Weak farm income is affecting loans in the rural Midwest, according to a survey of bankers in the region, as the rural economy declined for the 13th straight month and the outlook leading into 2017 remains dreary.

With grain prices slumping, Creighton University economist Ernie Goss said, farm income is slated to drop by 12 percent from 2015, prompting “an intense pessimistic outlook among bankers.”

He said an expected 25 percent increase in government support payments this year won’t be enough to offset the reduced income.And from Creighton:

Of 173 bankers in 10 states who responded to Goss’ September survey, four out of five reported restructuring more farm loans to adjust to borrowers’ slimmer cash flow, and 1 out of 5 reported they are rejecting more ag loan applications.

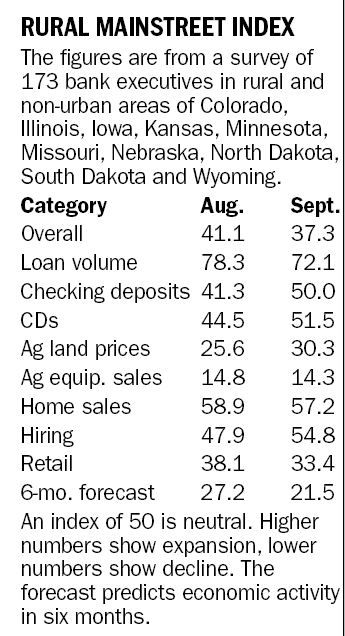

The result was a Rural Mainstreet Index of 37.3 on a scale of 0 to 100, well below the growth-neutral level of 50. The index was 41.1 in August and 49 in September 2015. The survey includes non-urban bankers in Colorado, Illinois, Iowa, Kansas, Minnesota, Missouri, Nebraska, North Dakota, South Dakota and Wyoming.

The bankers’ confidence index showed a lack thereof for the coming six months, hitting 21.5. That’s down from 27.2 in the August survey and 43.8 in September 2015.

The survey’s index of farmland prices was 30.3, the 34th consecutive month of decline. Farm equipment sales remained a casualty of low farm income, registering an index of 14.3....MORE

Rural Mainstreet Index Below Growth-Neutral for September:

Four of Five Bank CEOs Report Loan Restructuring