A quick hit from Global Macro Monitor, October 18:

Hot Retail Sales Not Supply Chain Positive

Summary

– The market narrative explaining the breakdown in the global supply chain is starting to come together

– Some of the rock star pundits are now touting the supply chain is being swamped by too much demand, which has been our narrative since summer

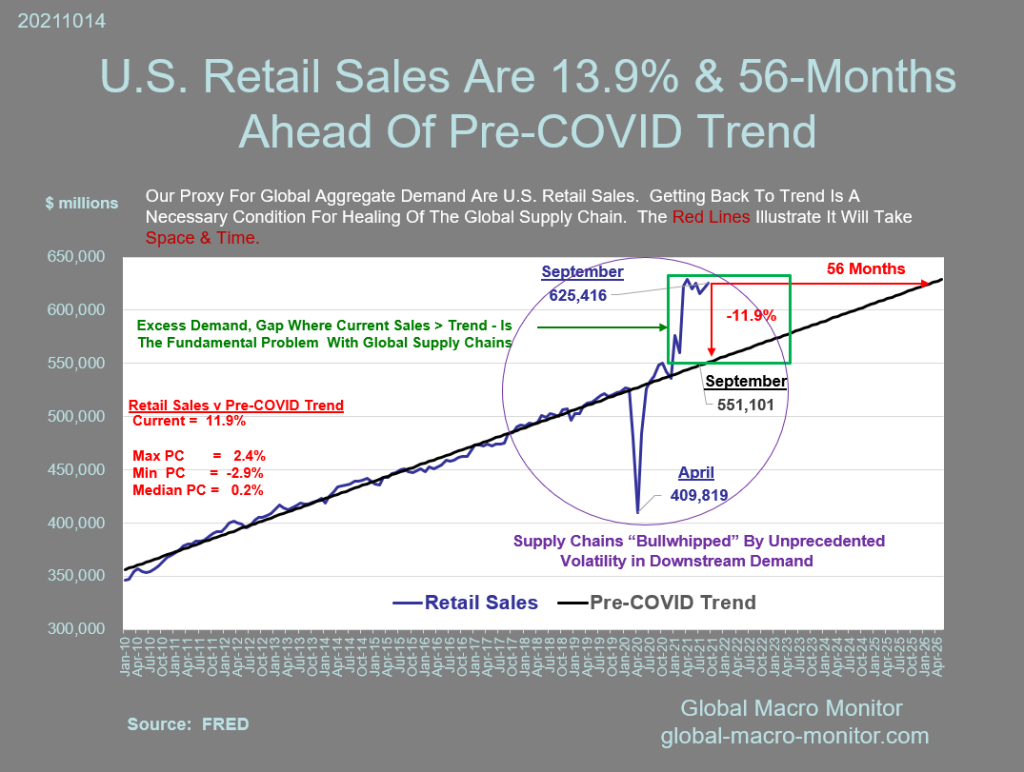

– The initial shock came with the 22 percent collapse in point-of-sale demand (we use U.S. retail sales as our global proxy), then an extraordinary 34 percent rebound over a six-month period

– The unprecedented volatility in retail sales “bullwhipped” the supply chain and caused mass confusion and panic among upstream suppliers

– As the pandemic forced consumers to shift their preferences from services (restaurants, Disneyland, etc) to durable goods (kettlebells, golf clubs, etc.), the supply chain for merchandise goods was initially overwhelmed by the new and unexpected demand

– The secondary shock came from the massive global stimulus, which drove consumption and retail sales much higher

– The combination of the shift in consumer preferences and massive increase in stimulus induced demand is primarily what broke the supply chain

– We don’t see an end to supply chain woes until point-of-sale demand moves back to its pre-COVID trend, which, for our proxy, dictates that U.S. retail sales fall by almost 12 percent from current levels or stay flat for 56 months, which, we believe is much too painful for the policymakers and markets

– We are not sure how this all plays out but we certainly don’t think “everything is awesome”

– We believe historians will write about the Shortage Economy: “The great supply shock of the COVID pandemic was, at the end of the day, a demand shock” ....

*****

....MUCH MORE

We'll be back to GMM later today but I wanted to be able to refer back to that rather amazing chart.

Very related, October 8's Money, Money, Money: "A Self-Fulfilling Prophecy: Systemic Collapse and Pandemic Simulation"