Ledgers and Innovation in Banking

From 15MB:

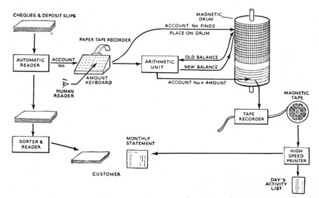

I was flicking through the New Scientist

magazine from 29th November 1956 when I came across a very interesting

article on the digitisation of banking, a subject of great current

interest. The article has a very useful diagram for those of us who

wonder how exactly it is that banks manage customers’ accounts using computers.

I don’t know which bank this is, probably TSB, but in any case it is

what the article says about digitisation that I found interesting.

Apparently, it’s all to do with something called “ledger management”.

The article gives a helpful example, explaining how “when a bank clerk

first accepts a cheque, he prints on it with something like a typewriter

a note of the amount in magnetic ink, all subsequent

operations—sorting, listing and entering in ledgers—can be done without

human assistance”.

Reading further on, I discovered that you can have different kinds of

ledgers that work in different ways. The author notes that this is only

one way of “ledgering automatically” and that the “choice of a system

depends on how far was is prepared to go: whether automatic book-keeping

is to be done only at head office, whether in this case the accounting

for all the branches, or whether branches will have their own equipment

or to be grouped around sub-centres”. The same centralisation versus decentralisation of ledgers argument continues to this day.

The article continues by noting that banks do not seem to be making

as much of this interesting new technology as they might and that “what

may prove to be more serious is the determination to cling to time-honoured procedures”. Well, yes indeed. This is just what Anthony Jenkins meant when he said that banks had yet to be disrupted by new technology

(shortly before he was fired as Barclays CEO). And if you think those

“time-honoured procedures” are fading, you’re dead wrong, since 95

percent of ATM transactions still pass through COBOL programs, 80

percent of in-person transactions rely on them, and over 40 percent of

banks still use COBOL as the foundation of their systems.

There’s no point using blockchain, or any other shared ledger

technology, to implement these existing processes. The way forward, in

banking at least, is to use the new technology to implement new ways of

doing businesses. There’s a good argument for thinking that the central

co-ordination mechanism for these new ways of doing business might well

be trust. Speaking at Davos, way back in 2015, Marc Benioff (the CEO of Salesforce) said that “Trust

is a serious problem, we have to get to a new level of transparency –

only through radical transparency will we get to radical new levels of

trust.”

I could not agree more. I think he is absolutely spot on. This is why

I have been focusing on the use of new technologies (and specifically biometrics, blockchains and bots)

to create a different kind of financial services infrastructure. I

spoke about this earlier in the year and the Digital Jersey Annual

Review [YouTube, 24 minutes] and have pushed a similar message out to a number of different audiences since then....MORE