And here's another part of the picture from Wolf Street, March 5:Serious slowdown in U.S. freight movements, per @JKempEnergyhttps://t.co/SVzba3BEq5 pic.twitter.com/AQ2kGLBlNk— Matthew C. Klein (@M_C_Klein) February 19, 2019

Trucking Boom U-Turns

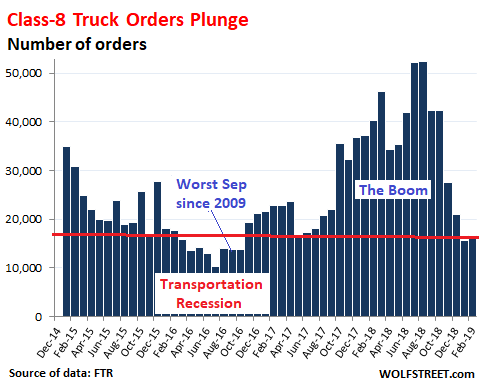

Orders for Class-8 trucks – made by Daimler (Freightliner, Western Star), Paccar (Peterbuilt, Kenworth), Navistar International, and Volvo Group (Mack Trucks, Volvo Trucks) – plunged 58% in February compared to February last year, to 16,700 orders, according to FTR Transportation Intelligence after they’d already plunged 58% year-over-year in January and 43% in December.

The orders in January and February were back in the range of the “transportation recession” that had hit the industry in 2015 and 2016. At the time, truck and engine manufacturers reacted with layoffs. But for now, they’re sitting on a massive backlog from the boom in orders last year (data via FTR):

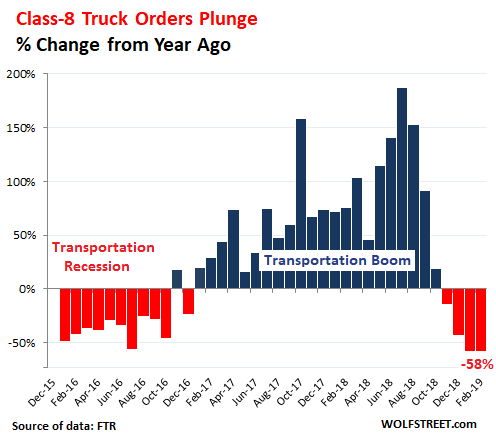

The business is infamously cyclical, with regular booms that lead to over-ordering and then overcapacity, followed by busts that then sort it all out again. The industry is also seasonal, so we can use year-over-year comparisons to eliminate most of the effects of seasonality.

The chart below shows the percent change of Class-8 truck orders for each month compared to the same month a year earlier. The year-over-year plunges over the past three months are of the same magnitude as the plunges during the last transportation recession (data via FTR):

“The weaker orders mean that backlogs will tumble for the second straight month, but they remain at historically high levels,” FTR says. These backlogs will keep plants running at capacity until mid-2019, and some truck makers “are booked solid for 2019 with limited sales slots open for the remainder of the year,” according to FTR.Previously from Wolf Street, February 21:

So truck makers are going to stay busy for a while, and fleets are getting their trucks, and trucking capacity is expanding and will continue to expand, even as orders get slashed.

This rising capacity finally provides some relief to shippers, such as retailers or industrial companies that need to ship their products to their customers. The transportation recession – as tough as it was on truckers, railroads, and truck and component makers – was nirvana for shippers: lower freight rates and no bottlenecks. But in 2018, they’d been complaining about soaring freight rates and shipping delays, and any loosening of those shipping conditions is a godsend to them....MORE

"What Trucking & Freight Just Said About the Goods-Based Economy in the US "