As we recalled a couple days ago, the top-tick yield for the 10-year note this cycle was 1.7650% on March 30. 1.6050% last.

Following up on Albert's September 5, 2008 ***Alert****Economic and equity market meltdown imminent****Alert***

Via ZeroHedge:

One of the theories seeking to explain the Lehman collapse and the ensuing financial crisis points to the record surge in oil prices which rose as high as $150 in the summer of 2008, and which combined with tight monetary conditions, precipitated a giant dollar margin call which in turn pricked the housing bubble with catastrophic consequences. In his latest note, SocGen's resident permabear draws on that analogy and writes that "as energy prices surge with a backdrop of central bank tightening it’s starting to feel a bit like July 2008" referring to that moment of "unparalleled central bank madness as the ECB raised rates just as oil prices hit $150 and the recession arrived."

Is today any different?

Pointing to the recent surge in global energy prices (described in detail in Gasflation), Edwards writes that "the current high energy prices will hugely impact the debate about whether the post-pandemic surge in inflation is transitory or permanent." And while we wait for the Fed (and to a much lesser extent the ECB) to commence tapering as neither will be willing to admit they were wrong about "transitory" being permanent, financial conditions are already sharply tighter with breakeven inflation rates (a proxy for market inflation expectations) surging, especially in Europe, and especially in the UK where the Retail Price Index points to 7% inflation as soon as April.

While market are perhaps hoping that central banks will reverse their path similar to what, the Fed did in Dec 2018, a toxic price/wage spiral has already taken hold as "ultra-tight labor markets conspire with households being bludgeoned by higher energy prices and the cost of living generally."

Meanwhile, even though central bankers repeat like a broken record that they view inflation as transitory, Edwards notes that "the increasing threat of transitory inflation becoming more permanent is prompting central banks around the world to begin their tightening cycles, either with actual hikes in rates (Norway and New Zealand) or threats of hikes next year (UK), or tapering QE (US and eurozone)."

So a double whammy of soaring prices and tighter financial conditions? July 2008 indeed.

Looking ahead, Edwards sees even tighter financial conditions as bond yields continue to drift higher due to the more inflationary backdrop together with the threat of Fed tightening (like Morgan Stanley's Michael Wilson, Edwards notes that "I do think that tapering is tightening"). As the evidence shifts, Edwards expects 10y yields to attempt to reach 2-2¼% - the upper bound of the long-term secular Ice Age downtrend.

And while this move would not violate the bond bull market, "it would certainly feel like a violation to equity investors" especially if it is rapid, and nobody would be hit harder than tech investors who have built nose-bleed valuations on ultra-low bond yields (Edwards discusses this in depth below). So while it is possible that we could yet see a Dec-2018-like Powell Pivot just weeks into a Fed Taper - as a reminder in late 2018 the "Ghost of 1937" emerged, forcing the Fed to ease long before it reached its target rate, Edwards asks "what about the R-word?"

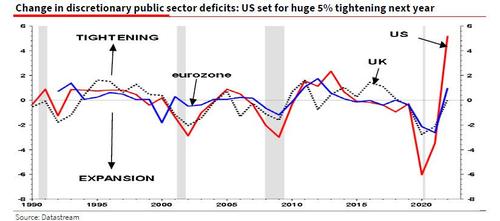

He is, of course, referring to a coming recession (borne out the current global economic stagflation), yet which virtually nobody anticipates. One reason why he sees the US as especially vulnerable to a recession is because the OECD is estimating a huge 5% fiscal tightening next year, the result of trillions in fiscal stimuli fading and turning into outright headwinds.

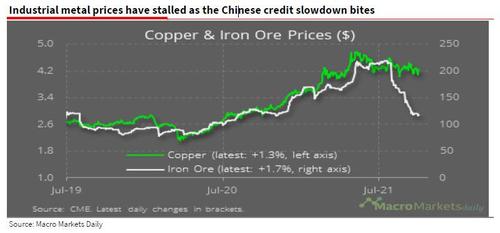

Real-time economic indicators already suggest that the slowdown has arrived: Edwards points to the latest Atlanta Fed GDPNow forecast which has fallen to just 1.3% for Q3, while Goldman recently forecast zero sequential growth in China this quarter. While this can be dismissed as all Covid (Delta) related, it could be something more, especially as the ongoing tightening Chinese credit impulse discussed here and elsewhere continues to punish the economy.

But while the economy is set to suffer from rising inflation and a concurrent increase in rates, it is markets that are even more exposed.

To demonstrate just how much, Albert pulls a chart from BCA Research which showed how conjoined global tech stocks have been with the US 30y bond yield since the start of this year. The SocGen strategist then notes that "if the US 30y yield rises to 2.4% from the current 2.1%, it would knock some 15% off tech stock prices. Imagine if the US 10y rose from 1.5% currently to 2¼%! We could see quite a bear market in tech!"....

....MUCH MORE

Oil made its spring-of-2008 run to $147.27, July 11 "on the way to $200" before collapsing to $33.87, Dec. 21, 2008

That 2008 alert from Albert may be the timeliest market/econ call in history. Robert Rhea caught the bottom of the Great Depression market crash two weeks after the fact. The DJIA proceeded to double in a year, the fastest move for a major index I can think of, outside of the Berlin Bourse during the 1923 hyperinflation. And Henry Kaufman, the original Dr. Doom more-or-less triggered the 1982 - 2000 bull run when he reversed his long-held (and correct) bearishness a week after the 776.92 bottom in the DJIA. Joe Granville missed the big bull but called the top within 24 hours of the Nasdaq's March 10, 2000 high of 5048 before it dropped some 77+%.

But the alert from Albert, hoo boy:

On September 7, 2008 Fannie Mae and Freddie Mac were placed into conservatorship.

On September 14, 2008 Merrill Lynch agreed to be acquired by Bank of America.

On September 15 Lehman filed their bankruptcy petition.

On September 16 AIG became a 79.9% subsidiary of the U.S. Treasury.

Within 10 more days the Nation's largest thrift, WaMu was seized and five days later Wachovia gobbled up.

Good times, good times.

Of course there have also been some misses over the years:

June 26, 2008

Société Générale: “We see a y-shaped global recession. We are going down before looping backwards”

May 8, 2008

This Week’s Advice: Canned Food, Guns and a Ham Radio

Nov. 17

Société Générale's Albert Edwards Upbeat, Almost Chipper: See's Humanity Approaching Broad Sunlit Uplands (Nov. 17, 2010)

Oct. 20, 2010

Société Générale's Albert Edwards: Cry Havoc and Let Slip the...Ah Screw it (Oct. 20, 2010)

"Société Générale's Albert Edwards: 'Equity Investors Are In A Vulcan Death Grip And Are About To Fall Unconscious"' (September 2010)

Société Générale's Albert Edwards: "I Have Been Wrong – I’ve Been Too Bullish" (Jan. 17, 2011)

Société Générale's Albert Edwards: "Many Think I am Mad..." (sub 2% Treasuries, S&P at 400 etc.) May 25, 2011

The treasuries worked out but equities ran contra.