Next to the "Who can put a value on a human life" pitch for biotechs and pharma my favorite rationale is "The accounting doesn't present a fair picture of the value" in these 'software is eating the world' stocks.

In drawdowns you find out just how much or how little GAAP matters.

From Tanay's Newsletter, Dec. 21, 2020:

One of the big shifts in the economy has been the rise of intangible assets such as software, data, customer franchises and so on, which now make up a bulk of enterprise value.

While the world has changed, accounting standards have not, which in my view has made income statements and balance sheets less relevant.

Today I’ll cover this rise of intangibles and how it has made accounting less relevant.

The rise of intangibles

Back in the day, a majority of most companies value stemmed from tangible assets. These were things like plants, machinery, raw materials and so on, which were then transformed into finished products and sold and thereby converted into revenue.

These assets sat on balance sheet, and so the balance sheet was a good representation of the assets that a company had amassed at any given point in time.

In today’s age, especially with technology companies, “intangible” assets have taken center stage and are the key driver of company value. Think intellectual property such as patents and trademarks, software and data, customer franchises and even goodwill and brands.

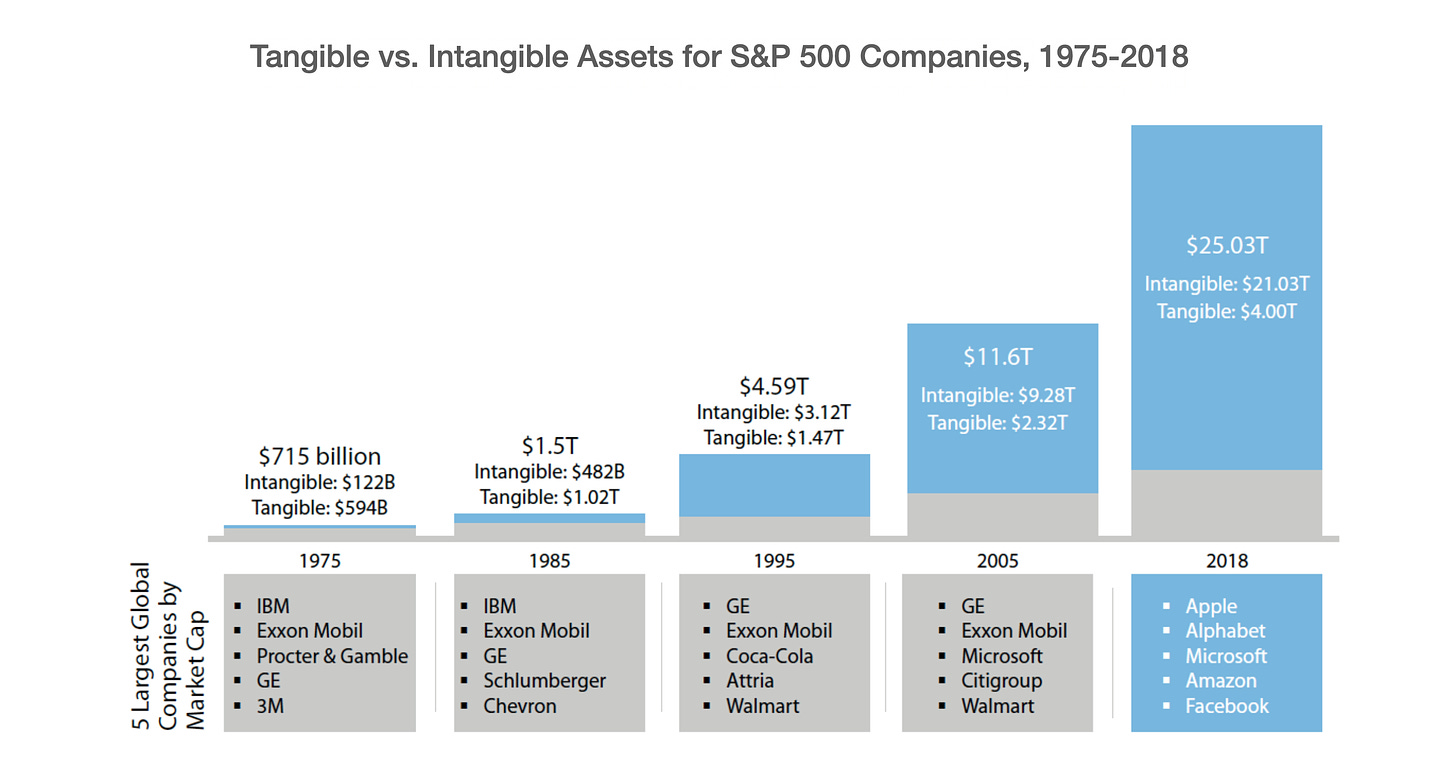

As the chart below shows, intangible assets have gone from making up 14% of the S&Ps enterprise value in 1975 to now representing over 84%!

Today, for most of the largest companies the majority of their value comes from intangible assets. Is this trend going to continue? The answer is a resounding yes.

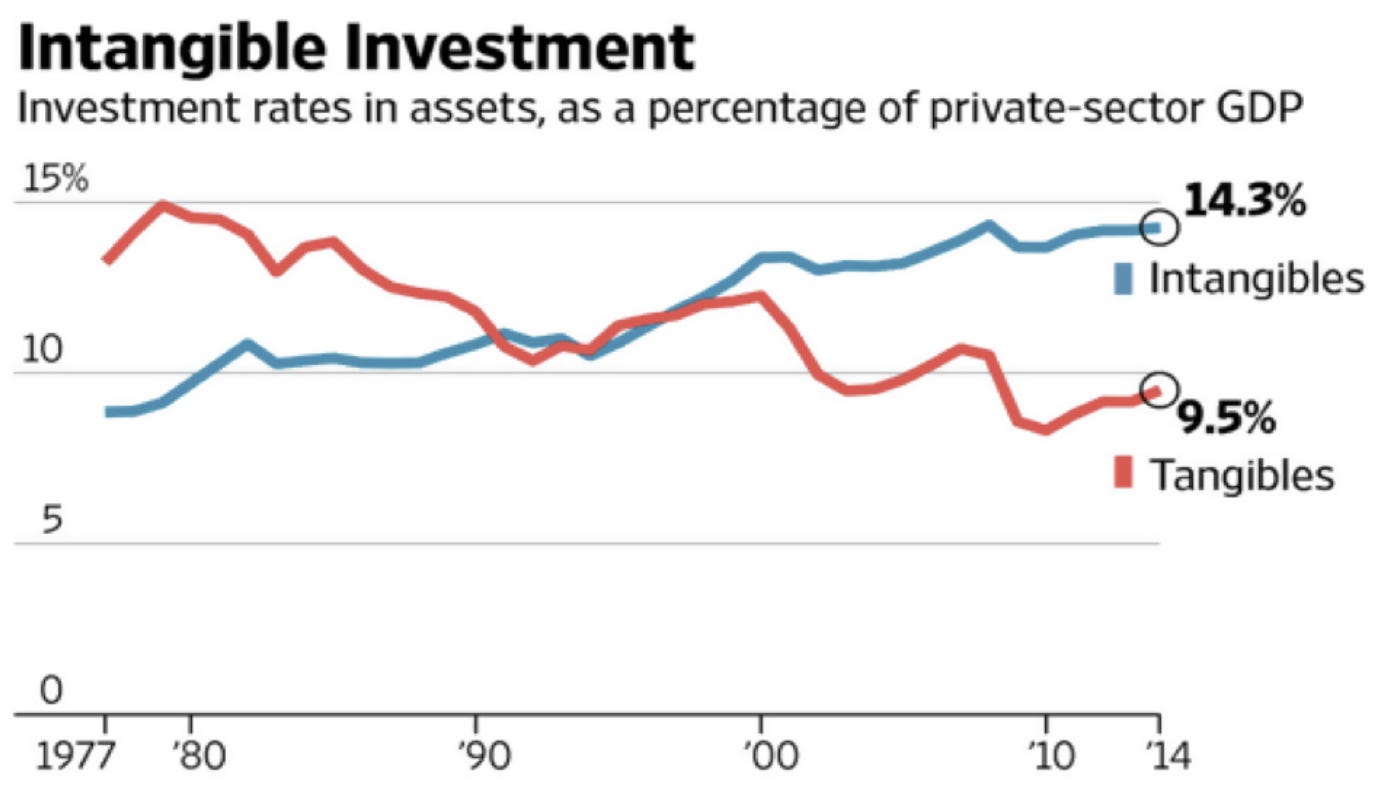

As the graph below shows, investment in intangibles crossed the investment in tangible assets in the mid 90s. Since then, the investment in intangibles and the delta has continued to increase.

Accounting’s Job To Be Done

So how does this impact Accounting? First, let’s quickly touch on what the goal of accounting is.

John Collison described the jobs to be done of accounting in his podcast with Patrick O’Shaughnessy as below:

We're actually trying to do a number of different jobs with accounting.

We're trying to figure out how much profit we are in so we know how much tax we have to pay. That's one job we have. We're also trying to help the business run itself. We're trying to broad a view of the business managers so that we can determine whether we need to invest in new machinery to be more efficient or something like that. We're also trying to solve for the needs of creditors, where people want to be able to evaluate the business and understand, really to enough money to pay off its debt. And then we're also separately, importantly, trying to solve for the needs of equity holders, where they're trying to understand what are the long-term cash flows for this business going to be.

And the reason I bring that up is people think of accounting and GAAP as these fundamentals that are etched into stone tablets. I mean, accounting standards are invented by us humans to give us a view of a business. And they're up to us to choose.

We can synthesize the overall JTBD of accounting as getting a better sense of the current state of the business and the ability to predict the future state (and cash flows of the business).

Intangibles and AccountingSo what’s the big deal about the rise of intangibles? The big deal is that the rise of intangibles has made accounting less relevant.

A 40-year accounting rule, SFAS No. 2 1974, which came into existence essentially prior to technology as we know it, requires that R&D be expensed.

“This Statement establishes standards of financial accounting and reporting for research and development (R&D) costs. This Statement requires that R&D costs be charged to expense when incurred. It also requires a company to disclose in its financial statements the amount of R&D that it charges to expense.”

And it’s not just R&D - investments in other intangibles such as brand, goodwill, customer franchises, unique processes, etc get expensed immediately, rather than being capitalized (and so don’t show up as assets on balance sheets)

By expensing them immediately, we’re essentially saying that they have no value in the future. But in reality, this investment leads to the creation of an asset that has value in the future.

So back to our goal with accounting: It’s to better understand a business for which we often use the income statement and the balance sheet to ascertain profitability and ability to generate profit in the future. But with the rise of intangibles given today’s accounting standards, both the income statement and the balance sheet are losing relevance.

Take two companies O and N. O is an “Old Economy company”, which invests $10M in a factory with machinery to produce physical widgets which it sells. It believes that the factory has a useful life of 10 years, and so depreciates the value of the factory by $1M each year. So in year 1, the impact on earnings of this investment is $1M expense, and $9M sits on the balance sheet.

Now take company N which is a “New Economy company”. It invests $10M in R&D to create software. This software will continue to be useful in the future, but per GAAP accounting, it will expense all of the $10M this year. So in year 1, the impact on earnings of this investment is a $10M expense, and the balance sheet reflects nothing. In addition, let’s say they spend $10M to acquire recurring revenue customers. They will earn revenue from these customers for many years in the future, but many of the costs are expensed immediately. In addition, their customer base has grown which will lead to recurring revenue in the future doesn’t show up on their balance sheet.

Two things stand out from this toy example:

Understanding the impact on earnings

Earnings can basically become meaningless when companies are investing in growth. Companies are being penalized in that their expenses are not being matched to the revenues. While they will continue to earn revenue from a software or a customer in the future, the expense the cost to build it or acquire that customer immediately. This artificially deflates earnings.

The balance sheet isn’t really reflecting all the assets that a company has built up and so can also be somewhat meaningless because many key intangible assets that result in the creation of these intangible assets are not showing up on it.

Now that we’re done with our toy example, let’s look at a few big buckets of spend and understand the impact of treating intangibles this way.

For simplicity, I’ll use a median SaaS company in this example, but it’s easy to see how the following apply to other industries such as pharma/biotech, tech, media or CPG....

....MUCH MORE

Perhaps though the world is finally ready for "Momentum Accounting & Triple Entry Bookkeeping"