Brutal.

From/via ZeroHedge, August 30:

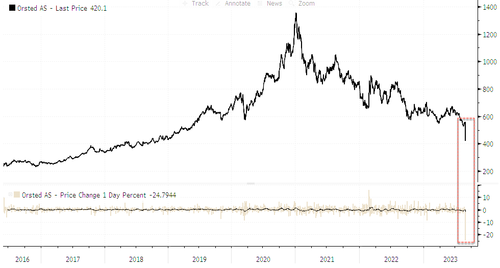

Shares of the world's largest offshore wind farm developer crashed in Copenhagen trading on Wednesday after it warned: "The situation in US offshore wind is severe."

Orsted A/S was hit with a massive 16 billion Danish kroner ($2.3 billion) impairment on its US portfolio due to snarled supply chains, soaring interest rates, and easy money tax credits drying up -- a warning sign the green energy revolution bubble is in trouble.

CEO Mads Nipper warned investors on a conference call: "The situation in US offshore wind is severe."

Shares in Denmark-listed green energy giant crashed 25%, the largest daily decline since it went public in early 2016.

Bloomberg explained more about the headwinds plaguing Orsted:

The company's Ocean Wind 1, Sunrise Wind, and Revolution Wind projects in the US are being hurt by supplier delays, which could lead to writedowns of up to 5 billion kroner, it said late Tuesday. High interest rates could also add another 5 billion. In addition, the developer is still in talks with federal stakeholders to qualify for additional tax credits, which haven't progressed as expected. If unsuccessful, it could lead to impairments of as much as 6 billion kroner.

Analysts at Bernstein warned clients in a note: "Today's announcement flags risks in the US portfolio and does not do anything to improve the downbeat investor sentiment on the stock."

"While the bulls could argue many of these issues related to the impairment are already known, the announcement is unlikely to bode well for an already-weakened Orsted share price," Citigroup Inc. analyst Jenny Ping told clients.

Analysts across the board were overwhelmingly pessimistic about the news (list courtesy of Bloomberg):

BNP Paribas Exane (cut to neutral from outperform)

- The potential write-down of DKK16b dwarfs the DKK2.5b impairment announced in January, analyst Harry Wyburd writes in a note

- Investor confidence will probably be "compromised" for some time

UBS (buy)

- Sam Arie puts the focus on which targets will remain valid in this context

- Says today's announcement is a negative and somewhat of a surprise

- Adds investors may be concerned in the change in tone since the June CMD where management seemed more confident in regulatory changes that would help to protect the return profile of these US projects....

....MUCH MORE

Somewhat of a surprise? Dude, you had one job. Or used to.

....We haven't had much to say about the wind business, either manufacturers or wind farm operators since their returns dropped below those offered by regulated utilities. If the U.S. offshore wind farms ever get started and then, if they can make any money we'll be back to themAugust 3:

"There Is A Financial Crisis Brewing In Offshore Wind Energy"