Our boilerplate mini-bio to David Goldman:

...The author of this piece, David Goldman, is Deputy Editor (Business) at Asia Times.

Prior to taking that position he was:

- Global head of credit strategy at Credit Suisse

- Global Head of Fixed Income Research for Bank of America

- Global Head of Fixed Income Research at Cantor Fitzgerald

In addition to apparently not being able to hold onto a job I think one of his requirements for moving on was a "Global Head" title. (JK, young Master. G.)

Here's his latest at Asia Times and after the jump some of his previous missives.

Inflation Shock Hits As Shelter Prices Boost CPI

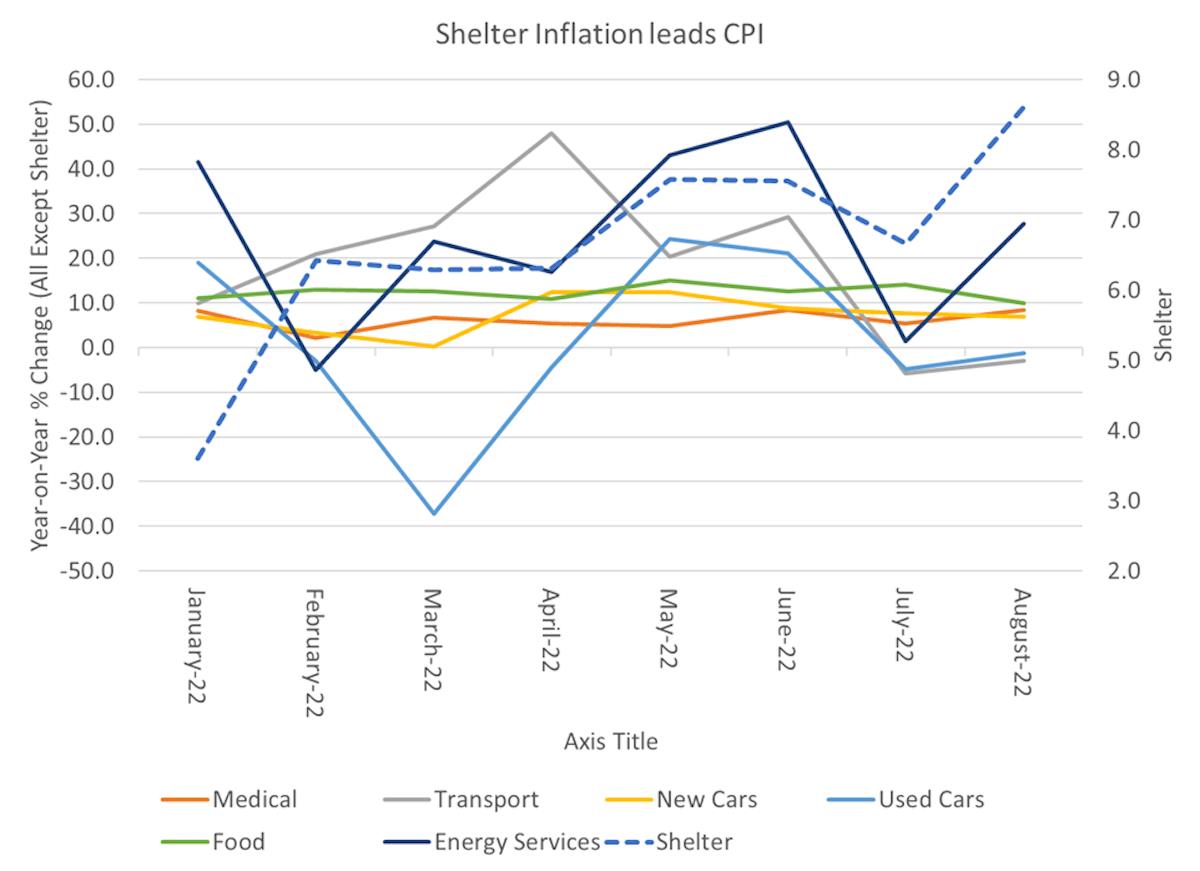

Tuesday's 5% plunge in the NASDAQ followed a higher-than-forecast August year-on-year rise of 8.3% in the US Consumer Price Index. Shelter, which represents almost a third of the index, accounted for most of the surprise, rising 8.6% year-on-year, according to the Bureau of Labor Statistics.

The only surprise is that investors didn't see this one coming.

I'd warned a year earlier that“US rent hikes will explode consumer inflation in 2022.” After all, today's rent inflation shows up in tomorrow's Consumer Price Index as leases expire. The August 2022 jump in rent inflation is just the beginning.

By raising interest rates, the Fed is making inflation worse. Housing is in short supply, and higher interest rates make it harder to build new rental units. This is NOT a credit-driven inflation but a supply-side shortage.

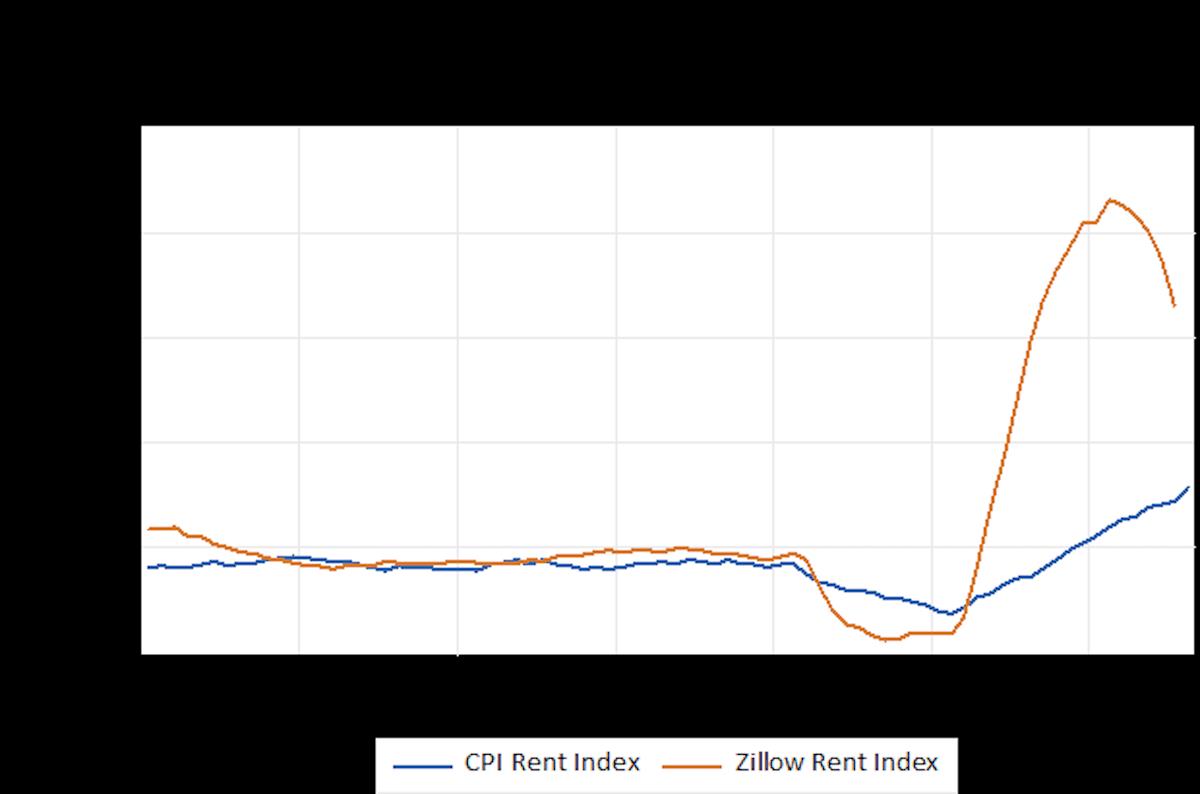

Private-sector measures of rent inflation, including Zillow and Apartmentlist.com, show rents rising at a double-digit rate for the past year, while the official measure of rent inflation remained in single digits.

As I wrote in August 2021,“It takes the Bureau of Labor Statistics about a year to catch up with rent inflation. What the government reported as rent inflation in July reflects the economy of a year ago and more. That's because renters' leases take a year or two to expire. The Zillow, Apartmentlist.com and CoreLogic reports reflect the average rent on a new lease, not the rent on leases signed in the past. As old leases expire and renters have to pay the higher market rate, rent inflation will surge.”....

....MUCH MORE

Previously from Mr. Goldman on this subject:February 11

"Worse to come from worst US inflation in 40 years"

January 22Its almost as though he was trying to tell us something.

"More inflation shoes to drop on NASDAQ by end-2022"

Soaring rent increases will hit the Consumer Price Index with a lag of up to eight months

January 20

David Goldman Looks At The Housing Component Of Official Inflation Statistics

October 2021

"Inflation depresses – later will clobber – stocks"

September 2021

Prices: "Rent blowout mysteriously missing from US report"

August 2021

"Home rents set to turbocharge US inflation"

And just for grins and giggles, May 3, 2022:

"NASDAQ rout can get much worse"

Despite getting lucky with this throwaway line late in the trading day on April 29:

That being said, we'll probably be up on Monday.

(Friday was the last trading day of the month, any position-squaring was being done as I typed, flip coin vigorously, et voilà)

We are no longer in a bull market. Here's a threefer. First up, David Goldman at Asia Times with the headliner, April 30....