The Federal Reserve has gotten themselves into a horrible bind. As former Philadelphia Fedhead Charles Plosser has said, the Federal Reserve should not have bought Mortgage Backed Securities and once they did, and the emergency of 2008 - 2009 had passed, they should have gotten out of the position they had built.*

Instead they kept buying.

And now they are in the position where they can't sell the paper into the open market without driving up mortgage rates further still and the mortgages underlying the MBS's aren't being re-financed because current rates are so much higher than the rates on the mortgages that homeowners hang on to their current mortgages.

And the last way that older mortgages are retired, upon sale of the property, isn't happening because the new higher rates are discouraging buyers.

The Fed pumped up the bubble until house prices got to around double what they would have been absent the Fed's buying/lowering interest rates. For that you can thank Noble Prize winner Ben Bernanke and now-Secretary of the Treasury Janet Yellen.

From Peter Tchir at Academy Securities, September 20:

Yesterday we briefly touched on how the market could trade on QT vs Stagflation.

Today we will address why the Fed should tweak quantitative tightening and how easy it is to do that.

The Why – Mortgage Market MeltdownLet’s start with the “why”. Why is the mortgage market faring worse than other bond markets?

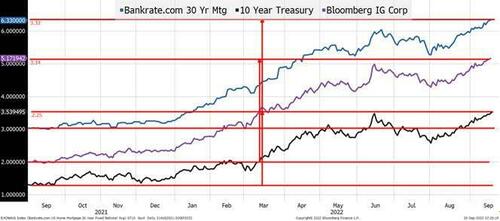

The 30-year Bankrate.com mortgage rate has more than double since last summer, spiking by 3.32%. Far more than the corporate bond index yield (which moved 3.14% higher) or the 10-year treasury yield which is “only” 2.25% more than it was. This is a reasonable comparison, given all three of these have similar duration.

Spreads have widened significantly more on mortgage bonds, than corporate bonds.

The Why – Anticipated QTThere are many reasons that mortgage markets may have underperformed, but I will blame QT for a big portion of that.The spreads gapped in March. They have continued to widen, but there is a big, obvious gap that started in February and peaked in March – the exact timeframe that QT was put on the table.

There was little evidence that the economy might soften back in the spring. Housing prices were still rising and it was generally a seller’s market. The Fed’s commitment to hiking rates aggressively was questioned and few thought the terminal rate would be 4% or higher. Yet mortgage spreads spiked.

The difference between mortgages and corporate bonds in the spring was that the Fed might have to sell one and not the other.

On May 4th, we got the Fed’s Plan for Balance Sheet Reduction.

It discusses primarily using run-off to reduce the size of their balance sheet.

Agency and Mortgage Debt would reduce by a “maximum” of $17.5 billion a month and that has now ratcheted up to $35 billion a month.

It seems impossible that on any given month the Fed will receive anywhere near $35 billion of reduction in their mortgage portfolio as maturities are long and pre=payment speeds have dropped like a rock (who is prepaying 3% mortgages in a 6% mortgage environment?).

That has led to speculation, or concern, from the start that the Fed would have to sell mortgages (that concern started in the spring – which we highlighted at the time). During QE the Fed was a price insensitive (indiscriminate) buyer, so “logic” would dictate that they will just hit bids on the way out as they have behaved as price takers, rather than price setters.

With liquidity abysmal, a potentially large, persistent, price insensitive seller it is no wonder the mortgage market is in disarray. No one wants to stand in front of that freight train at the best of times, let alone as further rate hikes are being priced in.

Fed losses would mount. Mortgage funds seem to be down around 10% or more in the past year (and year to date). The Fed’s portfolio would likely take 10% or so hits on every bond they sell (they rely on accrual accounting so their loss would be based on where they held them under that system, and not all bonds were bought at the peak, but 10% losses seems a reasonable number). If they had to sell $35 billion a month, that would add up quickly ($3 billion monthly losses). Assuming they go 75 bps this meeting, their cost of funding their position would be a little over 3% which may be enough that even on an accrual accounting basis, their portfolio switches to a loss for the Treasury department and Congress. We’ve discussed the Fed Profit Machine multiple times.

So Many Reasons Why To Tweak QTMy argument is that:

QT is the main reason mortgages have underperformed by so much.

Higher mortgage rates impact the economy, hurt housing, reduce mobility, and have so many other negative consequences, we need to be very careful here.

Finally, and less important, is selling will weaken the Fed’s profits and that could have some consequences in DC, the mainstream media and the average person in the street who doesn’t understand how things work on a detailed level.

To me, it seems obvious that setting up conditions that force the Fed to sell mortgages is a really bad idea for everyone involved....

- Former Philadelphia Fed President Charles Plosser: "Why The Fed Should Only Own Treasuries"

- Former Philadelphia Fed Head Plosser On The Federal Reserve Balance Sheet With Comments On the Mortgage Backed Securities Portfolio

Latest Federal Reserve's Balance Sheet: Once Again The Mortgage Backed Securities Portfolio Increased

The Mortgage Backed Securities Trap The Federal Reserve Set For Itself, In One Chart

Ahead of Tomorrow's Personal Consumption Expenditures Inflation Report, A Reminder

Dylan Grice: "Crash, Then Boom"

Fed Purchases Of Mortgage Backed Securities Have Destroyed The Housing Market

Followup: Despite What The Federal Reserve Says, Financial Conditions Are Loosening, Not Tightening

"The Fed Is About to Ramp Up Balance-Sheet Shrinkage. It May Get Dicey"

Sometimes I wonder if the Fed spent the last three months of "QT"* just waiting for the big banks to get their derivative books in order before doing a rugpull on real estate....

In Case You Missed It: "Blackstone Puts Finishing Touches on Record Real-Estate Vehicle" (BX)

Opportunistic, thy name is Blackstone....

Atlanta Fed Head Raphael Bostic On Mortgage Backed Securities: "We are going to have to actively try to sell them."Got it? Pull back from the market which a) avoids top-ticking and b) accelerates the downward trend already in place.

Wait.

Deploy cash offers when retail buyers have to contend with comparatively sky-high mortgage rates.