Before the headline story a quick note on the stock price.We focus on the stock, not the company. The company should be fine for at least the next couple years until the artificial intelligence biz catches up to NVIDIA and either takes a different approach or a really different approach and goes quantum computer.

When we posted "As NVIDIA Notches Its 10th Straight Daily Gain, Lots Of People Say Nice Things...HOWEVER (NVDA)" on Tuesday at $116.49 up $6.71:

...We agree and start to lighten up right here, right now.We didn't have any special insight or anything, just pattern recognition.

And any weakness in the overall market means lighten up some more.

The stock price had achieved verticality on the charts, so much so that four minutes after the close Tuesday the usually sober folks at Barron's posted "The Hot Stock: Nvidia Soars 6.9%" with this as their illustration:

We didn't have the advantage of seeing that, our post came out at fifty minutes before the close but if we had our declarative "right here, right now" (which they really caution against in junior analyst school) would have been even more emphatic. A picture really is worth a thousand words, or a few millions of dollars....

First up, Investopedia March 22:

Nvidia Not Out Of The Woods Yet (NVDA)

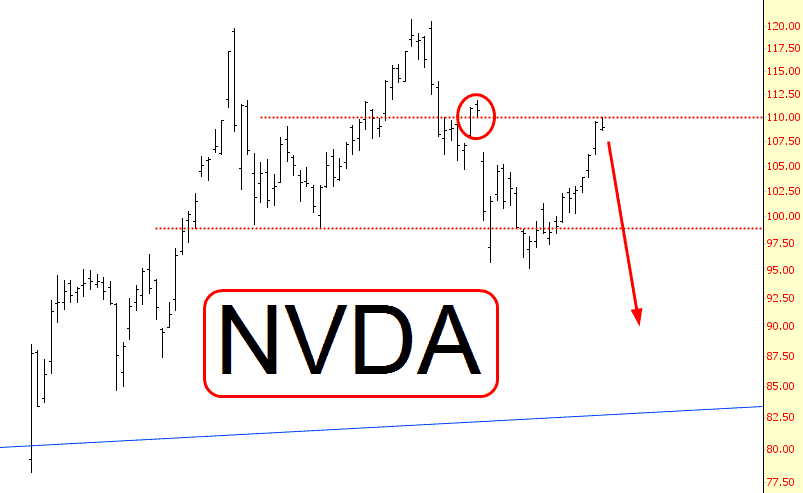

Nvidia Corp. is trading up about 1%, gaining back some of its losses from yesterday. Shares fell yesterday from around $110 to around $106. Certainly, the $110 level has been a problem for the stock over the last couple of days. The bigger problem is, where do shares go from here? In a stock like NVDA, just getting the direction right is a challenge, let alone figuring out what the market thinks it could be worth.

As we wrote earlier this week, the stock would not be out of the woods until it was able to break over $110, and to this point, it has not been able to do that. The stock tried to get over that hurdle all day on Monday and Tuesday morning, but was unsuccessful in its attempts. (See also: Did Nvidia Just Break Out?)

The morning shares of NVDA gapped lower on February 22nd; momentum shifted, and until it can get back above $110, the momentum is downward.

(Interactive Brokers TWS, Hourly Chart)

One can easily see how the stock has clearly entrenched itself with some positive momentum and ran into a wall of selling just below $110....MOREOn March 21st Slope of Hope had made a similar point:

Gap and Crap

It’s been an, ummm, busy morning. This is the most profitable day I’ve had in a LOOOOOOOOOOONG time, and every single one of my 71 short positions (even the ones I opened today) are in the green.

Every. Single One.

I’ve got to update my stops, but in the meantime, here’s NVidia, which I just shorted today. It covered its gap, and it’s insanely overvalued. See ya later, Slopers.

We have a couple points of difference with Slope of Hope:

1) Premier growth stocks always look overvalued.

2) Shorting NVDA is a risky little game. When we said lighten up, we were talking to folks who owned it in the '20's form late 2015, not a short.

That said, his point about the resistance at $110 is sound for a very sharp, very short-term trader.

The next resistance of course is the double all-time-high top at $119-120 so $111-120 should be tradable to the upside but in the meantime just be aware of the areas the stock petered out.

$108.42 last, up $1.33.