It's well known that in the United States recessions are often preceded by an inversion of the yield curve. Is there any economic rationale for this?

Most yield curve analysis refers to nominal interest rates. Economic theory, however, stresses the relevance of real (inflation-adjusted) interest rates. According to standard asset-pricing theory, the real interest rate measures the rate at which consumption is expected to grow over a given horizon.1 A high 1-year yield signals high expected growth over a 1-year horizon. A high 10-year yield signals high expected growth over a 10-year horizon. If the difference between the 10-year yield and 1-year yield is positive, then growth is expected to accelerate. If the difference is negative—that is, if the real yield curve inverts—then growth is expected to decelerate.

What is the economic intuition for these claims? One way to think about this is in terms of Friedman's permanent income hypothesis, which states that an individual's desired consumption expenditure today should depend not only on current income, but also on the likely path of his or her income over the foreseeable future.2 According to this theory, if people expect higher future income, then they will want to consume more today to smooth out their consumption. They can attempt to do so by saving less (or borrowing more). If a community is collectively "bullish" in this sense, desired consumer spending should rise in the aggregate and desired saving should fall, leading to upward pressure on the real interest rate.

Now, consider an economy that grows over time but where growth occurs unevenly (i.e., the economy alternates between high- and low-growth regimes). Imagine, as well, that the economy is occasionally buffeted by negative "shocks"—adverse events that occur at unpredictable moments (an oil price spike, a stock market collapse, etc.). In such an economy, recession is more likely to occur when a negative shock of a given size occurs in a low-growth state as opposed to a high-growth state.

Next, suppose that an inverted yield curve forecasts a deceleration in growth. Then the deceleration will entail moving from a higher-growth state to a lower-growth state. Suppose this lower-growth state is near zero. In this state, growth is now more likely to turn negative in the event of a shock. In this way, an inverted yield curve does not forecast recession; instead, it forecasts the economic conditions that make recession more likely.

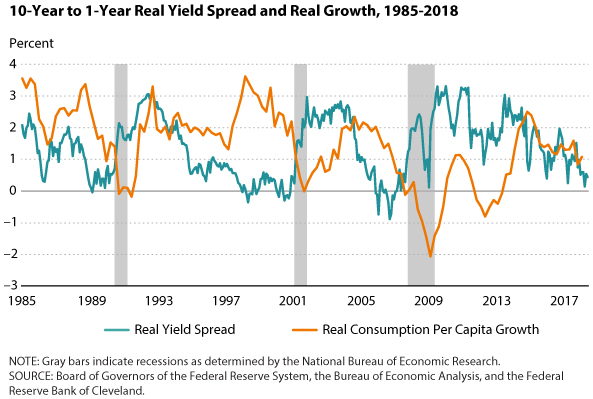

How does this idea match with the data? The figure plots the 10-year to 1-year real yield spread along with the year-over-year growth rate of real per capita consumption (excluding durables).3

As is clear from the figure, the real yield curve flattened and inverted prior to each of the past three recessions. Consistent with the theory, consumption growth tends to decelerate as the yield curve flattens. This is true even in non-recessionary episodes. In particular, the consumption growth decelerations of 1985-86, 1988-89, and 2006-07 were each associated with or preceded by a flattening or inverted yield curve. Each of the three recessions occurred when consumption was growing at a moderate to low pace....MOREThe writer, David Andolfatto is Vice President of the Federal Reserve Bank of St. Louis.

See also his personal blog, MacroMania to which we add, when linking, the disclaimer:

Views should in no way be attributed to the Federal Reserve Bank of St. Louis, or to the Federal Reserve System.

Via:Neither should the blog be taken as an endorsement of the fashion sense of the Federal Reserve Economics Data clothing line:...

Interpreting the Yield Curve: Counterintuitive Stimulative Effects of Rate Hikes