From MarketWatch:

A popular Turkey-focused ETF tumbles nearly 8% as cost of borrowing lira soars

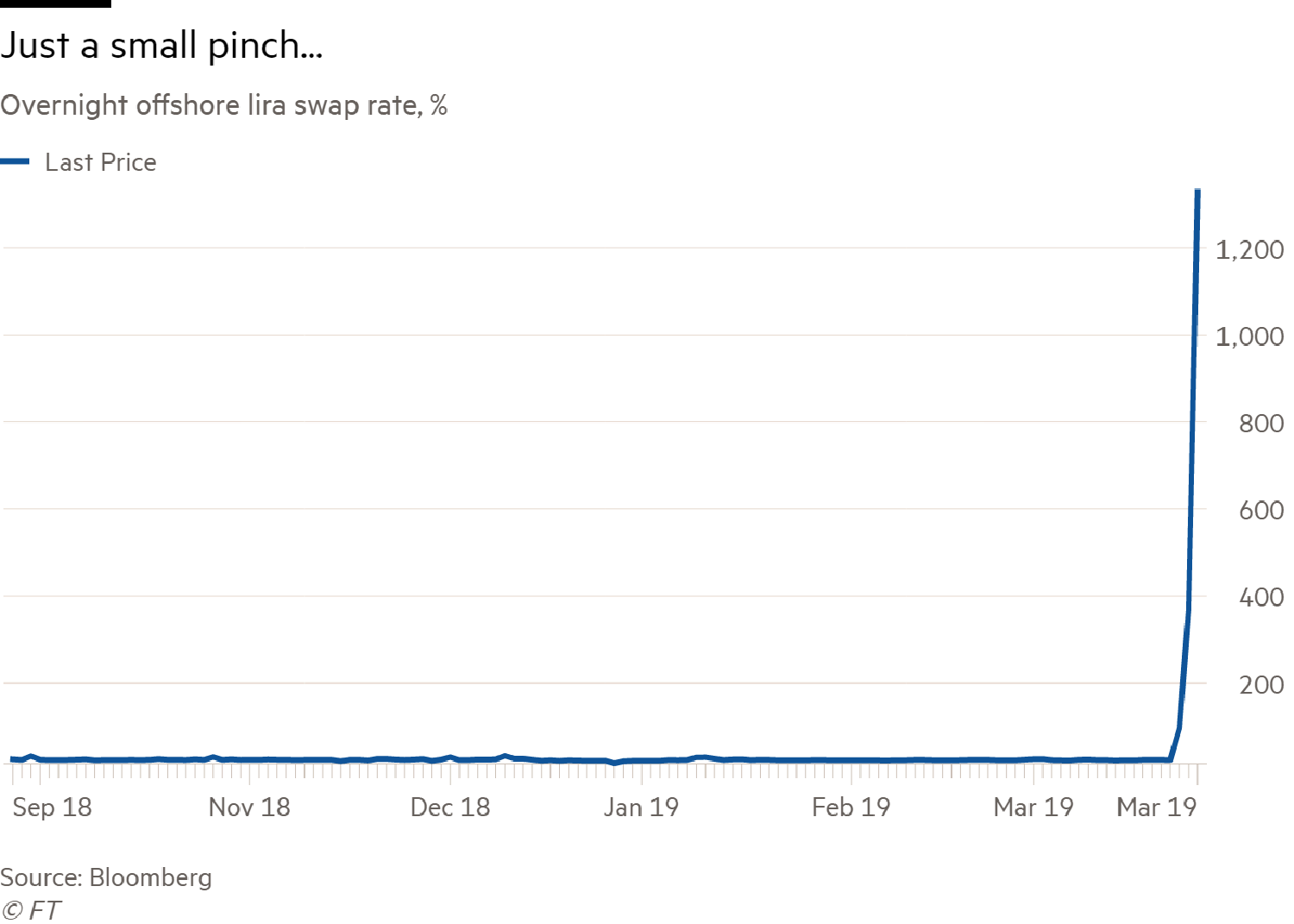

A popular way to bet on Turkey's stock market was tumbling sharply on Wednesday, as the Turkish government prevented foreign banks from accessing lira in so-called swaps transactions, a tactic intended to prevent bets against lira ahead of a weekend election, according to reports. That move has sent the overnight cost of borrowing lira, or swap rate, to 1,200% from 23%, according to Reuters. The exchange-traded iShares MSCI Turkey ETF TUR, -7.83% was down 7.8% midday Wednesday as the Turkish lira USDTRY, +1.9126% was weakening sharply against bucks....MOREAnd from Colby Smith at FT Alphaville, a look at the currency:

Turkey: trading constraints “unprecedented”

With local elections just days away, Turkish authorities are taking “extreme” measures, as one investor puts it, to protect the value of its currency.

The cost to borrow liras offshore overnight soared past 1,000 per cent today, hitting as high as 1,337 per cent at pixel. That is triple the rate from yesterday, and leagues higher than the 23 per cent level seen last week:

Not a Bitcoin chart from 2017.

“It sends the signal that something is dysfunctional here, especially because the lira is still selling off despite this huge squeeze in the offshore market”, says Paul McNamara, an Investment Director focused on emerging markets at GAM. “This is unprecedented. I can't think of a parallel in emerging markets.”...MORE