From Bloomberg Businessweek, February 14:

The billion-dollar startup bubble is deflating, and more than $1 trillion in value is locked up in companies with dwindling prospects.

As hard as it is to remember, there were buzzy startups in Silicon Valley before the tech world became solely fixated on artificial intelligence. By the time the Covid-era tech boom crested in 2021, well over 1,000 venture capital-backed startups had reached valuations above $1 billion, including fake meat purveyor Impossible Foods Inc., home maintenance marketplace Thumbtack and online-class platform MasterClass. Then came a squeeze sparked by rising interest rates, a slowing initial public offering market and the feeling that any startup not focused on AI was yesterday’s news.

A reckoning that has been looming for years is becoming painfully tangible. In 2021 more than 354 companies received billion-dollar valuations, thus achieving unicorn status. Only six of them have since held IPOs, says Ilya Strebulaev, a professor at Stanford Graduate School of Business. Four others have gone public through SPACs, and another 10 have been acquired, several for less than $1 billion. Others, such as the indoor farming company Bowery Farming and AI health-care startup Forward Health, have gone under. Convoy, the freight business valued at $3.8 billion in 2022, collapsed the following year; the supply chain startup Flexport bought its assets for scraps.

Some startups feel like the “rug has been pulled out from under them,” says Sam Angus, a partner at the law firm Fenwick & West. “The fundraising reality has shifted.”

Welcome to the era of the zombie unicorn. There are a record 1,200 venture-backed unicorns that have yet to go public or get acquired, according to CB Insights, a researcher that tracks the venture capital industry. Startups that raised large sums of money are beginning to take desperate measures. Startups in later stages are in a particularly difficult position, because they generally need more money to operate—and the investors who’d write checks at billion-dollar-plus valuations have gotten more selective. For some, accepting unfavorable fundraising terms or selling at a steep discount are the only ways to avoid collapsing completely, leaving behind nothing but a unicorpse.

The fundraising market for startups began to sour in 2022 when, among other things, the Federal Reserve raised interest rates seven times after a decade of historically cheap money. These rate increases led to cost-cutting and industrywide layoffs, a trend that peaked in the first quarter of 2023, according to data provider Statista. Some companies that had been focused on growth shifted their goal to near-term profitability to reduce their reliance on venture capital....

....MUCH MORE

Sometimes I sort of miss the unicorn days.

But then I remember 2015: "Silicon Valley Is a Big Fat Lie":

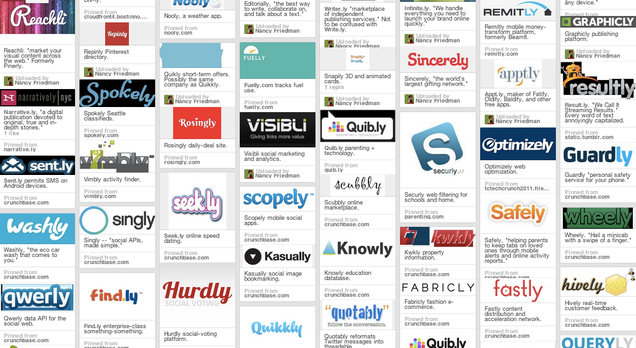

Comparing the geniuses of old Silicon Valley, for example (ca. 1993), Nvidia, "Nvidia Wants to Be the Brains Of Your Autonomous Car (NVID)", who make the chips that will go into the world's fastest supercomputer with the list of names currently on offer:

Bitly, Borkly, Barnly, Molestly, Strinkingly, Happily, Crappily, Maply, Morply, Dottly, Dootly, Godly, Angrily.And you almost want to cry. See also after the jump....