Thursday Oct. 16, 2014 5:07 am PDT

"Citigroup Sees $1.1 Trillion Stimulus From Oil Plunge"

Brent $82.75 down $1.03, Nov. WTI $80.37 down $1.41 after trading as low as $79.78.From Pragmatic Capitalism:

Equity index futures indicating down 152 on the DJIA and down 21.25 on the S&P 500.

With every downtick starting to feel the old "Long ain't wrong" vibe....

You didn’t think I was going to let you go into the weekend all depressed now did you? I mentioned last week that the recent downturn in stocks appears to be a purely non-USA event. That is, the US economic data that’s been coming out in recent weeks really looks no different than anything we’ve been seeing for the last few years. Specifically, we saw three of my favorite macro indicators this week all come in at record high levels or strong levels....MORE

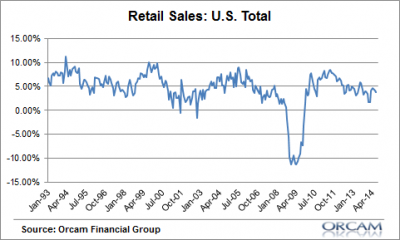

Retail sales missed expectations on a monthly basis, but are still growing at a 4.5% annual clip. Healthy by any standard:

Initial jobless claims fell to a 14 year low...

Back on August 15 we hypothesized (okay, guessed):

The Peak-to-Trough Magnitude of the Recent Decline Was 4.3%":

I'd expect the next one to be deeper but also reward "Buy-the-dips" setting up a nasty little experience on the next-next one for folks coming in at down 10% who watch in horror as the drop doubles to 20%....We just went through the "next one" with a low on the S&P at 1820 (currently 1893) so if past performace is indicative of future results I'd look for new highs and then a slow downmove the turns first into the river rapids and then the waterfall decline. to take us to 1600 or thereabouts.