From Wolf Street, January 12:

Electricity Has Been in a Slump for 14 Years, But All Heck Has Broken Loose in How it’s Generated

In 2021, developers and power plant owners plan to bring 39.7 gigawatts (GW) of new electricity generating capacity on line, and retire 9.1 GW in generating capacity, for a net increase in capacity of 30.6 GW, according to the EIA today. 70% of the capacity additions will be from wind and solar, 16% will be from natural gas, and 3% will be from a nuclear reactor. These are utility-scale power generators and exclude rooftop solar. Of the retirements, 86% will be coal and nuclear.

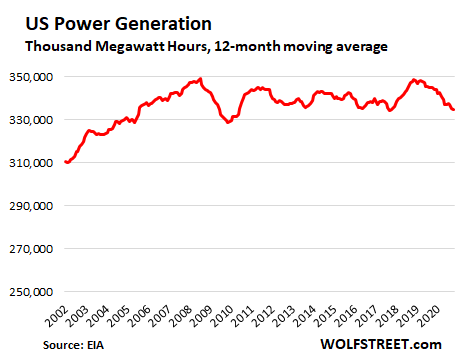

Electricity generation in the US has been a no-growth business since 2006, as efficiencies in electrical equipment (LED lights, appliances, air conditioning, etc.) and further offshoring of manufacturing have kept consumption roughly stable despite growth in the economy and population. But where all heck has broken loose is in how this power is being generated (data via the EIA).

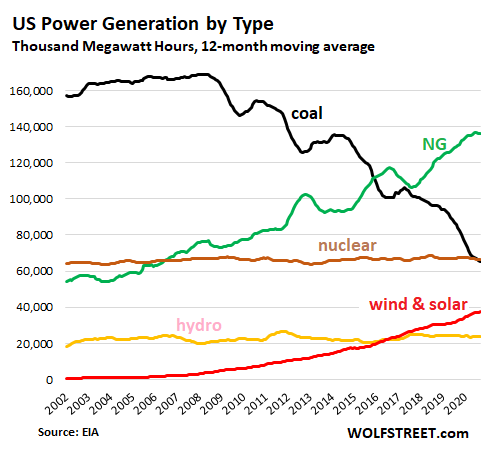

Coal-fired power generation has collapsed by over 60% in 12 years, from around 169 GW hours per month on average in 2008 to 65 GW hours per month on average over the past 12 months, according to data from the EIA. It went from “King Coal” by a wide margin in 2008 (black line in the chart below) to #3, after surging natural gas-fired power generation (green line) blew by it in 2015 as the US has become the largest NG producer in world. And toward the end of 2020, coal fell even below nuclear power (brown line).

In a few years, wind and solar combined (red line) will blow by coal as well. With wind and solar, the big enticement for power generators is that the “fuel” is free and that there won’t be any “fuel” price increases in the future, no matter what inflation will do:

The decline of coal has long been lamented by railroads. In 2020, according to the Association of American Railroads, coal carloads plunged by 24.6% from 2019, to just 3.01 million carloads, the lowest annual total on record....

....MUCH MORE