Amazing what some Sudden Stratospheric Warming will do to temperatures as the polar vortex gets stretched and split.

But then, long-suffering reader knew this two weeks ago.*

From ZeroHedge:

Goldman Sach has flipped on their bearish natural gas stance to a bullish one.

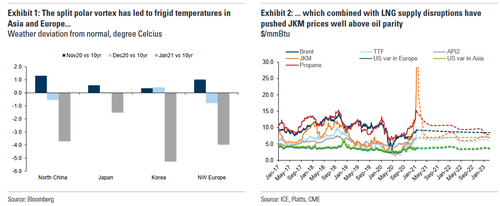

Goldman's Samantha Dart's reasoning behind the view shift is due to a combination of factors including "supply disruptions, shipping delays, and strong LNG demand, supported by heavy nuclear maintenance in Japan and a cold start of the year in NE Asia, have significantly tightened the LNG market."

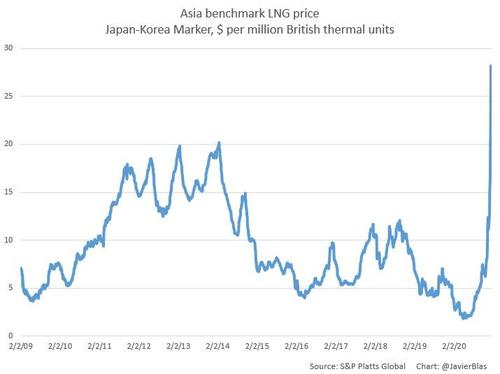

Prices of the supercooled fuel in especially Asia have reached astronomic heights in recent days. The most critical LNG markets are in Asia and Europe, which comes as a polar vortex split that has dumped Arctic air in both regions, boosting natgas prices.

Goldman points out LNG Asian benchmark JKM has jumped to a fresh all-time high of $32/mmBtu today as the "market struggle to ration demand while supply takes weeks to move incremental Atlantic Basin supply into Asia."

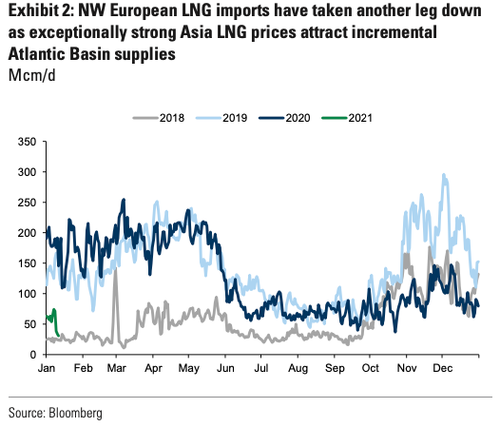

While LNG prices are soaring in Asia, cold weather in Europe has led to the Dutch Title Transfer Facility (TTF) physical short-term gas and gas futures contract to soar 29% higher to $9.43/mmBtu in the last two days. Goldman suggests that "even deeper-than-expected drop in NW European LNG deliveries, we now see European balances even tighter."

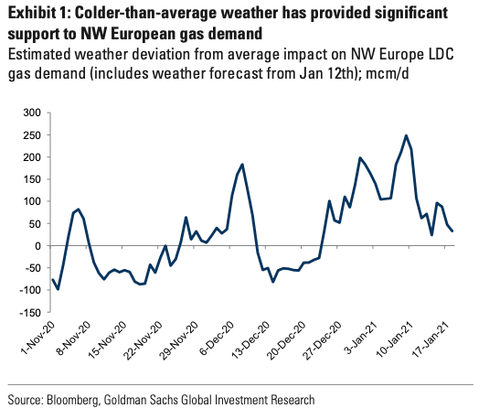

Colder-than-average temperatures have provided significant support for European natgas demand.

"TTF price forecasts skewed to the upside," Goldman said, adding that it's due to "weather-driven tightness realized thus far."

We see risks to our revised TTF price forecasts skewed to the upside as, given the LNG and weather-driven tightness realized thus far, we believe that even a warm turn to the weather would not be enough to take this year's storage path towards a capacity breach. This effectively eliminates the risk that TTF may need to sell off this winter to once again close the US LNG export arb.....

....MORE

*December 30, 2020*Stratosphere warming watch* Strong signals now emerge for a disruptive stratospheric warming event in early January, possibly impacting the course of Winter

For moneymaking opportunities in natural gas the main effect to look

for is descending cold air disrupting the polar vortex and changing the

jet stream from a zonal pattern which contains the cold in the arctic to

a meridional pattern which allows alternating tongues of cold and then

warm air to pass over a given spot in the northern hemisphere. Here's a

map of the two patterns from December last year:

The question, should the SSW occur, is does the cold air go to North America or Europe/Eurasia.

Because the meridional pattern alternates warm/cold it is not a one-way bet but instead can set up a long-short-long sequence if 1) you get the correct area for the event and 2) you get the first trade right.

Very tricky in practice.

And from Severe Weather EU:....

The JKM Index mentioned in the ZH piece is comprised of individual cargoes, including this one via Bloomberg Singapore's Stephen Stapczynsk:

🚨Record Asian LNG Alert 🚨

— Stephen Stapczynski (@SStapczynski) January 12, 2021

Total sold a cargo Feb. 11-15 delivery to China at $39.30/mmbtu via the Platts MOC

That’s likely the costliest LNG cargoes ever transacted. Frigid winter weather, coupled with an already tight market, has resulted in this historic price rally