Shades of another disruptor, Sam Insull, leverage at the holding company level, leverage at the operating company level, leverage all the way down

From ZeroHedge:

Did The Tech Bubble Just Pop: Investors Balk At SoftBank's Attempt To Raise $100 Billion

Something is not quite right with SoftBank.

Last week, we reported that in a surprising twist, Masayoshi Son's SoftBank, which in early May was reportedly considering a $100 billion IPO for its Vision Fund, had instead changed track and was now seeking to take out a $4 billion margin loan collateralized with its stake in Uber, and to a lesser extent, Guardiant Health and Slack (which itself has yet to go public).

This prompted us to ask: "just how much cash does the fund really need, and what, exactly, is going on behind Softbank's closed doors?"

The question got a renewed urgency on Sunday, when the WSJ reported that SoftBank's attempt to raise a second mega fund has been met with "a chilly reception from some of the world’s biggest money managers", signaling that as the WSJ put it politely, "a crucial initiative for the firm faces significant hurdles." We would put it less politely: the fact that the company behind many of the largest VC investments in the past decade is suddenly encountering the proverbial "closed window" may be the surest sign yet - more than even the Uber and Lyft IPO flops - that the second tech bubble of the 21st century has now popped.

According to the report, the Japanese tech giant made preliminary approaches to some of the world’s largest investors as it seeks to raise $100 billion for another fund dedicated to tech startups, but was rebuffed after several of these prominent investors reportedly planned to make limited or no contributions. These include Canada Pension Plan Investment Board and Saudi Arabia’s Public Investment Fund, whose $45 billion check made it the largest backer of SoftBank’s first tech fund, known as the Vision Fund (Saudi Arabia is having its own problems with oil once again sliding, putting the country's budget in jeopardy and forcing Riyadh to buckle down on foreign investments).

There is another reason why SoftBank, seen by many as nothing more than a venture fund-of-funds, may be having capital raising problems: why give it money in the first place? Indeed, many of the biggest and most sophisticated funds already have existing and programs to invest directly in late-stage startups and aren’t interested in paying fees to another party, the party in question being SoftBank.

Meanwhile, some of those with less experience who might benefit from the Vision Fund’s access to deals said they are concerned about its lack of transparency and its governance and see an investment as a bet on the acumen of one person: SoftBank Chief Executive Masayoshi Son.

The question then becomes whether Masayoshi Son some investing guru, or whether his track record is a case study of how a rising tide lifts all boats. Clearly, Son's experience in trading bitcoin, which he bought at the all time highs, only to sell it more than 50% lower in early 2018, booking a $130 million loss, leaves quite a few questions about his investing philosophy (even if cryptocurrencies are clearly a special investing case).

In any case, to overcome investor skepticism, the WSJ reports that SoftBank tapped Cantor Fitzgerald to help with the fundraising effort:

Cantor recently contacted prospective investors seeking commitments of as little as $50 million—or even less if they join feeder funds run by the investment bank, according to an email that was seen by The Wall Street Journal and people familiar with the matter.There was a silver lining: SoftBank didn’t authorize Cantor to seek even smaller commitments, and the investment bank scrapped internal plans for feeder funds and commitments of as little as $50 million after the company objected, for obvious reasons: if SoftBank represents that it is desperate for cash, it may as well turn off the lights (which doesn't mean it is not desperate for cash).

Of course, a plan to rely on hundreds of smaller investors will be a massive departure from SoftBank’s first Vision Fund, which was anchored by a dozen or so big contributions, and as the WSJ notes, "accepting money from small investors tends to be a last resort for firms raising big investment pools."

Which brings up another odd decision by SoftBank: Why Cantor? The company which was crippled on Sept 11, is best known as a bond broker and doesn’t have the distribution network of a Goldman Sachs or a Bank of America. But its president, Anshu Jain was formerly co-CEO of Deutsche Bank, where Rajeev Misra, who heads the Vision Fund, was a key lieutenant and the men are friends. Cantor is hoping to tap Jain’s network as well as contacts of Howard Lutnick, Cantor’s CEO, for investors, people close to the firm said.

Meanwhile, there is also the question whether the "equity check" from SoftBank will even arrive. The Japanese megabank has said it could contribute $50 billion in cash and other assets to Vision Fund II, but according to the WSJ, the company is under financial pressure because of a heavy debt load and weakness at Sprint which it controls. SoftBank is trying to sell Sprint to T-Mobile US Inc., but the deal has run into resistance at the Justice Department; if it isn’t approved, SoftBank’s ability to put so much into the new fund could be jeopardized leaving outside investors in the cold.

In short, a perfect storm is forming for SoftBank, whose first fund, raised two years ago is already almost fully spent, after generating a 29% annual return through March. Adding urgency to the new plan, Son - who believes in distracting skeptics with his furious investing pace - continues to eye even more and ever more expensive deals.

But with such a return, existing investors should be delighted to reinvest in Son one would think. Well, maybe not, because some clear fissures have emerged between SoftBank and its core sovereign wealth fund investors. Specifically, the Saudi PIF and Abu Dhabi's Mubadala Fund, which invested $15 billion in the first Vision Fund, have veto power over investments above $3 billion and $5 billion, respectively, and that has clogged the deal-making process on at least one occasion. One of the Vision Fund’s investments in delivery startup DoorDash took four months after it was held up by Saudi Arabia, and both sovereign-wealth funds balked at a planned $16 billion investment in co-working startup WeWork last year.

So if SoftBank's largest investors are getting cold feet about allocating any more cash to Mr. Son, why would anyone else want to? That, of course, is the $100 billion question.

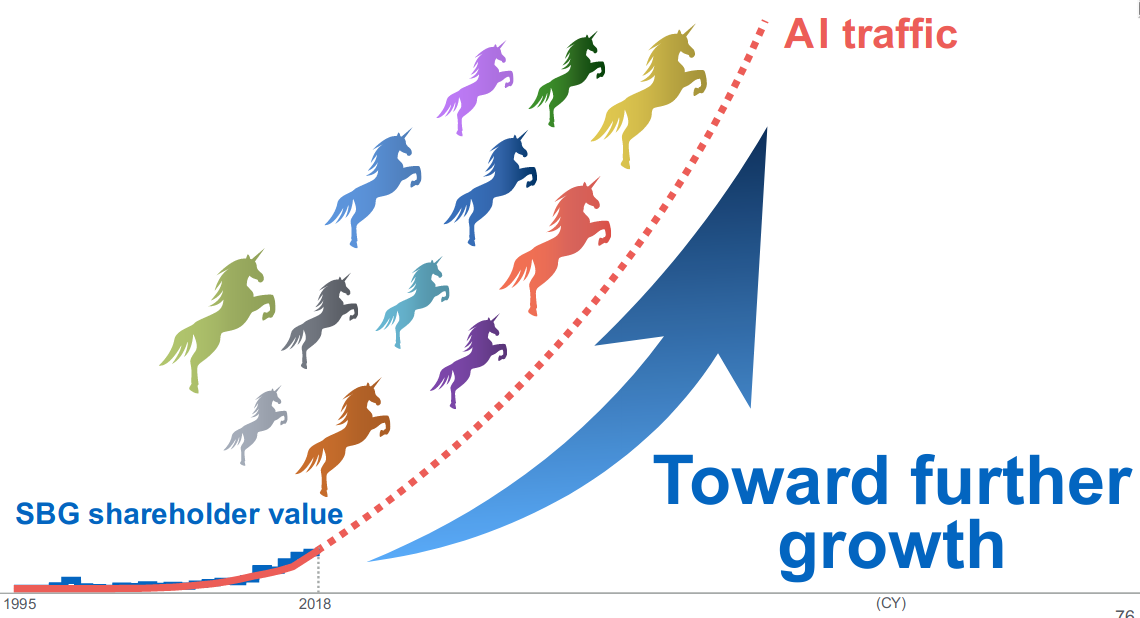

Prospective investors say they have met or spoken with Misra and Penny Bodle, the Vision Fund’s head of investor relations. Those that have signed a nondisclosure agreement were given a 37-page pitch deck, a copy of which was reviewed by the Journal, and which likely includes slides like this one.

The document, which of course is light on financial details, includes a timeline indicating how Son has foreseen major technological shifts over the years, such as the birth of the internet. It also contains case studies of a number of holdings—among them Indian hotel-booking startup OYO Hotels & Homes; Southeast Asian ride-hailing company Grab Holdings; and WeWork—and outlines how they benefit from interaction with other members of the Vision Fund portfolio....,,,MORE