From ZeroHedge, Aug. 14:

PBOC Cuts Rates In Surprise 'Easing' Ahead Of Dismal China Data Dump; Japanese Economy Surged In Q2

An Asian avalanche of data and headlines:

Japanese GDP surged in Q2 - doubling expectations on export-led growth

Japanese domestic spending weak

PBOC surprises with rate-cuts (biggest MLF cut since 2020)

MoF fix dramatically stronger than offshore yuan

Yuan tumbles below 2023 lows on rate-cuts

China 10Y yield drops to lowest since 2020

Chinese macro data missed across the board

China gold premium to London is soaring

China did not report its (record high) youth unemployment rate

* * *

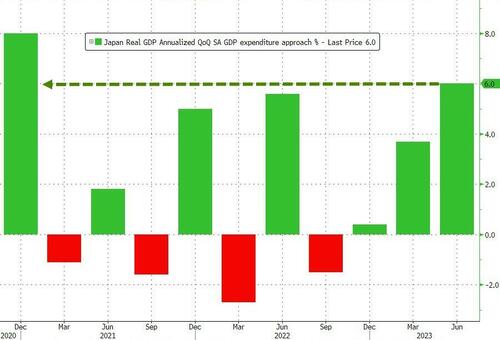

The Japanese economy grew dramatically faster than expected in the second quarter, driven by strong exports data.

GDP grew at an annualized 6.0% in Q2 (the strongest growth since Q4 2020), more than double the 2.9% growth expected...

Source: Bloomberg

Outside of the post-COVID chaos, this is strongest annualized GDP growth for Japan since Q1 2015, even as economists see headwinds on the horizon in the US, China and Europe.

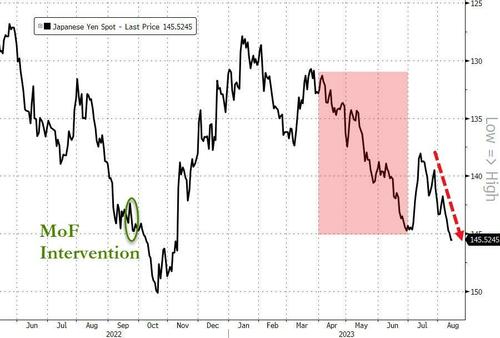

The export growth was helped by a plunge in the yen during Q2 (which, again outside of the COVID craziness, is the biggest quarterly drop in the Japanese currency since Q4 2016).

In fact, as Bloomberg reports, the yen has tumbled back toward a level that triggered the first yen-buying intervention since 1998 in September as yield differentials widened.

“We believe the Ministry of Finance will start pushing back in the 145-148 range,” wrote Joey Chew, head of Asia FX research at HSBC Holdings Plc in a note.

“But, if it does not, short positions on yen will likely be rebuilt further.”

Source: Bloomberg

Perhaps the apparent strength of the Japanese economy will provide 'room' for the 'buying' intervention to stop the yen's freefall?

The anemic yen has been a double-edged sword for the economy, said Takahide Kiuchi, an economist at the Nomura Research Institute.

“It can be a positive for exporters, increasing competitiveness and revenue,” he said.

“However, it could undermine consumption.”

And sure enough, while strong external demand supported the growth, domestically things aren't so rosy as rising inflation made domestic households more hesitant to spend with private consumption dropping 0.5% QoQ - the weakest since Q1 2022...

“Compared with the January-March period, the improvement seen in consumption driven by increased activity has weakened,” said Harumi Taguchi, principal economist at S&P Global Market Intelligence.

“Rising prices are increasingly causing consumers to hold off on buying items.”

Source: Bloomberg

Additionally, the high reliance on exports makes the recent growth vulnerable to other countries’ malaise. Recent softness in China, Japan’s largest trade partner, is a particular source of worry.

“We see clear signs of slowing in China and Europe,” Mr. Kiuchi, of the Nomura Research Institute, said.

That means “the stability of this high growth is unclear.”

Japan is the world’s third-largest economy, and the largest creditor by far... meaning its growth or fragility reverberates around the world...

“The only problem - it was all export driven and masked rocky conditions in domestic demand," Bloomberg economist Taro Kimura explains.

"The drop in consumption, despite a tailwind from this year’s reopening, reflects the impact of wages lagging far behind cost-push inflation.”

...but tonight we also get a data dump from the world's second largest economy - China.

Amid a growing debt crisis, China's trade outlook looking similarly dire (with overseas shipments tumbling in July by the most in more than three years, and imports contracted for a fifth consecutive month), and China’s banks having extended the smallest amount of monthly loans since 2009, and aggregate financing was less than half the level forecast by economists; the signals heading into tonight's data suggest that China’s economy weakened further in July and Beijing was slow to arrest the decline.

Ahead of the China data dump, there was much excitement as the PBOC surprised with more 'easing' - sooner than most expected:

PBOC conducts 401b yuan of 1-year medium-term lending facility at a yield of 2.5% vs 2.65% in the last operation, the central bank says in a statement.

PBOC also sells 204b yuan of 7-day reverse repo at a yield of 1.8% vs 1.9% in the last operation

Today’s MLF operation is “totally out of expectation,” says Becky Liu, head of China macro strategy of Standard Chartered Plc:....

....MUCH MORE