“The complete evaporation of liquidity in certain market segments of the U.S. securitization market has made it impossible to value certain assets fairly regardless of their quality or credit rating.”

BNP Paribas press release, August 9, 2007

In his memorable review of 21 books about the 2007-09 financial crisis, Andrew Lo evoked Kurosawa’s classic film, Rashomon, to characterize the remarkable differences between these crisis accounts. Not only were the interpretations in dispute, but the facts were as well: “Even its starting date is unclear. Should we mark its beginning at the crest of the U.S. housing bubble in mid-2006, or with the liquidity crunch in the shadow banking system in late 2007, or with the bankruptcy filing of Lehman Brothers and the ‘breaking of the buck’ by the Reserve Primary Fund in September 2008?”

In our view, the crisis began in earnest 10 years ago this week. On August 9, 2007, BNP Paribas announced that, because their fund managers could not value the assets in three mutual funds, they were suspending redemptions. With a decade’s worth of hindsight, we view this as a propitious moment to review both the precursors and the start of the worst financial crisis since the Great Depression of the 1930s. In future “10-years-after” posts, we hope to review other aspects of the crisis, including the various policy responses and key episodes involving runs on Bear Stearns, Lehman, the government-sponsored enterprises, and AIG.

But, first things first: What is a financial crisis? In our view, the term refers to a sudden, unanticipated shift from a reasonably healthy equilibrium—characterized by highly liquid financial markets, low risk premia, easily available credit, and low asset price volatility—to a very unhealthy one with precisely the opposite features. We use the term “equilibrium” to reflect a persistent state of financial conditions and note that—as was the case for Humpty Dumpty—it is easy to shift from a good financial state to a bad one, but very difficult to shift back again. The bad state is usually associated with increased co-movement of asset prices; contagion across firms, markets, and geographic jurisdictions; and an adverse feedback between the financial system and the real economy, so that as one deteriorates it makes the other even worse.

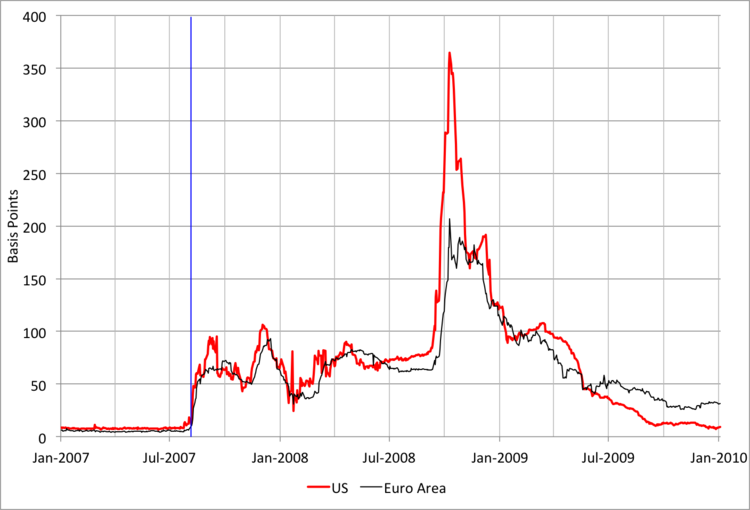

Below are two charts that highlight the dramatic impact of the August 9, 2007 Paribas event. Both exhibit a sudden shift from a good equilibrium to a bad one (which proceeded to worsen further as the crisis advanced). In the first chart, we show the classic fever thermometer of the crisis—the U.S. dollar three-month LIBOR-OIS spread—at a daily frequency (the red line). This spread is the difference between the interest rate at which top-quality banks in London claimed to be able to borrow from other banks in the uncollateralized market (LIBOR) for three months and a proxy for the expectations over the next three months of the safest, most liquid, nominal interest rate. It jumps on August 9 and does not sink back below this heightened level until after the Federal Reserve publishes the results of its first stress tests on May 7, 2009. The chart also highlights the rapid contagion of strains in this critical dollar funding market to the short-term market for funding in euros (the black line).

Three-month LIBOR-OIS interest rate spreads (basis points), 2007-2009

Note: Vertical blue line denotes August 9, 2007 (BNP Paribas announcement). Source: Bloomberg.

We focus on the LIBOR-OIS spread because of what it measures. Viewed in isolation, the spread between the rate charged for providing a loan to a bank and one for a risk-free loan reflects the combination of a liquidity premium and compensation for counterparty risk. As the spread widens, we can infer that either liquidity is more expensive, the perceived risk of default is higher, or some mix of both. It seems likely that the initial shock was dominated by a broad scramble for liquid funds, as alternative means of financing suddenly dried up (especially in dollars and for shadow banks). However, during the remainder of 2007, as central banks moved aggressively to reduce bank (and shadow bank) short-term funding costs, the persistence of the LIBOR-OIS spread increasingly pointed to worries about counterparty solvency. Other indicators of funding disruption, such as the cross-currency basis swap that showed large and widening deviations from covered interest parity, exhibit the same pattern (see here)....MUCH MORE