From the International Monetary Fund's iMFdirect blog:

Posted on September 1, 2016 by iMFdirect

By Christine Lagarde

Versions in: عربي (Arabic), 中文 (Chinese), Français (French), 日本語 (Japanese), Русский (Russian), and Español (Spanish)

Low growth, high inequality, and slow progress on structural reforms are among the key issues that G20 leaders will discuss at their meeting in Hangzhou, China, this weekend. This meeting comes at an important moment for the global economy. The political pendulum threatens to swing against economic openness, and without forceful policy actions, the world could suffer from disappointing growth for a long time.

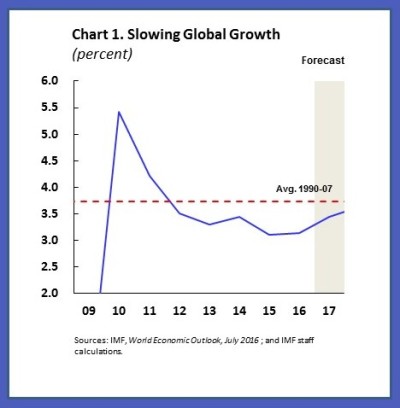

2016 will be the fifth consecutive year with global GDP growth below its long-term average of 3.7 percent (1990-2007), and 2017 may well be the sixth (Chart 1). Not since the early 1990s—when ripple effects from economic transition caused growth to slow—has the world economy been so weak for such a long time. What has happened?

In advanced economies, real growth is running almost a full percentage point below the average of 1990-2007.

- Many are still plagued by crisis legacies, such as private and public sector debt overhangs, and impaired balance sheets of financial institutions. The result has been stubbornly weak demand.

- The longer demand weakness lasts, the more it threatens to harm long-term growth as firms reduce production capacity and unemployed workers are leaving the labor force and critical skills are eroding. Weak demand also depresses trade, which adds to disappointing productivity growth.

Emerging economies have also been slowing—but from an exceptionally fast pace of growth in the past decade. Their slowdown is therefore more a return to the historical norm. Developments within emerging economies are quite diverse. In 2015, for example, GDP in two of the four largest economies—China and India—grew between 7-7½ percent, while GDP contracted by close to 4 percent in the other two—Russia and Brazil. But there are important common factors:

- On the supply side, slowing productivity and adverse demographic trends are weighing on potential growth—a trend that started before the global financial crisis. And with little expectation of stronger growth tomorrow, firms have even less incentive to invest, which hurts both productivity and short-term growth prospects.

- One is the rebalancing of the Chinese economy from investment to consumption, and from external demand to domestic demand. While a stable Chinese economy growing at sustainable rates is ultimately good for the world economy, the transition is costly for trading partners that rely on Chinese demand for their exports. It can also trigger bouts of financial volatility along the way.

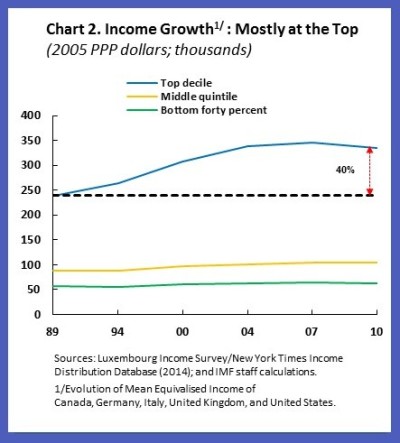

Weak global growth that interacts with rising inequality is feeding a political climate in which reforms stall and countries resort to inward-looking policies. In a broad cross-section of advanced economies, incomes for the top 10 percent increased by about 40 percent in the past 20 years, while growing only very modestly at the bottom (Chart 2). Inequality has also increased in many emerging economies, although the impact on the poor has sometimes been offset by strong general income growth.

- The second, related, development is the large decline in commodity prices, which has taken a toll on disposable income for many commodity exporters. The adjustment of commodity exporters to this new reality will be difficult and protracted. In some cases, it calls for a change in their growth model.

Forceful policy actions are needed to avoid what I fear could become a low-growth trap. Here are the key elements of a global growth agenda as I see them:...MORE

- The first element is demand support in economies that operate below capacity. In recent years, this task has been delegated mostly to central banks. But monetary policy is increasingly stretched, as several central banks are operating at or close to the effective lower bound for policy rates. This means fiscal policy has a larger role to play. Where there is fiscal space, record-low interest rates make for an excellent time to boost public investment and upgrade infrastructure....