From Yahoo Finance:

Buy the Dip? What Dip?

...MUCH MORE...What Dip?

The S&P 500 reached a peak-to-trough decline of 4.3% last Thursday. The “buy the dip” question continues to be posed, but again, is it even a dip yet? As you can see by the table below which outlines corrections since March 2009, it has been over two years since the S&P 500 has suffered a pullback of 10%. Given that backdrop and the longest streak above the 200-day moving average in history, investors have redefined the word “dip” to mean any decline that lasts more than a day.

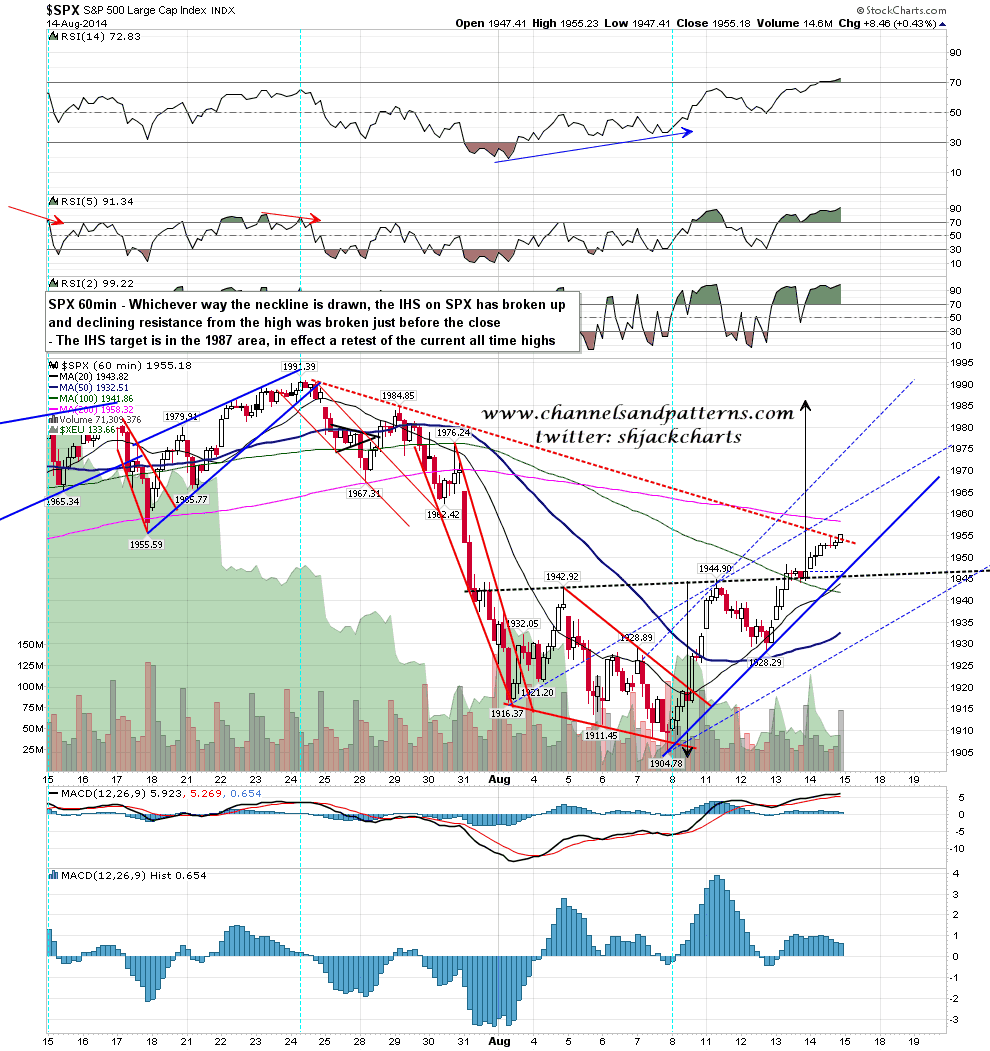

Here's a graphic representation from Slope of Hope:

Never Play Chicken With Trains