I know that runs counter to a lot of commentary but the upticks are not a problem. Yet.

The bigger headwind facing the market is the Fed's balance sheet unwind sucking up liquidity.

And next year's planned mega-IPOs threatening to do the same.

Two quick hits. First up, Reuters, Dec. 24

Rate futures market says Fed is all but done with hikes

The Federal Reserve is finished raising U.S. interest rates.

That is the message emerging from the interest rate futures market as Monday’s full-blown flight from risk assets drove traders to price out nearly any prospect of further rate increases from the Fed, which raised rates again only last week.

Stocks fell sharply on Monday amid concern about slowing economic growth, the government shutdown and reports that President Donald Trump, increasingly angry about the U.S. central bank’s rate hikes, had discussed firing Fed Chairman Jerome Powell. Trump on Monday labeled the Fed as the “only problem” for the U.S. economy, and Treasury Secretary Steven Mnuchin made unsuccessful efforts to soothe investors’ concerns over Wall Street’s deepening losses.

The federal fund futures contract expiring in January 2020 FFF0, watched closely as a gauge of where the Fed’s benchmark overnight lending rate will be at the end of next year, surged 10.5 basis points in price on Monday.And from Wolf Street, also Dec. 24:

That left the contract with an implied yield, which moves in the opposite direction of its price, of 2.41 percent, squarely within the current range for the Fed’s target rate....MORE

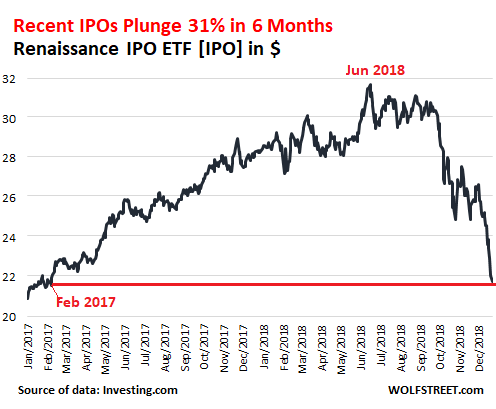

Nasdaq down 24% already. Renaissance IPO ETF down 31%. But Uber and other unicorns are planning record IPOs in 2019, à la dotcom-crash-debut in 2000.

The IPO hype machine has produced some very successful companies and a lot of spectacular wealth transfers from the hapless public to early investors selling their shares. Here are two of the standouts that I covered:

Snap [SNAP], purveyor of the Snapchat app and must-have sunglasses with a built-in camera: Shares peaked at $29 on the second day after its IPO, given it a market capitalization of $32 billion. Shares closed on Friday at $4.96 and this morning trade at $5.24, down 82% from day two of trading.

Blue Apron [APRN], the cream of the crop of about 150 VC-funded meal-kit startups founded over the past five years, was valued at $2 billion during its last round of funding in June 2015 when it was one of the most hyped unicorns that would change the world. Then enthusiasm began to sag. By the time the IPO approached, the IPO price was cut from a range of $15-$17 a share to $10 a share. Shares closed on Friday at $0.68 and are trading this morning at $0.71, down 93% from its IPO price.

But not all IPOs are “tech” companies – though there’s nothing “tech” about a meal-kit maker other than the least important part, the app. The Renaissance IPO ETF [IPO] holds the shares of companies across the board that went public over the past two years. After two years, the companies are removed from the ETF. Its top five holdings are in real estate, insurance products, music streaming, and cable TV, so not exactly pushing the boundaries of tech invention.

These five IPOs haven’t done all that badly, compared to the wholesale destruction of Blue Apron, though they all have dropped sharply from their recent peaks (prices as of this morning):

Overall, the Renaissance IPO ETF has plunged 31% from its peak in June 2018 (data via Investing.com):

- Vici Properties [VICI], a casino property company, at $18.02, is down 22% from its peak in January 2018 shortly after the IPO.

- Athene Holding [ATH] – a “retirement services company that issues, reinsures and acquires retirement savings products” – at $38.36, has dropped 29% since September, 2018.

- Invitation Homes [INVH], Blackstone’s buy-to-rent creature that acquired over 48,000 single-family homes out of foreclosure at the end of the housing bust, at $19.40, is down 18% from its peak in September.

- Spotify [SPOT], the music streaming service, at $107.46, has plunged 46% from its peak on July 26. It went public in April.

- Altice USA [ATUS], a cable TV operator, at $15.37, is down 39% from the peak on the day after its IPO in July 2017.

The Nasdaq itself has dropped 24% from its all-time peak at the end of August....MUCH MORE

It is in this new reality that some of the biggest startups and some of the biggest money-losers in the startup circus are trying to unload the shares to the public in 2019 before the “window” closes. The enormous hype about these IPOs has already started, with bankers funneling this hype to the Wall Street Journal, which breathlessly reported on the big numbers to be transferred from the public to the selling insiders and the companies. The hyped numbers are truly huge.

The biggest candidates that are that are now being hyped for an IPO in 2019 are:

Uber, with a current “valuation” of $76-billion, could go for an IPO in early 2019 that would value it at “as much as $120 billion,” the WSJ reported, based on the hype the bankers are now spreading to maximize their bonuses. Not all shares would be sold in the IPO, so the proceeds in this scenario could reach “as much as $25 billion.”...

The venture capital crowd are desperate to get out of these deals and last week as the equity markets were getting hammered you could hear a low moan rising from Sand Hill Road.

Here's a vignette from 2011, in a different context, but which could be repeated word for word re: the attitude of the VC's:

I'm reminded of a situation I watched back in the day. A trader sold a position to another firm a few minutes before a trading halt. The news was negative. The buyer D.K.'ed (Don't Know) the trade, meaning we'd still own the position, at which point the head of the firm got on the phone and told his counterpart "I don't want the shit, whyd'ya think I sold it to you?"