From American Affairs Journal:

What is an economist? There is an easy answer: economists are social scientists who create simplified quantitative models of large-scale market phenomena. But they are more than that. Besides their scientific role, economists have achieved a social cachet that far exceeds what one might expect from a class of geeky quasi-mathematicians. In addition to being scholars, economists today often advise national leaders, occupying some of the most influential roles in government. They are commonly treated like modern sages, given column space in our most prestigious periodicals, and turned to for analysis that goes far beyond pure economics and veers into politics, culture, and even morality. They command high salaries in government, academia, and the private sector, and they even have their own Nobel Prize.

Economists and their admirers presumably believe that the respect and social prestige accorded to them is earned rather than accidental—that they are respected and honored in proportion to their numerous accomplishments and the value they can provide to society. Skeptics like me disagree, and believe that economists are overrated, overpaid, and beyond some limited cases do not contribute to society as much as they would have us believe. At any rate, given their exalted status, it seems necessary to examine more closely what value economists actually provide to society and whether it justifies their popular acclaim.

The prominent economist N. Gregory Mankiw once jokingly suggested an analogy for the value that an economist provides to society. During a talk he gave about the Great Recession, he joked that being an economist during a recession is like being an undertaker during a plague: times are sad, but business is good. Undertakers make a valuable contribution to society, but a necessarily limited one: they do not predict plagues, nor do they cure any of the victims. If economists really were analogous to undertakers, we would expect that their social standing should be greatly reduced. Merely cleaning up some of the fallout of forces that one does not understand or control is not what brings one a plum cabinet post, exorbitant salary, or Nobel Prize.

In practice, economists seem to view themselves more like doctors during a plague. They confidently claim to have solid answers about the cause of the disease (or recession) as well as how to treat and eradicate it, and make a living from convincing people of this special expertise. Mankiw himself seriously compared economists working on the economy to doctors treating a sick patient in the pages of National Affairs in 2010. Even if one accepts this analogy, it leaves ample room for both positive and negative interpretations. During the Black Death, doctors enjoyed good business, but usually provided patients only a mixture of incompetence and superstition rather than healing or real knowledge. By contrast, during some of the great successes of medical history, like the eradication of smallpox, doctors provided expertise and effort that greatly increased human well-being.

In a recent article in aeon, Alan Jay Levinovitz offered yet another analogy for what economists do for society. He wrote that economics is “the new astrology,” and that its dazzling mathematics is only a distraction from its failure at “prophecy.” To make his case, he cited numerous failures of seemingly clever economists to predict the future, make money, or avert recessions.

An apologist for economics could respond to this by saying that economics is more like the early stages of astronomy than today’s astrology. For hundreds of years, legitimate and sober-minded astronomers advocated incorrect theories like Ptolemaic geocentrism because they didn’t know any better. However, they were on the right track: after more assiduous observation and study, astronomers corrected most of their incorrect notions and have collectively given to us a mature field that is capable of understanding distant galaxies and landing a rover on Mars. Though astrology was always irredeemable, astronomy only needed time and better observational technology to become the respectable field it is today. If economics is comparable, it only needs time and better observations in order to become as powerful and as correct as astronomy.

So which is it: are economists more like astronomers, working through occasional scientific imperfections to deliver valuable insights, or are they more like astrologers, charlatans pretending to have secrets to an esoteric mystery that is really nothing more than nonsense? Are they the doctors who eradicated smallpox, tireless and altruistic in their pursuit of truth and human flourishing, or are they the plague doctors who made a living peddling myths and quackery? These are not only idle philosophical questions. The millions of dollars that U.S. taxpayers spend annually on full-time government research economists and grants to academic economic research deserve to be properly justified or, if necessary, rerouted.

In this essay, I will attempt to quantify the performance of the economics profession over the last several decades. I will argue that the data suggests that economics has progressed very little for many years, and performs especially poorly around the time of recessions, when it would be most important for economists to perform their duties well. Because of this, I will also propose an adjusted and more modest role for economists in public life.

Case Study: Macroeconomic PredictionTo evaluate the performance of economists, it may be helpful to explore some data from the Survey of Professional Forecasters (SPF), a quarterly survey that has been conducted by the Federal Reserve Bank of Philadelphia since 1968. The survey is simple: the Federal Reserve Bank contacts professional economic forecasters and asks them to predict future values of a variety of macroeconomic indicators, including unemployment and nominal GDP. Surveyed professionals make predictions for the near future (including the current quarter) as well as the more distant future (up to about four quarters in advance). Anonymized records of predicted values and actual values since 1968 are available for free on the Philadelphia Federal Reserve Bank’s website.

In the SPF data, measuring the accuracy of a forecast is straightforward—it is simply the difference between a predicted value and the corresponding actual value, where the differences closest to 0 represent the best performance and the differences furthest from 0 represent the worst. An example data point might come from a forecaster who was surveyed during the second quarter of 1975, and was asked to make predictions about the final measured unemployment in the second quarter of 1976. If the forecaster guessed 4.5 percent unemployment but the actual realized value was 6.0 percent (for example), his absolute error was 1.5 percentage points. If another forecaster guessed 7.5 percent for the same quarter, his absolute error would also be 1.5 percentage points (overestimates and underestimates are treated the same).

After calculating the absolute errors for each forecast in every quarter, we can take the average of the absolute errors from all forecasters in a particular quarter to gauge the forecasters’ overall performance in that quarter. Then, we can look for two things: first, absolute performance in every quarter, to answer the question of how well economists perform at macroeconomic forecasting, and second, change over time, to answer the question of whether economists’ macroeconomic forecasting has improved over the decades.

The SPF dataset includes 6,808 forecasts of unemployment and 6,716 forecasts of nominal GDP. Here, I will only examine forecasts that are made four quarters ahead (for example, forecasts that are made in 1975, quarter 2, about the final realized unemployment rate in 1976, quarter 2).

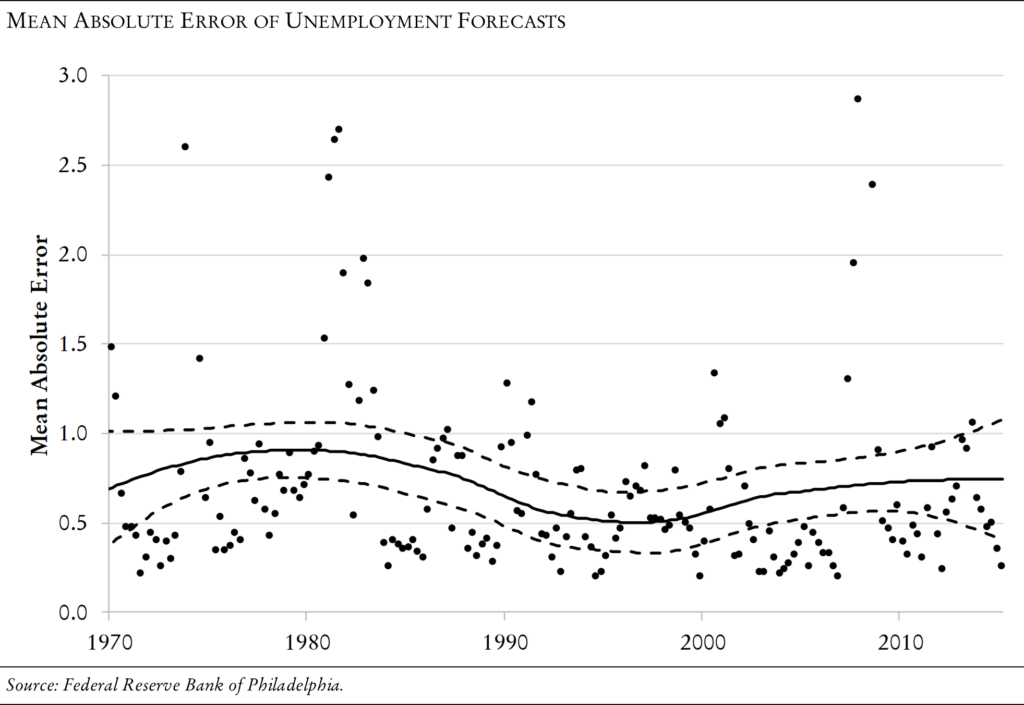

The mean absolute errors over time for SPF predictions of U.S. unemployment are shown in the chart below. In this figure, the black dots show the quarterly mean absolute errors of unemployment forecasts. So a value of 1.5, for example, means that the average forecaster’s guess was 1.5 points away from (above or below) the true value: either guessing 4.5 percent or 7.5 percent unemployment when actual unemployment was 6.0 percent. The solid line shows a “Loess curve,” which is something like a rolling average of the plotted mean errors. (A Loess curve is based on a weighted local regression methodology rather than a raw average.) The dotted lines show a “confidence interval” for the solid Loess curve.

One of the easiest things to notice about the errors plotted in the above chart is how large they get. The majority of quarterly average errors are larger than half a percentage point, which is a considerable difference for a figure that is almost never outside the 6-point window between 4 and 10. In many quarters, the average error is larger than 1 percentage point and even exceeded 3 points in one quarter. The value of the Loess curve is never less than 0.5 percentage points....MORE

As for the trend of the data, there is no sharp increase or decrease. There are many different methodologies for finding time trends in data, and some of these methods will indicate a slight downward trend for these errors. At best, the downward trend is very slight. However, there is evidence that the errors are stagnant:

Another important thing to point out in this data is that the errors appear to be especially large just before and during recessions. We can see spikes around 1973–1975, in the early 1980’s, and the early and late 2000’s, all periods of recession. These spikes are similar to each other in maximum height. The period of best forecast performance was the 1990’s, a period of steady and sustained economic growth.

- The Loess curve reached its minimum value in 1996, two decades ago. Throughout the 2000’s the Loess curve rises, as does its confidence interval.

- The most recent confidence interval contains the estimated Loess value from the earliest recorded quarter (1968, quarter 4). Similarly, the earliest confidence interval contains the estimated value from the most recent recorded quarter.

I believe the above figure is damning to the economics profession. It shows a profession that frequently makes large errors (see the many high error values plotted), that predicts recessions very poorly or not at all (see the bad performance around recession quarters) and that has improved little or not at all over the years (see the relatively flat and sometimes-increasing “average” line). The errors around recession years are consistent in their large size—I cannot see evidence for an increased ability to predict recessions. Looking at the chart, it is easy to wonder whether the hundreds of economics research papers published annually are worth the millions of dollars that are spent funding them. It is not clear that they deliver anything more than a flat Loess curve indicating stagnation. The yearly Nobel Prize in economics is meant to represent game-changing advances in the field. But it is not clear that big advances have happened at all in economics over the time plotted above, let alone the annual game-changing advances that the Nobel committee claims.

So, economists have a poor track record at prediction, and show little or no evidence of progress over the decades. If they cannot predict well or improve at prediction, it is not clear why we should believe that they have done any better at anything else they claim to be able to do. It is also not clear that we should continue to ask their opinions about the economy’s state or future. Neither is it clear from these poor results that we should exalt them to cabinet posts or give them column space in prestigious periodicals. What then is their value? I will consider this below.

Interpreting the DataBefore moving on to assess the value of economists in public life, it would be worthwhile to consider the implications and limitations of the data shown in the case study above....