I wonder what their first indicator was?

From ZH via OilPrice, February 16:

On a day when one of our preferred stocks, Exxon, has hit the highest price since last June following an upgrade from Credit Suisse which upped its price target for the energy giant to $62 from $52, the energy sector has seen further tailwinds from none other than Goldman, whose strategist Alessio Rizzi writes that the bank continues "to have a pro-cyclical tilt in our asset allocation" and following the poor performance of energy stocks in the past year, the bank thinks that "adding energy equity exposure is attractive at this juncture, especially considering our constructive commodity view."

To justify its bullish bias, Rizzi writes that since the start of the year, "markets have been risk-on and cross-asset performance has repriced the potential for reflation" which is in line with Goldman's core views as it expects "pro-cyclical assets to outperform, supported by strong global growth and broadly dovish policy from central banks. Our US economists revised up 2021 US GDP growth to 6.8% given the increased chance of a large US fiscal stimulus package and pulled forward the first Fed policy hike to 1H 2024."

This is most clearly seen in the ongoing surge in oil prices which are now back to their pre-covid levels.

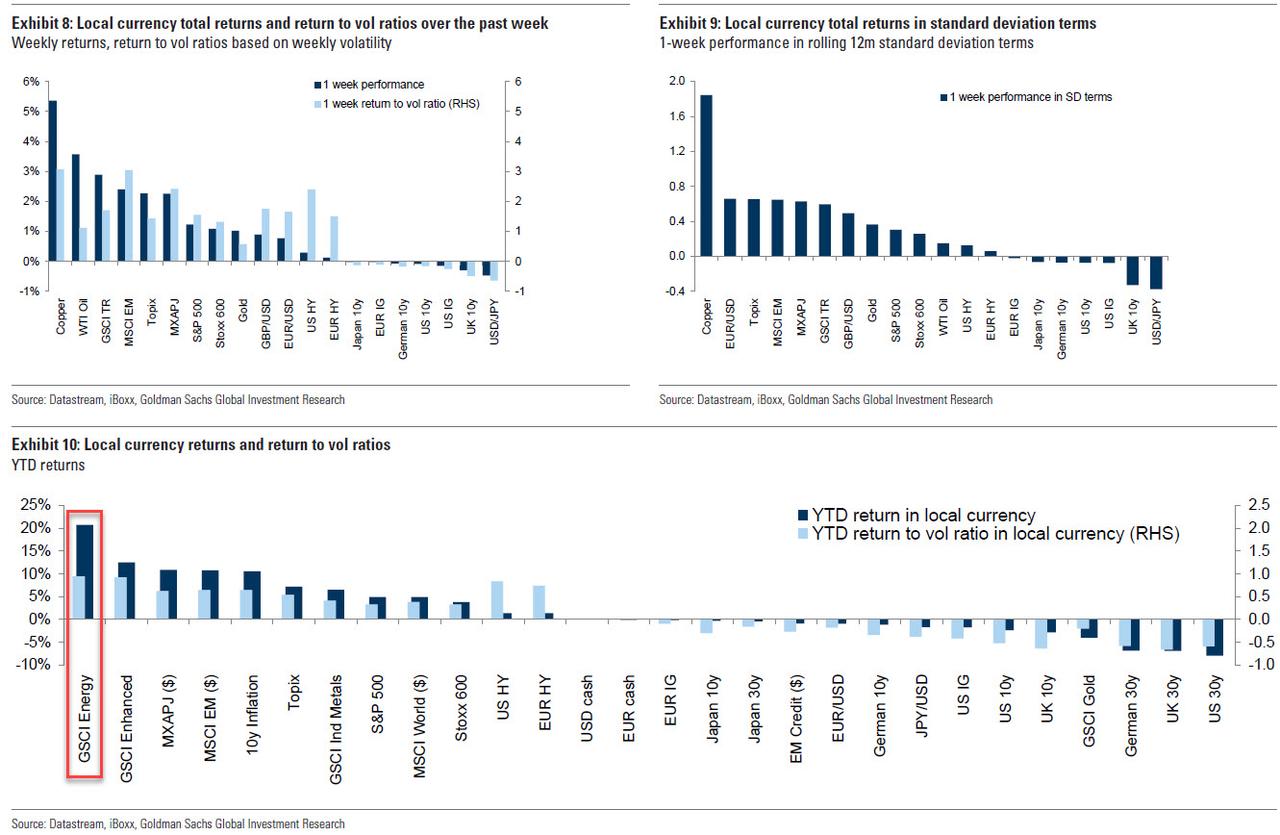

And while commodities have clearly benefited the most during this reflationary shift and Energy is now the best performing asset YTD...

.... many energy related assets have lagged during the strong commodities rally, especially over the last month perhaps due to ongoing concerns that regulatory intervention will shift the goalposts in favor of clean energ. In fact, Goldman notes that energy related FX and the US energy equity sector are almost unchanged since mid January, while the European energy sector sold off and USD Energy HY spreads widened vs HY....

....MUCH MORE (chart mania)