Point/Counterpoint.

First up, Yahoo Finace, February 29:

Fed's preferred inflation gauge logs lowest annual rise since March 2021

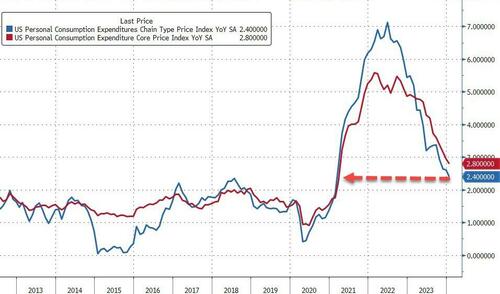

The Fed's preferred inflation gauge logged its lowest annual increase since March 2021 in January, matching Wall Street forecasts, while monthly prices rose at the fastest rate in a year.

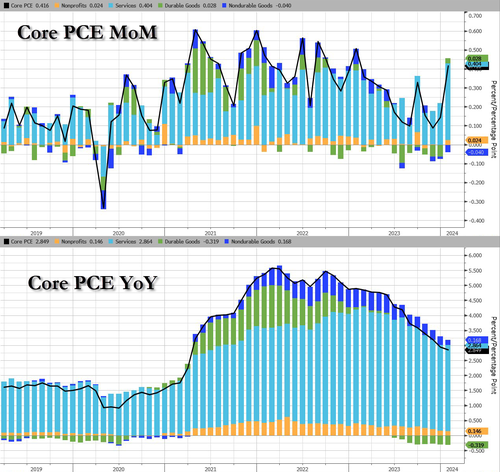

The core Personal Consumption Expenditures (PCE) index, which strips out the cost of food and energy and is closely watched by the Federal Reserve, rose 2.8% over the prior year in January, the slowest annual increase since a 2.2% increase in March 2021.

Compared to the prior month, core PCE rose 0.4%, the most since January 2023 and an increase from the 0.1% increase seen in December. The monthly increase marked a stark shift in the inflation data.

Prior to Thursday's release, the six-month annualized rate of price increases had been below the Fed's 2% goal for two consecutive months. After the January data, the six-month annualized PCE price increase is 2.5%.

"Fed officials have signaled they do not need better news on inflation to cut rates, just continued good news," Oxford Economics deputy chief US economist Michael Pearce wrote in a note to clients. "With the trend in inflation still downward, gradual rate cuts this year are still on the table."....

....MUCH MORE

And from ZeroHedge:

SuperCore Inflation Soars In January, Services Costs Re-Accelerate As Govt Handouts Spike

GOOD NEWS... One of The Fed's favorite inflation indicators - Core PCE Deflator - dropped to +2.8% YoY in January (as expected) - the lowest since March 2021.

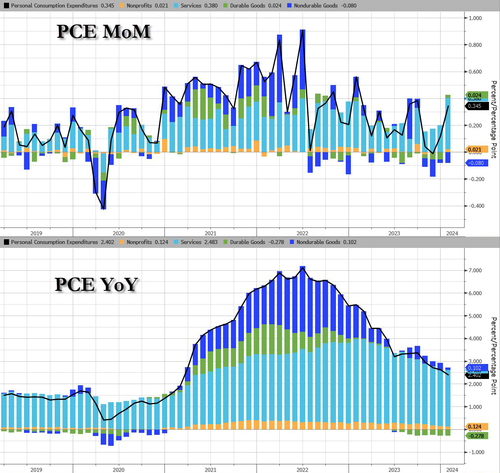

Headline PCE Deflator rose 0.3% MoM as expected, down at +2.4% YoY in January ...

Source: Bloomberg

BAD NEWS... Services soared on a MoM basis...

However, shorter-term signals are less encouraging:

Core PCE 3M annualized rate 2.8% from 2.0%

Core PCE 6M annualized rate 2.6% from 2.2%

On a core basis, services costs jumped even more and Durable Goods costs flipped from deflation...

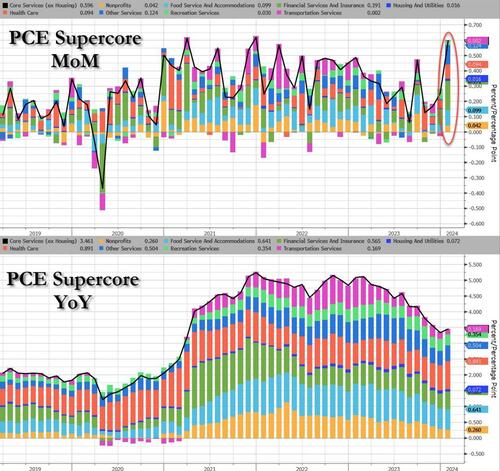

UGLY NEWS... Even more focused, from The Fed's perspective, is Services inflation ex-Shelter, and the PCE-equivalent actually ticked up on a YoY basis to 3.45%, thanks to a large 0.6% MoM jump - the biggest MoM rise since Dec 2021.

Source: Bloomberg

Under the hood, the SuperCore, every sub-element rose MoM...

Source: Bloomberg

Income and Spending both increased with the former soaring 1.0% MoM (+0.4% exp) but the latter up only 0.2% (in line)...

....MUCH MORE

Finally, some additional Point/Counterpoint: