What will central banks buy next? Big questions for markets this week

The ECB governing council meets next week for the first time since June with the data since suggesting little change in the direction of the EU economy. So it would be a surprise to many if there was an announcement of fresh monetary easing, such as cutting the deposit rate further below zero.Meanwhile his confreres at Alphaville have some further thoughts on more traditional (yikes!) asset purchases:

One question some are asking, however, is what policy tools are left to central banks in a future slowdown, or if current measures are not enough. Could the ECB follow the example of Japan, buying assets such as equities?

Morgan Stanley argues that it would take serious risk of deflation for the ECB to do so, and that an Exchange Traded Fund structure might help to avoid questions of ownership rights.

For instance, the Bank of Japan ETF purchases cover several indices initially amounted to 3.75 per cent and more recently were increased to 7.5 per cent of asset purchases. A similar magnitude in the euro area would translate into annual purchases of as much as €72bn, while committing a similar proportion of the ECB balance sheet, 2.5 per cent, would translate into €82.5bn of stock buying....MORE

ECB warnings and yield target allusions

Or illusions…

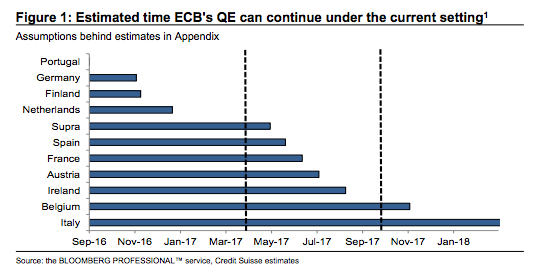

Before we get to that though, here is a thing we know and have known since the ECB launched its (probably) soon to be extended QE programme: Draghi et al will have to deal with the idea of QE scarcity — it’s running out of available bonds to buy.

It’s already coming up against a self-imposed constraint and it has been well flagged that the big one, Germany, is looming as an ever larger roadblock:

Despite already including corporate bonds in its purchasable basket, the ECB is going to need to do something else to fix this problem since it’s unlikely to fix itself, via an increase in yields spurred by the Fed say.

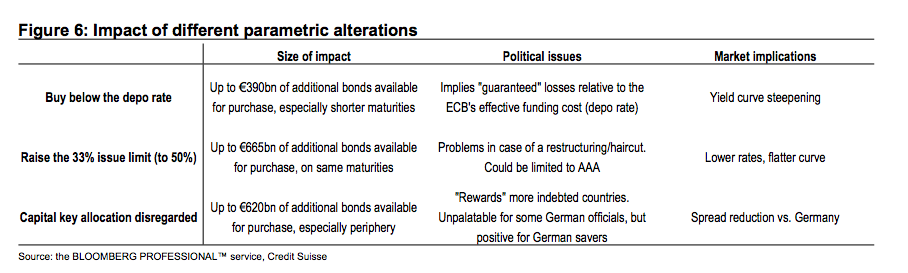

Here is a thing we also know and have already mentioned in this post: the constraint is self-imposed and, as such, can be alleviated. Like this, for example:

...MORE

And:

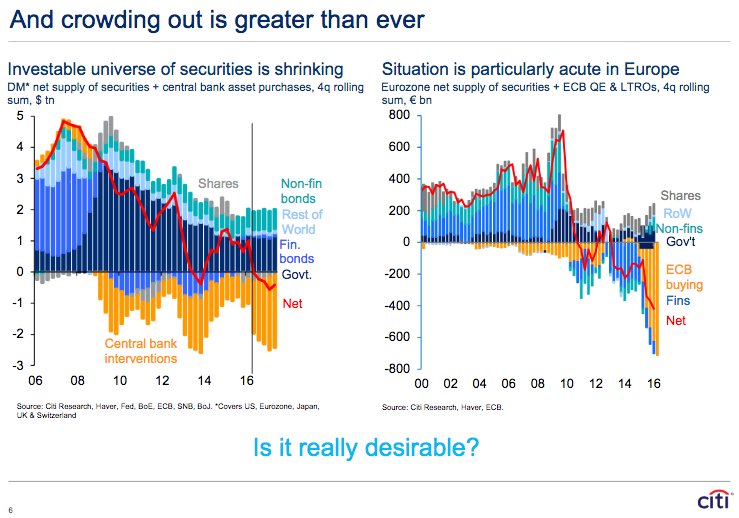

QE: quantitatively shrinking collateral reuse

Adding to the QE scarcity concerns already highlighted by David earlier on Monday, here’s a couple of charts from Citi’s Hans Lorenzen reflecting the fundamental “too much of a good thing” problem with QE.

Glaring, right?And if that's not enough crazy, back to cloud-cuckoo-land.

As has been frequently mentioned to us by the IMF’s resident collateral expert Manmohan Singh, when the central bank becomes the market for quality collateral in the context of regulatory policy which restricts collateral re-use for macro-prudential reasons, this technically amounts to the very same thing as narrow money policy.

In Singh’s opinion, the only thing which can consequently return the collateral and repo markets to a normal state of functionality is a strategic decision to allow collateral held on central bank balance sheets to be actively reused in the market.

As Singh has explained to us, in economic terms the “reuse” or rehypothecation of a security is identical to the money creation that takes place in commercial banking through the process of accepting deposits and making loans. That’s why restricting collateral reuse even in the context of ample QE still has the end result of tightening monetary policy all round (especially in a world where bank reserves, which are only accessible to licensed banks, might be deemed an inferior final settlement security than T-bills).....MORE

Here's Reuters:

Any ECB move into stocks unlikely to be plain sailing

* Analysts say all options on the table for the ECB* BOJ buying of stocks sets precedent for the euro zone

* ECB would struggle to match BOJ's equity purchases

* Euro zone scheme seen as far more complex than Japan

* Europe, Japan ETF graphic: tmsnrt.rs/2bZ1IkA

LONDON, Sept 2 The ECB may soon be forced to follow the Bank of Japan's example and buy equities as part of any expanded stimulus programme, but it faces significant hurdles in helping all 19 euro zone members equally without distorting a key market for investors.

The European Central Bank could run out of eligible bonds for its 1.7 trillion euro bond-buying scheme, meaning alternative options are on the table should it decide to loosen policy further to lift growth and inflation across the bloc....MORE