It would be good for Gunvor if the Putin ownership rumors are true. Though they deny he's ever had a stake having a liquidity backstop might prove very important.

From ZeroHedge:

Earlier this week, we noted that some of the world's largest commodity traders were facing massive margin calls from wrong-way spread trades in the natural gas markets.

According to reports, it appears the trading shops have all been hammered by a spread (or arbitrage trade) gone wrong.

For years, the prices of European (red) and US natural gas (green) have traded within a well-defined range. When the spread between the two reaches one extreme or the other, you buy one and sell the other – easy, right ?

Source: Bloomberg

So as European NatGas prices surged in Q2, it reached a notable extreme relative to US NatGas, prompting traders to instigate the strategy of selling European Gas and Buying US Gas in the hopes the spread compresses.

The strategy backfired last month when European gas prices soared due to a variety of factors including low inventories, high demand for gas in Asia, low Russian and LNG supply to Europe, and outages.

Since then, the situation appears to have grown more grim, as Bloomberg reports that major energy traders including Gunvor Group. and Mercuria Energy Group. have reduced the size of their trading positions and increased borrowing from lenders to cover large margin calls stemming from the unprecedented surge in European gas prices, according to people familiar with the matter.

Specifically, Bloomberg reports that both Gunvor, the biggest independent trader of liquefied natural gas, and Mercuria, a major power and gas trader, asked banks for additional credit to fund margin calls arising from their hedging positions, said the people, who asked not to be named because the information is private.

But, as 'Structurer', Jacques Simon, details in the following report, the situation could be far more grave for Gunvor...

TL;DR...

Two weeks ago Gunvor was in the debt market for the 1st time since 2013 according to BBG. We note that Gunvor is the world largest LNG independent trader and also the biggest by % share among the houses with this exposure.

The trader is a net buyer of netbacks (a type of contract under which it receives the Henry hub index and pays the TTF or Platts JKM index to the producers).

Recently it has changed its LNG head in Singapore and we are also aware that Gunvor Singapore uses a strategy called “the box” whereas the trader locks the arbitrage spread at predetermined levels by swap hedges.

U.S website Zerohedge reports that Gunvor is facing massive margin calls as the global natural gas arb explodes.

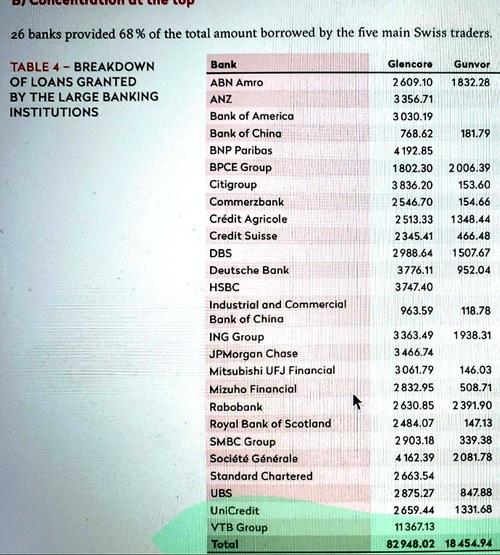

Among the injured will be ABN amro, Credit Agricole, Rabobank, SG, Natixis, ING and Unicredit.

The margin calls are between $3.6B and $6.1B in the coming months for a company with a $2.5B net equity.

We will explain what is “the box” and then show our calculations for the margin calls and summarize our assumptions below.

The banks have offloaded $300M worth of their credit-risk on Gunvor last September to the bond market but since then the Dutch TTF-Henry spread has gone parabolic and the group’s financial position has significantly deteriorated.

The trader’s future is purely and simply in the hands of Goldman Sachs, Citi and the long swap dealers at TTF.

* * *

GUNVOR FINANCIAL POSITION

Gunvor is very secretive on their financial positions, only releasing partial and selective information.

Gunvor’s debt is unrated.

The trader turnover is 94 million mt/year and the rule of thumb is that each 1$ in sale is backed by 5$ of debt. With the turnover growth we believe Gunvor debt is minimum $20B.

If the House capital is $2.5B in H1-2021 then we derive that Debt/Capital ratio is 8X.

THE NETBACKS

Netbacks are based on the premise that the spread between two global LNG markets are underpinned by the transportation costs.

The arbitrage flows is from the low price market towards the higher price market putting a downward pressure on the overpriced market, and has the effect of reimposing a netback-based parity between the markets. Netbacks assume an access to financing, prompt cargoes in the cheap market, and shipping capacity.

DUTCH TTF-HH-Transportation costs-Tolling fee= NETBACK TTF

JKM-HH-Transportation costs-Tolling fee= NETBACK JKM

IF NETBACK TTF >= NETBACK JKM, the trader will ship the LNG to TTF until the equation parity is restored again.

The caveat: It is another mean-reversion trade based on moderate volatility.

See, Druz, T., Capra Energy Group, “When will European LNG Imports Recover ?” (2021)

THE “BOX”

Gunvor Singapore buys TTF netbacks which are defined as the Dutch TTF minus Henry Hub minus the Freight U.S Gulf Coast to Europe minus a $2.45-2.55 tolling fee. Gunvor is now long the TTF and that it must pay to the producer in exchange for the gas.

To protect its margin the trader sells the TTF and buys the HH times the number of cargoes per month.

Based on the current TTF/HH spread and the hedged level the trade becomes a “box” if Gunvor is long freight.

Typically when the spread goes over the pre-hedge level, the freight cost rises => and Gunvor (long) absorbs the risk because it leases a 10-year fleet. In this situation Gunvor still makes a profit despite a $2-3 margin call on the hedge because it can resell the physical cargo or resell the freight voyage (relet).

However this is not the behavior observed during Q3 and in Q4-21… As the TTF-HH goes above the 90th percentile value (blue line) while the freight (purple) has not converged with the arbitrage.

Gunvor has not captured the arbitrage with the freight.

What a trader employee at Gunvor did was underwriting a gigantic amount of risk (CALLs like optionssellers.com…) analogous to multiple times the trading-firm capital.....

....MUCH MORE

I had completely forgotten about https://jacquessimon506.wordpress.com/