From FT Alphaville:

Five scattered points about oil, crises, Keystone and other stuff

Some thoughts, musings, and simply fun items we’ve recently come across:

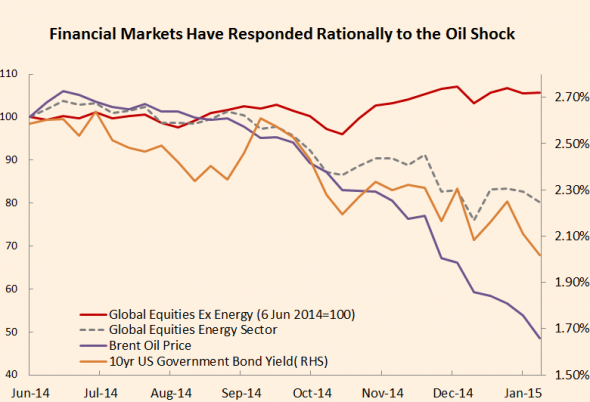

1) As of the start of this week, global non-energy equities have held up fine:

The chart comes from an excellent recent post by Gavyn Davies, whose team at Fulcrum used the MSCI World local price return (excluding the energy sector by backing out its historical weekly weights) and the MSCI World Energy Sector local price return. ...MOREWe've been trotting out the divergence between oil and oil equities vs. the broader market for a while now:

Jan. 6

Resiliance, Brittleness and Catastrophic Failure: Everything Is Fine, Until It Isn't

For what it's worth, we're bullish.

Jan. 2

You are Getting Sleepy: Equities Look Tired

It is still a bull market but stocks are looking 'heavy' on the charts.

Dec. 29

Small Caps Finally Break Out

Dec. 23

ConvergEx's 'Off The Grid Economic Indicators'

As I mentioned yesterday, despite this remaining a bull market for the majority of equities, the triumphalism of some commentators following the most recent 5%-decline-and-v-shaped-recovery approached outright hubris and we will be "dancing closer to the fire door as the band plays on"....

Dec. 22

"Roubini’s Unsettling Scenarios: Five Faces of Doom"

We continue to believe it's a bull market for the larger universe of equities but saw enough gloating, from folks who should know better, at the most recent downturn and v-shaped recovery* that we're starting to believe we may be beyond complacency and are approaching hubris. We will be dancing a bit closer to the fire door even as the band plays on.

Dec. 13

"Mass Exodus: Dow Plunges 678 Points This Week, S&P 500 Suffers Largest Loss Since 2012"

We're still in a bull market, the underlying economy is supportive but unlike the 7 1/2% dip that bottomed in October or the earlier August break-fake, we didn't see this one coming.

And that is troubling as our models, going back to mid-August, were looking for a three-beat...

Dec. 2

Cramer: "I Don't Want to Cause a Panic. But..."

Contrary to the thesis, despite the fact oil was down today the larger market managed to trade at an all time DJIA high, 17,897.05.

What the heck is he thinking?

For the record: The broader market is going higher, oil and gold are going lower and I'm going home.

Nov. 29

"Lower oil price could stoke US stock bubble"

Nov. 14

Quantifying The Stimulative Benefits of The Oil Price Decline (SPY; XLE)

Easily the most important story in global macro, the related strength of the dollar is a distant second.

The stimulus effects are the reason we have a prima facie (but only on its face) paradoxical call for a higher S&P 500 (SPY) while at the same time looking for dramatic underperformance from a major sector (XLE)

Nov. 4

"Energy shares lead Wall St lower in broad decline" (XLE; ERY)

...Repetitious but at least we varied the type size/face.

And we still think the broader market is going higher.

Recent history: The S&P closed at 2,012.10 on Nov. 4, 2014, 2046 last.