From CB Insights:

Will a meatless food

industry featuring lab-grown meat, seafood substitutes, and insect

protein be the future of food? Food giants from Tyson to Cargill

are working to navigate a future where protein isn't dominated by

traditional animal sources.

At the moment, meat is still king.

By some estimates, 30% of the calories consumed globally by humans

come from meat products, including beef, chicken, and pork. The global

meat market is worth $1.8T, according to CB Insights’ Industry Analyst Consensus.

Americans consumed a near-record 220 pounds of red meat and poultry

per capita in 2018 — in 1960, that figure was just 167 pounds, according

to the USDA.

Also in 2018, USDA figures showed domestic production of meat hit a

record high of more than 100B pounds. That translates to a staggering

number of animals grown for food: around 30M beef cows in the US and

20M+ pigs in Iowa alone.

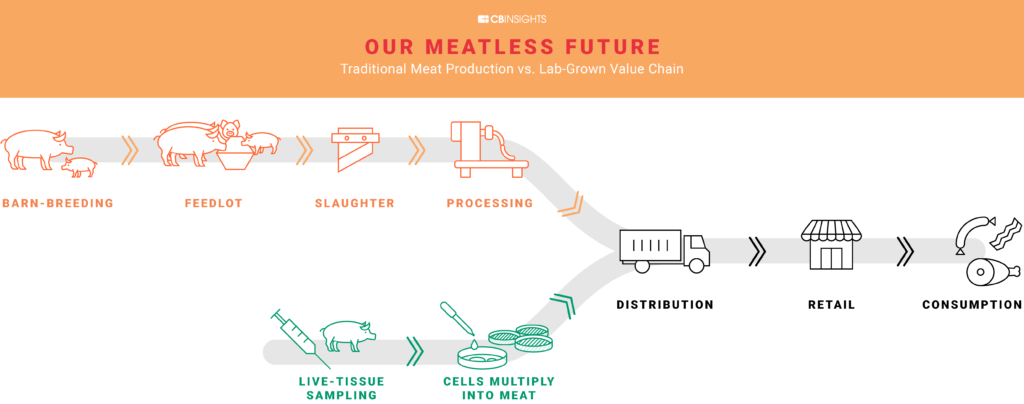

To meet this skyrocketing demand, the meat industry has evolved into a

complex global business that involves farms and feed lots, as well as

meat middle-men, like processing and storage centers, transportation and

logistics, slaughterhouses, and more.

Together, the 6 largest meat companies represent $60B in market

capitalization — as of the beginning of the year — with the largest,

Hormel, boasting a $23B valuation.

The industry has seen massive consolidation, as companies like Hormel

and Brazil-based JBS have grown bigger and bigger through the

acquisition of new meat brands and products.

Since 2014, Hormel has spent around $3B on acquisitions, including

Applegate, Fontanini Italian Meats and Sausages, Ceratti, and Columbus

Manufacturing.

One of the biggest deals in this space was pork producer WH Group’s

2013 acquisition of US-based Smithfield Foods, which owns brands such as

Armour and Farmland. At the time of the deal, Smithfield was valued at

$7.1B.

Despite high-profile deals in the sector, the industrial meat

industry faces a rising tide of challenges related to business, ethical,

and environmental concerns.

Meanwhile, startups using technology to engineer meat in labs or

manufacture it from plant-based products are rising in popularity. In

2019, one of the world’s biggest alternative protein brands, Beyond

Meat, the manufacturer of the plant-based Beyond Burger, went public at a

valuation of almost $1.5B.

Shortly after, Burger King released the Impossible Whopper — a

meatless variant of its most well-known product. The Impossible Whopper

replaces beef with plant-based meat manufactured by Impossible Foods, a

Redwood City-based company that has raised more than $700M in disclosed

equity funding. The company was given a valuation of $2B at its last

funding round.

In addition to offering new products, these alternative protein

startups have the potential to upend the meat production process.

Going forward, the meat value chain could be simplified dramatically,

as “clean meat” labs could take the place of farms, feed lots, and

slaughterhouses.

Especially

vulnerable to these changes are food companies like Tyson, Pilgrim’s,

and Sanderson Farms, which rely on animal meat products for 80% or more

of their revenue, as seen below.

Using CB Insights data, we dug into some of the major trends in the

growing meatless industry, from startups to watch to key investors to

future trends & challenges.

Table of contents

Startups innovating across the meatless ecosystem

Startups are disrupting the meat production value chain through the

development of high-tech protein products, threatening established

players like Tyson.

Meat substitute startups are not only competing with prepared and

frozen meats, but are also creating alternative snacks (such as Beyond the Shoreline‘s kelp jerky).

While the environmental benefits of lab-grown meat are potentially

dramatic, meatless products are still significantly more expensive on a

per-pound basis than animal alternatives.....

.....

MUCH MORE