The unpredictable economics of pawn shops

Take the same item to 4 different pawn shops and you might get offers that vary by hundreds of dollars. Here’s why.

You’re down on luck, your funds are running low, and you’re in dire need of a few hundred bucks in cash — ASAP. The bank won’t help you, and the payday loan place wants a 400% annual interest rate. All you’ve got left is the gold pocket watch your great-uncle Chester gave you.

What do you do? You head to the pawn shop.

Every year, some 30m Americans frequent the country’s 11.8k pawn shops in the hopes of securing a loan in exchange for collateral.

As one pawn shop owner tells The Hustle, “everything that can be pawned will be pawned:” Wedding rings, shotguns, antique horse saddles, prosthetic limbs, and any electronic device imaginable. Collectively, the loans, purchases, and sales pawn shops make on these small items add up to a $6B+ per-year industry.

But not all offers are created equally. If you walk into 5 different pawn shops with that gold watch, you might get offers that differ by 200% or more.

We wondered why that was, so we went looking for an answer. And along the way, we learned a few other things about pawn shops that will make you question whether you should do business with them at all.

How a pawn shop works

The typical pawn shop transaction goes down like so:

Zachary Crockett / The Hustle

Pawn shops are generally a last resort for people in lower-income brackets.

“The average customer might be living paycheck to paycheck, or maybe he had an unexpected expense emergency come up,” says Jimmy Rodriguez, the owner Max Money Pawn in Houston, Texas. “He needs fast cash, and I’m the most convenient option.”

According to the National Pawnbrokers Association, 7.4% of all US households have frequented a pawn shop. This figure jumps up to 40% among lower-income earners, who often don’t have enough cash on hand to cover a $400 emergency expense.

The average pawn shop loan is just $150 — but even a small loan can rack up considerable interest fees for someone in financial straits.

When Christine Luken, a counselor in Cincinnati, fell on tough times, she took her grandmother’s ring to a pawn shop and was given a $150 loan. “I had to pay $30 a month in interest,” she told the website Student Loan Hero. “I ended up paying interest on it for 24 months, $720 in total. That’s 480% of what I originally borrowed.”

Pawn shop interest rates vary from state to state. In California, the limit is 2.5%/month (30% APR); in Alabama, it’s 25%/month (300% APR) — high enough to be considered predatory, but not quite as bad as a payday or title loan.

In 85% of all cases, customers are able to pay back their loans. But when they don’t, the pawn shop still makes money by selling the collateral.

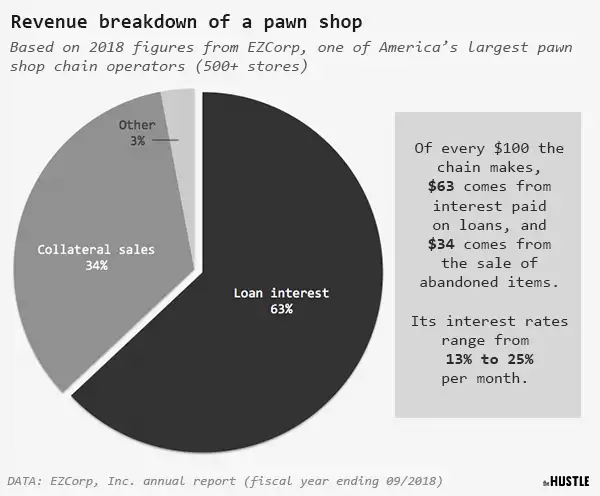

To get a better sense of what a pawn shop’s revenue breakdown looks like, we took a look through the most recent annual report for EZCorp, Inc., one of America’s largest pawn shop chains.

Among its 500+ US shops, 63% of all revenue comes from loans and fees (which range from 13% to 25%), and 34% comes from selling the collateral.