When I hit publish on the natural gas storage report earlier today the front Henry Hub futures were at 3.018. Last I saw they were at 2.882, in the face of the coldest weather of the year coming down from Canada and dropping temperatures to quite extraordinarily low figures from North Dakota southeast down to St. Louis and Chicago and Indiana.

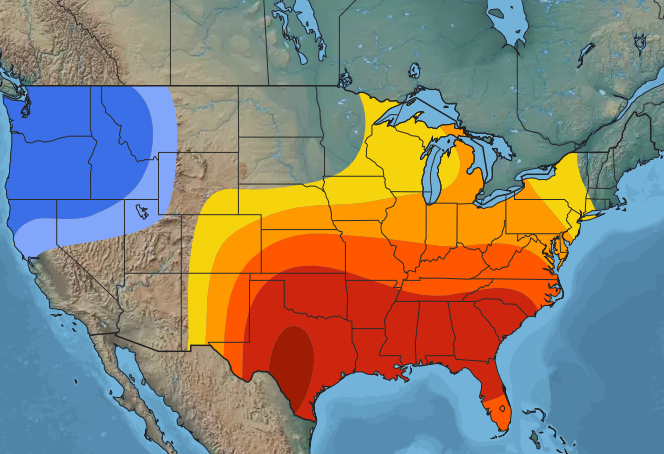

And while they don't burn as much natural gas in Fargo as in the bigger cities the area impacted by the cold is huge. Here's the NOAA's Climate Prediction Center outlook via NatGas Weather:

Those are temperature anomalies, not actual temps but as can be seen, sub-freezing lows are expected as far south as central Texas.

And NGW's commentary for next week and the week following:

Feb 5-11: A frigid cold shot will push into the Rockies and Plains today, then spread across the rest of the northern and eastern US this weekend w/ lows of -20s to 20s for strong national demand. A more impressive Arctic blast will follow late next week across the northern and central US w/lows of -30s to 20s. Overall, national demand will be HIGH into early next week, then VERY HIGH late next week.

I don't care who you are, Peary, penguin or polar bear, -30° F (-34.5° C) is cold.

And here's one more wrinkle. in addition to increasing demand the cold can also reduce supply.

From S&P Global Platts, February 1:

....3. Cold snap to drive US Midwest gas storage withdrawal

What's happening? A spike in US Upper Midwest demand mixed with lower inflows and production freeze-offs should flip the natural gas storage surplus in the region to a deficit. Bakken Shale supply is expected to shrink at a time when areas around Chicago and Detroit will most need the support, increasing the region's reliance on gas in storage.

What's next? In 2020, a similar cold spell dropped Bakken production by 200 MMcf/d. Higher Midwest demand appears likely to persist based on forecasts for colder weather in February and sustain the upside risk to Chicago prices for the coming weeks.

....MORE CHARTS