From ZeroHedge:

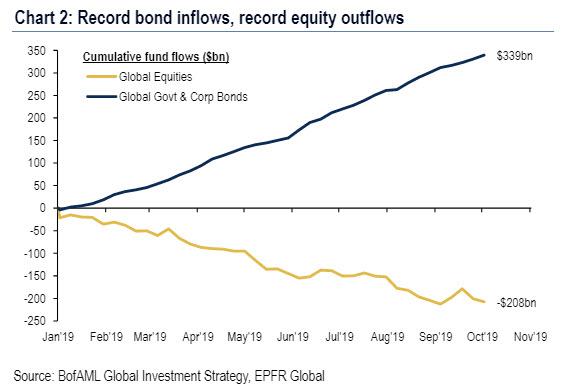

It's been a year of record equity outflows...

... and yet the S&P 500 is trading at all time highs. How is that possible?

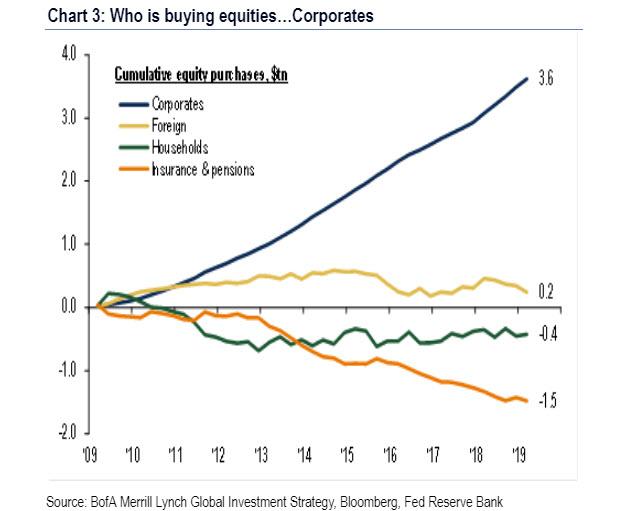

Perhaps instead of trying to explain or justify it, one should just go with the flow and indeed, Albert Edwards starts off his latest letter by pointing out the obvious: "the world has gone mad." Here's why:it’s not just equities rising to record highs… Christie’s US recently sold two pairs of late 1990s tortoiseshell sunglasses for $2,750, massively outstripping their $200-300 estimate. The ‘Not-QE4’ liquidity splurge has sent risk assets bananas, so the economic narrative has become one in which the US economy is “robust”. No it isn’t. And labour’s fightback has a recessionary downside.While the simple answer why equities continue to soar even as investors liquidate their equity exposure is thanks to nearly $4 trillion in buybacks...

... Edwards finds a more apt culprit: "The surge in equity markets has come on the back of the Fed hosing liquidity into the banking system via repos and T-Bill purchases." So is it QE or is it "not QE"? Here is Edwards snarky answer:Remember this is not QE4, as the Fed has repeatedly assured us. Tell that to the equity market, which is certainly reacting as if it was as it as forges to new all-time highs. We have heard these Fed denials before. Remember Bernanke assured investors that QE was different to monetisation because everybody knew with certainty that the Fed was going to take all the QE back. Well, that worked well, didn’t it?To this all we can add is that "Not QE" is adding between $60 billion and $100 billion in liquidity every month. So, yeah, there's that.

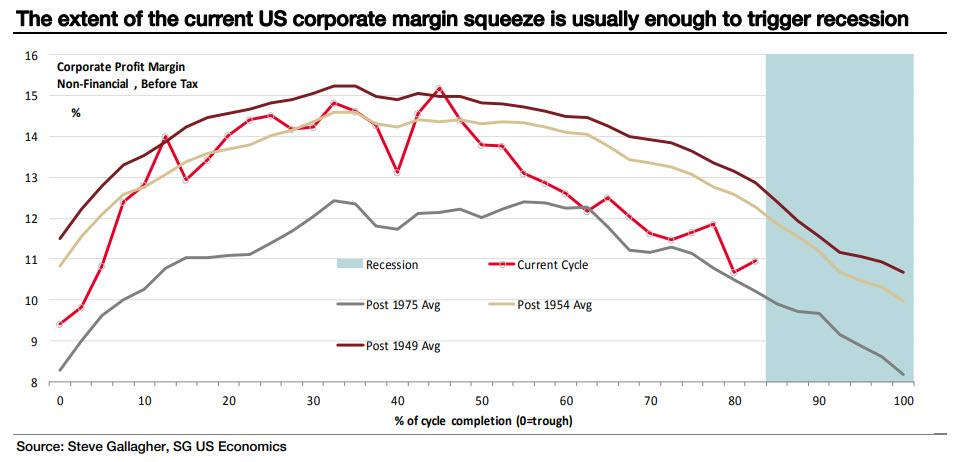

Ok, fine, it is QE, but is that really bad? Well, yes. Here's Edwards:In my opinion QE is totally discredited. I believe it had only a marginally positive impact on economic growth (mainly by driving exchange rates down, most notably in the eurozone and Japan). But the damage QE did in terms of wealth inequality compounded years of painful income inequality.Oh, and here is the CEO of the world's biggest hedge fund, Ray Dalio, sounding just like this website in 2009 (and every year after):money is essentially free for those who have money and creditworthiness, it is essentially unavailable to those who don’t have money and creditworthiness, which contributes to the rising wealth, opportunity, and political gaps. Also contributing to these gaps are the technological advances that investors and the entrepreneurs that I previously mentioned are excited by in the ways I described, and that also replace workers with machines. Because the “trickle-down” process of having money at the top trickle down to workers and others by improving their earnings and creditworthiness is not working, the system of making capitalism work well for most people is broken.Going back to Edwards, the SocGen strategist notes that "investors are desperate to believe this is a rare mid-cycle pause. The ‘markets’ write the economic narrative so the S&P's surge to all-time highs is prompting commentary that the economy is doing just fine. No it's not." Not surprisingly, Edwards urges readers here to read Ray Dalio's recent comment.Dalio thinks the world has gone mad and if Christie's recent auction is anything to go by, he is right. The good news: as I show inside, labour is fighting back hard to get its rightful share of national income. The bad news: the fightback has triggered a savage corporate profit margin squeeze that is already severe enough to trigger an investment-led recession.Here Edwards points to the following chart to demonstrate where in the business cycle corporate profit margins are right now:

...MORE