As noted in the outro from a 2017 post:

...Much more important than the direct monetization of big data is the strategic advantage it can bestow over time.

In a winner-take-all economy, as in a horse race, small differences in superiority are rewarded all out of proportion to the actual advantage. A top thoroughbred may only be a couple fifths of a second faster than the field but those two lengths over the course of a season can mean triple the earnings for #1 vs. #2.

In commerce the results can be even more dramatic because rather than the 60%/20%/10% purse structure of the racetrack the winning vendor will often get 100% of a customer's business.Outro now intro. Here at Climateer Investing WE RECYCLE

From VoxEU:

Knowledge in the hands of the best, not the rest: The decline of US business dynamism

The US economy has witnessed a number of striking trends that indicate rising market concentration and a slowdown in business dynamism in recent decades. This column uses a micro-founded model of endogenous firm dynamics to show that a decline in the intensity of knowledge diffusion from frontier firms to laggard ones plays a key role in the observed shifts. It presents new evidence on higher concentration of patenting in the hands of firms with the largest stock that corroborates declining knowledge diffusion in the economy.

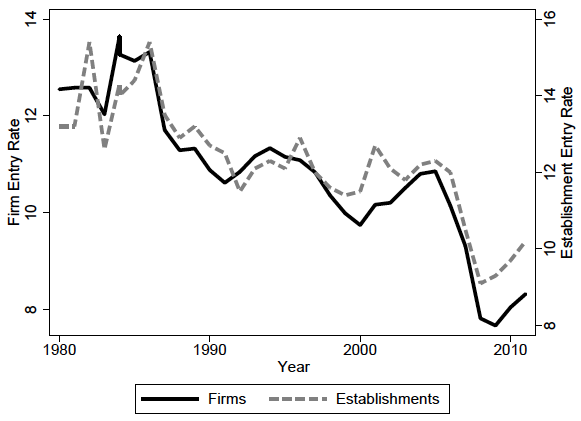

The US economy has been losing its business dynamism since the 1980s and especially since the 2000s. This shift has manifested itself in a number of empirical regularities – the entry rate of new businesses (Figure 1a), the job reallocation rate, and the labour share have all been decreasing (Decker et al. 2016, Karabarbounis and Neiman 2013, Barkai 2017, among others). Yet, the profit share, market concentration, and markups (Figure 1b) have all been rising (e.g. Autor et al. 2017a, 2017b, De Loecker and Eeckhout 2017, Gutiérrez and Philippon 2016, 2017, Eggertsson et al. 2018, Farhi and Gourio 2018). These trends have drawn notable attention from academic as well as policy circles. Indeed, the Federal Trade Commission has recently held “Hearings on Competition and Consumer Protection in the 21st Century” with special attention given to competition and market concentration. While suggestions for the potential drivers of these structural shifts are abundant, there is little consensus in the literature on the underlying cause(s) that could jointly account for these potentially related developments.

Figure 1 Entry rates and markups

a) Firm and establishment entry rate

b) Average markups

Notes: Panel a is based on authors’ calculations from

Business Dynamics Statistics database. Panel b is taken from De Loecker

and Eeckhout (2017).

In two recent complementary papers, we contribute to this important, and predominantly empirical, debate by offering a new micro-founded macro model – which provides a unifying theoretical framework that can speak to all those symptoms – conducting a quantitative investigation of alternative mechanisms that could have led to these dynamics, and presenting some new facts on the rise of patenting concentration. In Akcigit and Ates (2019a), we review the findings of the literature and focus on the following prominent regularities:...MUCH MORE