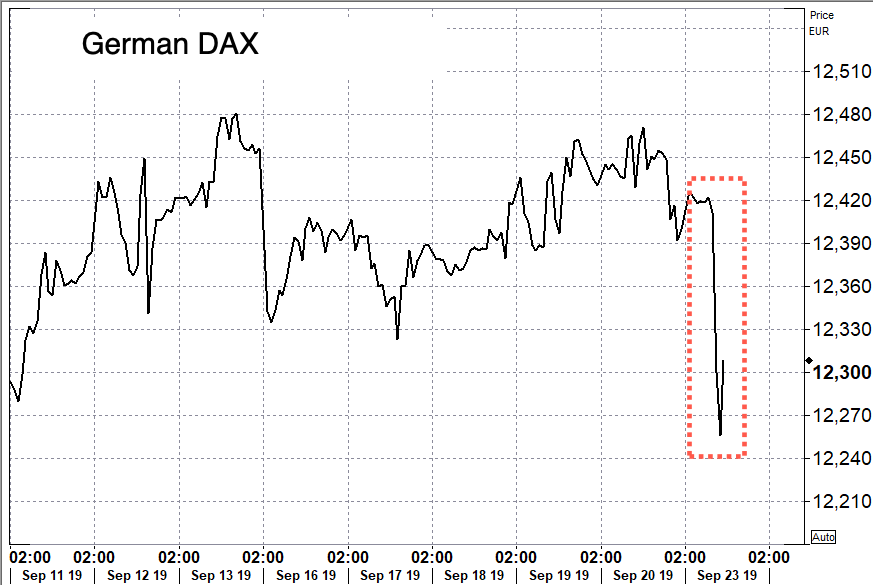

And the DAX, which seemed to be ignoring the bank downgrades and the OECD recession call has taken a small bite of reality-wurst, but there's going to be a LOT more to choke down, if I may extend the metaphor.

From ZeroHedge:

Weakness in euro-area manufacturing hit a climax this morning as German private sector activity plunged to a seven-year low. The Germany Manufacturing PMI slumped in September, dropping to 41.4, down from 44.7 in August, printing below the lowest sellside estimate (consensus of 44.4); worse, the German manufacturing recession is now spreading to the services sector, where the formerly resilient services PMI also slumped from 54.8 to 52.5, missing the lowest expectation, and resulting in the first composite PMI print below 50, or 49.1 to be precise, since April 2013. The rate of decline was one of the sharpest in seven years.

Key findings of the report indicate business conditions across Germany continue to deteriorate with no end in sight.

- Flash Germany PMI Composite Output Index (1) at 49.1 (Aug: 51.7). 83-month low.

- Flash Germany Services PMI Activity Index(2) at 52.5 (Aug: 54.8). 9-month low.

- Flash Germany Manufacturing PMI(3) at 41.4 (Aug: 43.5). 123-month low.

- Flash Germany Manufacturing Output Index(4) at 42.7 (Aug: 45.8). 86-month low.

Commenting on the flash PMI data, Phil Smith, Principal Economist at IHS Markit said that "The manufacturing numbers are simply awful. All the uncertainty around trade wars, the outlook for the car industry and Brexit are paralyzing order books, with September seeing the worst performance from the sector since the depths of the financial crisis in 2009.

"Another month, another set of gloomy PMI figures for Germany, this time showing the headline Composite Output Index at its lowest since October 2012 and firmly in contraction territory. "The economy is limping towards the final quarter of the year and, on its current trajectory, might not see any growth before the end of 2019.In kneejerk reaction, global equity futures across the world slumped. European equity futures, from the STXE 600, DAX, CAC 40, FTSE MIB, and IBEX 35 were down over -1%. S&P500 mini tumbled nearly -1%, rejecting the 3,000-handle, and finding a short term bottom around 2982 at the 5 am est. hour.

"With job creation across Germany stalling, the domestic-oriented service sector has lost one of its main pillars of growth. A first fall in services new business for over four-and-a-half years provides evidence that demand across Germany is already starting to deteriorate."

...MORE