Shipping: "Mega-Ships May Be Too Big NOT to Fail"

From Bloomberg View:

It was always going to be tough for the world's container shipping

lines -- accustomed to decade after decade of growth in the volume of

video-game consoles, auto parts, furniture, frozen seafood and all

manner of other things transported in boxes across the sea -- to adjust

to a slowdown in global trade.

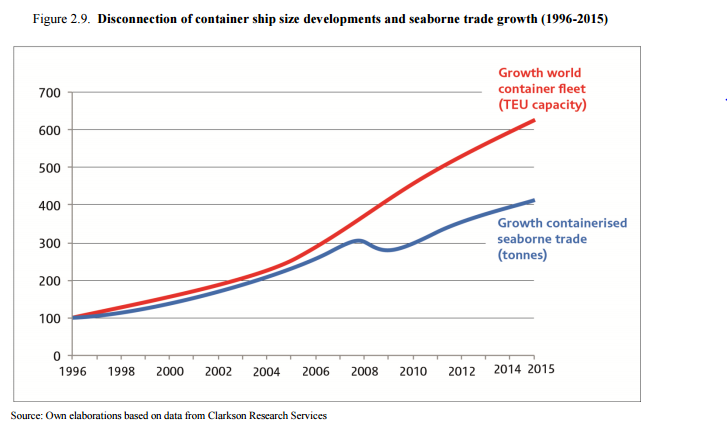

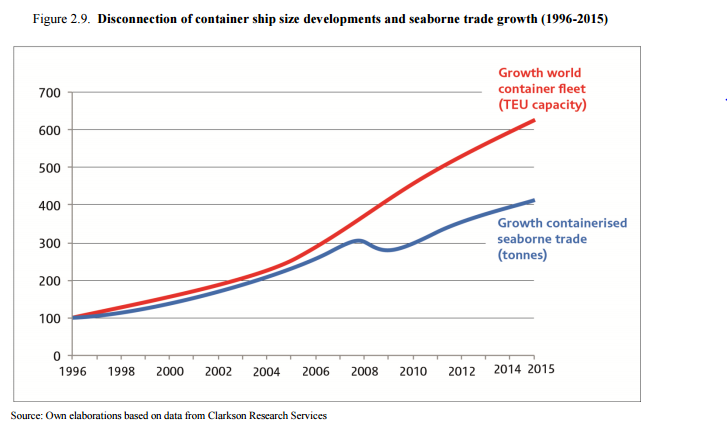

What has

made it a whole lot tougher is that, not long before trade peaked as a

share of global gross domestic product in 2008, container shippers began

adding capacity at an even faster pace than they had before. Container

traffic has actually held up better than bulk shipping (which is heavy

on raw materials like iron ore) and oil tankers, with volume still

growing in the low single digits annually. But capacity growth has

far outstripped demand.

This is from a 2015 report

by the Organization for Economic Cooperation and Development's

International Transport Forum on "The Impact of Mega-Ships." It makes

for fascinating (if pretty wonky) reading now. The gist is that the

move to giant ships, with capacities now approaching 21,000 TEUs (for twenty-foot equivalent units,

the standard measure of container volume), adds all sorts of costs to

the global transport system that may end up outweighing the per-TEU

energy and staffing savings from bigger boats. My Bloomberg View

colleague Adam Minter already wrote a whole column

about these problems; I'll address them briefly in a moment. But the

big question for me is why shippers kept adding capacity even as demand

slowed.

One answer is simply that, a decade ago, demand for container shipping seemed to be accelerating. Global container traffic

grew 17 percent from 2006 to 2007, up from 11 percent the year before.

Big new ships aren't built overnight, so it's understandable that the

container lines did a bit of over-ordering back in those days.

Still, that doesn't explain why they kept adding capacity even after

that demand acceleration didn't pan out.

Another answer is that adding capacity is just what container shippers do. Here's a fun observation from a 2012 Boston Consulting Group study that urged shippers to stop adding capacity already:

Traditionally,

the industry and key industry observers have measured carriers' market

share on the basis of capacity rather than the freight volumes they

actually transport. Therefore, carriers have typically expanded their

capacity to strengthen their market position.

A final

answer is that the biggest container shipping line, Copenhagen-based

Maersk, thought that ordering a set of new 18,000 TEU mega-ships in 2010

could change the dynamics of the industry. In an essay published last week,

Olaf Merk, ports and shipping expert at the International Transport

Forum and co-author of the mega-ship report cited above, took a stab at

explaining Maersk's reasoning....MORE