Yay!

As an intro, here's Goldman Sachs on speculation in the oil markets:

...Conversely, speculators bring fundamental views and information to the market, impacting physical supply management and facilitating price discovery. As a result, speculators have a loose relationship with price. In other words, as speculators buy, prices generally tend to rise, and vice versa. Accordingly, speculators also contributed to the extreme price movements over the last two years. For example, new data suggests that speculators increased the price of oil by $9.50/bbl on average during the 2008 run-up. Thus, speculators exacerbated the volatility that was nonetheless rooted in the fundamental imbalance.”

-Goldman Sachs, Global Economics Paper No. 194, page 7, March 30, 2010.*

The mechanitions and manipulations of the giant traders during the run-up and collapse are to this day, very, very murky.

From FT Alphaville:

A right oil hotchpotch

Just a few developments to update oil watchers on. Plus one conspiracy theory.

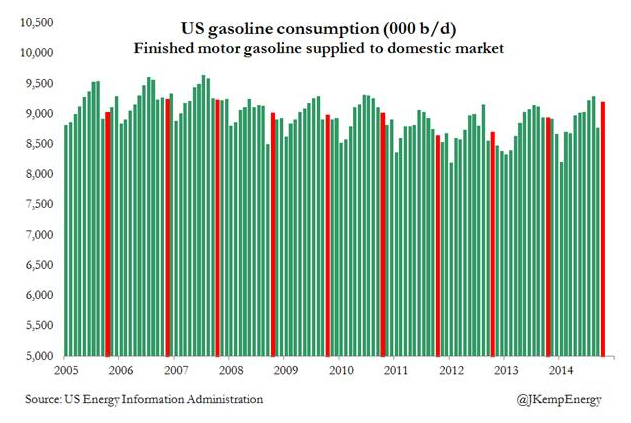

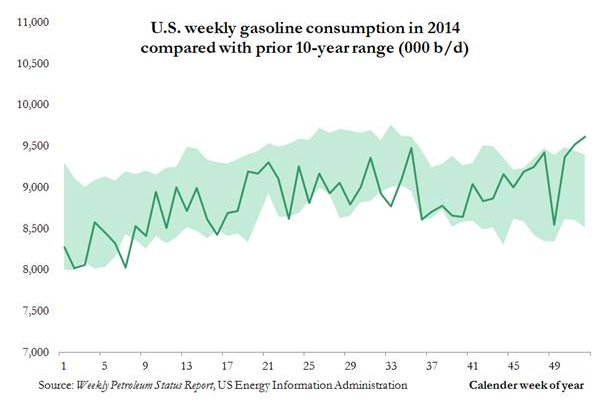

First, John Kemp of Reuters observes on Thursday that gasoline demand is now at multi-year seasonal highs:

He directs us to this story, which notes:

Weekly U.S. gasoline demand soared to five-year highs last month, after a collapse in oil prices, in a worrying sign that previous gains in efficiency and emissions cuts may evaporate. The week of Dec. 26 2014 saw the highest weekly consumption since July 2010.But you can check the updated EIA figures over here, and they too show that the seasonal demand uptick has continued into January.

Second, Olivier Jakob at Petromatrix says in his daily research report that the price of Brent in Swiss franc terms is now back at the lows of 2009 and most interestingly of all, that if the Brent contango narrows any more that this will start to challenge the economics of floating storage. Again, not your usual oil-price decline effect.

Jakob also notes that our favourite trade of 2009, the great ETF USO Fund inflow arbitrage, may be back because financial inflows into the fund are looking robust. We do wonder if that trade will be quite as successful this time round for the algo trading firms which like to play their own version of the contango trade by means of the fund.

Last of all, we want to draw attention to comments from Iranian Oil Minister Bijan Zanganeh two days ago, which noted:

“Even if the oil price goes down to $25 a barrel, the oil industry will not be threatened,” the Fars news agency quoted him as saying.What’s striking about that statement, of course, is the very specific reference to $25 crude prices. Why $25? Why not $30? or $35? Perhaps because the last time Brent crude was at $25 was …:

… well, June, 2003. Which, of course, is just before crude prices broke range and started their epic rally.

On more prolonged terms, we should note, the last time oil was anywhere near $25 was between 2001 and 2002.

That’s worth noting because December 2001 was when Enron collapsed.

So what’s this a subtle reference to really? Could it be, perchance, the fact that the entire oil and commodity rally was something of a financial speculator-induced sham which detached commodities entirely from their fundamentals?

Some clues as to why that might be the case come by way of news headlines from the 2001-2003 period and a hint of the market-structure changes that were going on at that time....MUCH, MUCH MORE

*Google Webcache of Goldman Korea's PDF

Here's Scribd via Baidu.