% YoY MISS vs +10.4% exp, WORSE than +10.9% prior

China Retail Sales YTD +13.7% YoY MISS vs +13.8% exp, WORSE than +14.9% prior

China Fixed Asset Investment YTD +5.2% MISS vs +5.4% exp, WORSE than +6.1% prior

China Property Investment YTD +6.0% YoY MISS vs +6.1%, WORSE than +7.2% prior

China Surveyed Jobless Rate 5.0% MISS vs 4.9%, WORSE than 4.9% prior

Ugly - and not like Beijing to allow this level of disappointment...

*****

So, its a miss across the board with retail sales coming in below the lowest of analyst expectations.

Consumption weakened despite support from still strong sales around the “Singles Day” shopping festival, which didn’t help offset the impact of the outbreaks of Covid-19 on consumption of services, restaurant and catering sales, and purchases at physical shops.

The data highlights the downward pressure on the economy from the real-estate sector and the scale of the challenge facing the Chinese government in stabilizing the world’s second-largest economy.

As a reminder, Beijing was uncharacteristically honest about its rapidly slowing economy this week:

Beijing has pledged to “front-load” policies to shore up the economy next year, as leaders remained on high alert against strong headwinds at the tone-setting annual central economic work conference that concluded on Friday.

“We are facing threefold pressure, including contraction of demand, supply shocks and weaker expectations,” the official Xinhua News Agency reported, citing an official statement from the conference. “Our policy support should be front-loaded appropriately.”

The emphasis on “stability” – the word appeared 25 times in the 4,700-word statement – comes as leaders are trying to project a positive image to the world ahead of February’s Beijing Winter Olympics, and with their sights set on the 20th National Party Congress – a key political gala that will usher in twice-a-decade leadership reshuffle for the Communist Party in the second half of next year.

“We need to concentrate on stabilising the macroeconomy, keeping the economic operation within a reasonable range and maintaining social stability,” the statement said.

“[The meeting] emphasised the downward pressure – the notion of ‘threefold pressure’ was very rare in the past,” said Zhou Hao, a senior emerging markets economist with Commerzbank.

He added that it was also uncommon for such official statements to mention the need to strengthen countercyclical regulations, and said it also warrants mentioning that the phrase “houses are for living in, not for speculation” showed up again, in reference to Beijing’s strong regulation of the sector.

As Mike Shedlock noted earlier, China faces a number of headwinds:

Financial risks amplified by the Evergrande debt crisis

A regulatory crackdown

Biden continues Trump tariff policies

US monetary tightening

Climate change pressures from the US and EU

Most of which will inevitably cross the Pacific...

.....MORE

The sting, as has been said is in the tail.