From UPFINA:

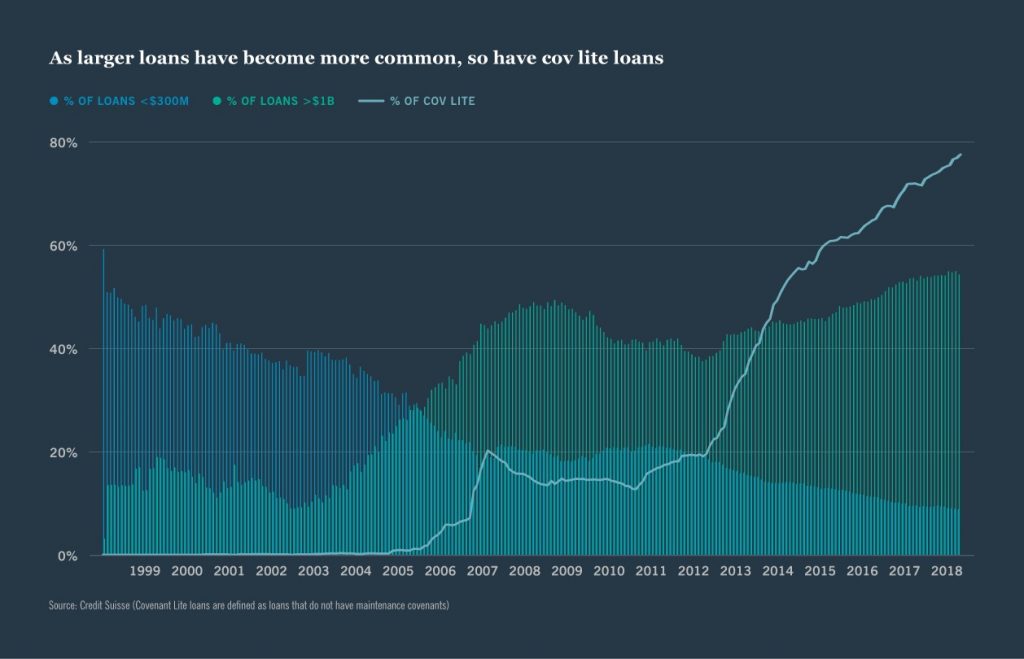

Cov-lite loans are loans with fewer covenants. That means they have fewer restrictions for borrowers. A lender might set a covenant based on leverage to ensure the borrower doesn’t fall into trouble. If the borrower violates a covenant, the lender can reprice the loan. As you can see from the light blue line in the chart below, cov-lite loans are about 80% of leveraged U.S. debt.

The situation is a bit more complex than saying these new loans are black boxes so it will definitely end badly in the next recession.

It takes high confidence to claim all these loans given out by lenders are a mistake. Obviously, lenders don’t see it that way. There is an argument to be made that they won’t be problematic. Cov-lite loans had lower default rates and higher recovery rates in the last recession. Specifically, in November 2009 the overall default rate on levered loans was 10.81% and the cov-lite default rate was 5.19%.

Cov-lite loans have also had high recovery rates. From 1987-2017, the average recovery rate was 71%. For first lien loans it was 73%, for 2nd lien loans it was 53%, and for senior unsecured loans it was 47%. In the last recession, default rates were lower because only the best borrowers received cov-lite loans. This cycle, cov-lite loans will look like the average since they dominate the market. Therefore, the question is if default rates will peak higher in the next recession. That partially depends on the depth of the next recession.

Cov-lite loans might perform worse in the next recession because, according to S&P Global, based on post-crisis defaults, cov-lite recoveries are down about 10 cents on the dollar compared to pre-crisis vintage. That’s interesting because the average spread between cov-lite loans and treasuries has been lower than that of full covenant loans. That implies cov-lite loans on average were considered less risky. The two spreads have been close since 2010 and are correlated. The market doesn’t see the fear spread by the bears....MORE