First up, from Semafor, February 24:

On The RecordSemafor Business’ signature interview series, On The Record, brings you conversations with the people running, shaping, and changing our economy. Read our earlier conversations with Mattel CEO Ynon Kreiz on Hollywood’s golden age of IP, Washington Post CEO Will Lewis on the media doom cycle, and Delta CEO Ed Bastian on the 2020 airlines bailout.Three years ago, an army of bored, stimulus-rich day traders upended the stock market. They may have rallied on Reddit and Twitter, but they traded on Robinhood, which became the face of the meme-stock craze and was nearly brought down by it when it ran out of cash to cover its customers’ trading.

That moment is over. SPACs are dead. Memelords couldn’t save Bed Bath & Beyond. The index fund that tracked meme stocks, built to “capture a zeitgeist,” shut down in November. What froth remains has been funneled into AI stocks, which at least carry the promise of profits.

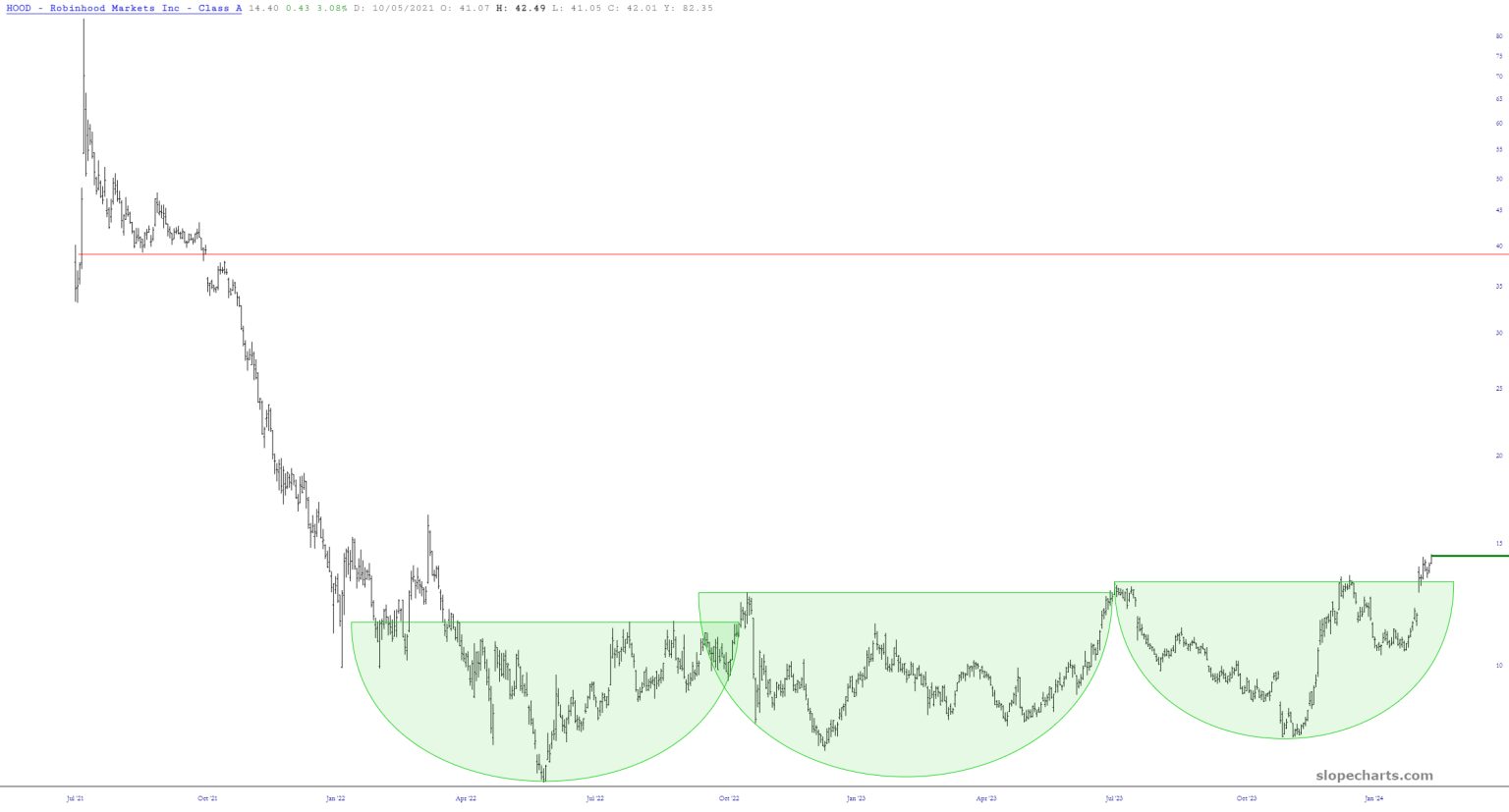

Robinhood is still here, trying to thrive beyond the moment that launched it. Trading volumes on its app have fallen by half since early 2021; stocks and cryptocurrencies don’t hold the same appeal when Treasury bonds pay 5%. The company’s shares are down more than 70% from their peak.

Regulators are taking aim at the gamified investing that Robinhood pioneered, which has brought newcomers to the markets — a good thing in a country where the vast majority of wealth-creating assets are owned by already wealthy people, but one that encouraged, through smartphone confetti, engagement beyond what is perhaps wise.

I talked with Vlad Tenev, the company’s 37-year-old CEO, about the way forward. In the sunlit penthouse of Robinhood’s surprisingly anonymous Manhattan headquarters, he sipped bottled green tea and described a Robinhood that looks more like the legacy firms it set out a decade ago to unseat. (Credit cards are coming; check back in on mortgages in a few years.) It must also keep the loyalty of its most active customers, while fending off competitors that are courting Gen Z investors.

This interview was condensed and edited for clarity.

We’re three years out from the meme-stock craze. What did you learn?The importance of clear communication. I wish I’d been more patient. I was very keen to get out there and start talking right away, and I was dealing with lots of issues internally, trying to make sure everything was stable, and I just wasn’t really sleeping. So I was not as compelling as I could have been in explaining exactly what happened....

....MUCH MORE

And from Slope of Hope, also February 24: