And from ZeroHedge, March 17, 11:55 am:

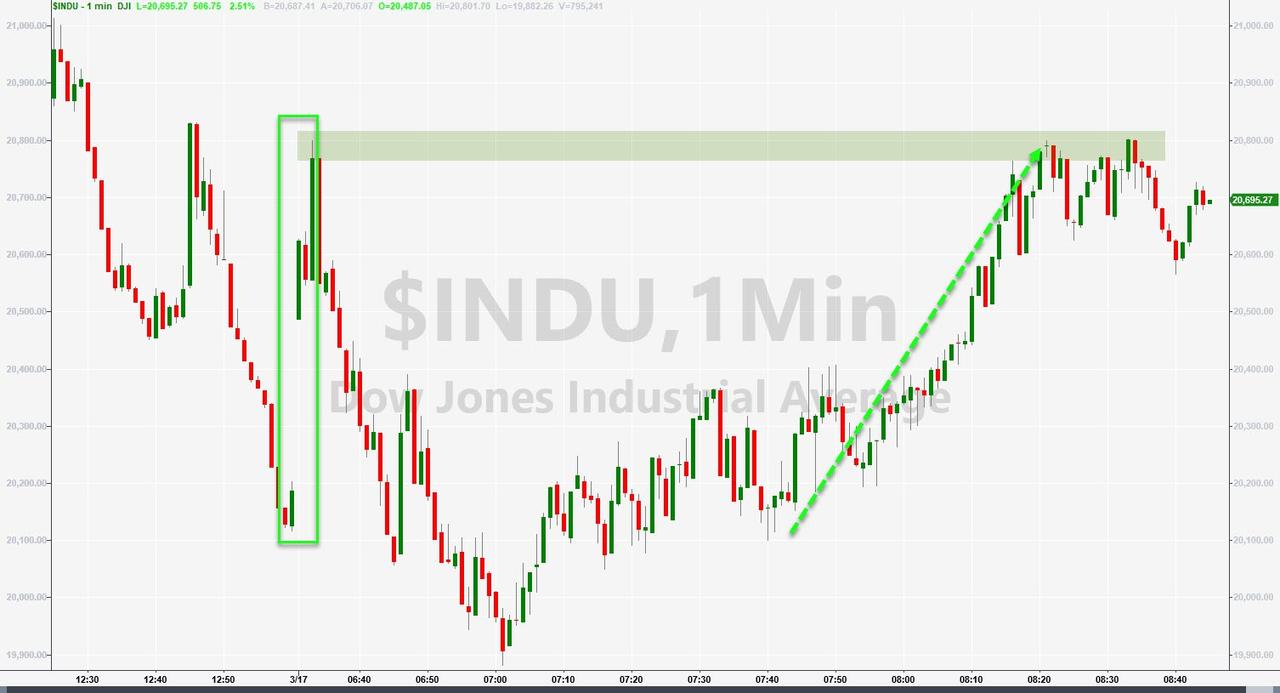

The stock market is rallying, VIX is falling, and bond yields are rising modestly following The Fed's decision to reinstate its Commercial Paper bailout facility (CPFF).

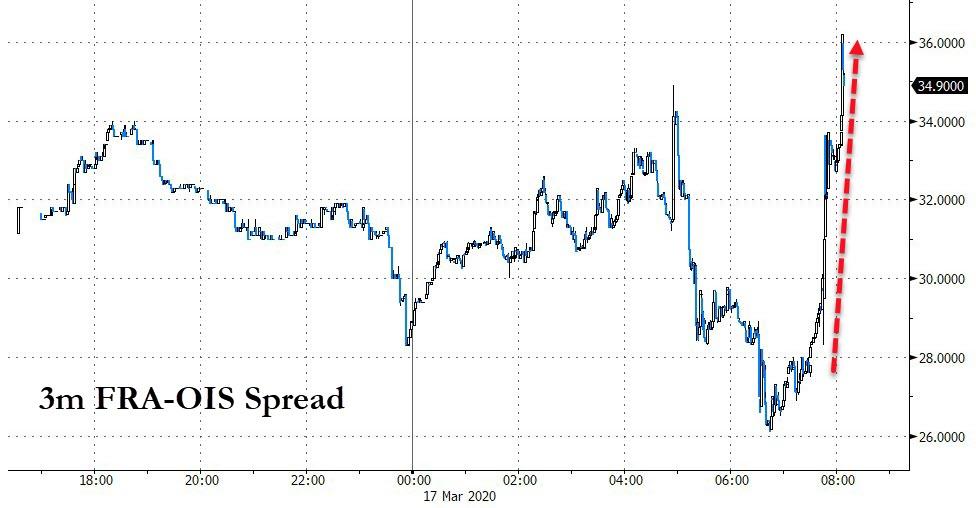

As Bloomberg notes, the spread of Libor to overnight index swaps should tighten as the Federal Reserve ramps up the reinstated Commercial Paper Funding Facility (CPFF).

Though we think the Fed and the Treasury are generally concerned about liquidity, a freezing of the CP market for industrial companies is a larger risk than for financial firms during the current crisis, in our view.However, the FRA-OIS spread has spiked higher indicating rising stress in the financial system's liquidity markets...

In 2007-09, asset-backed CP was the major risk, but today that's less of a worry.

Industrial companies have few options other than CP for short-term financing, unlike financials, which can tap the discount window and other liquidity sources.

It would appear The Fed's "whack-a-mole" may have 'solved' one problem (corporate liquidity crisis) but the dollar/liquidity shortage in the global financial system is worsening (which is odd, since if companies did not have access to CPFF they would be forced to drawdown all revolvers and crush the financial system further).

Additionally, as BofA warns:

As noted in the outro from that Monday post:"This facility does nothing to assist the money funds trying to raise cash and address outflows" implying The Fed will have to unleash another backstop.....

...The US Dollar Index (DXY-cash) is down -0.55% at 98.20.We see no sign.

If you are looking for a sign that might be a place to watch for one....