And Larry Summers is a poopyhead.

From FT Alphaville:

The real reasons why the US Treasury’s debt maturity has been rising

Depending on whom you ask, the lengthening maturity of US government debt is either a smart response to unusually loose financial conditions or an unhelpful countervailing force to Federal Reserve policy.

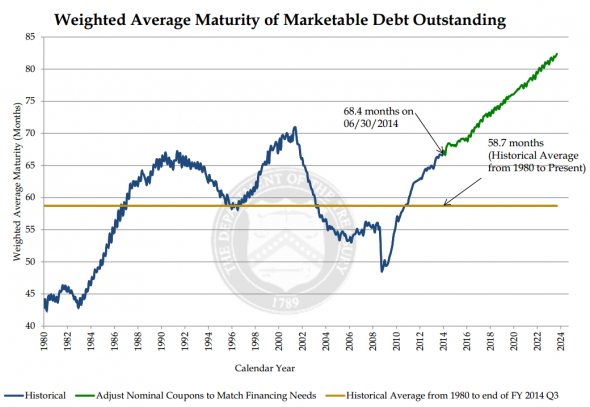

Either way, the assumption is that the chart below (from page 23 the Treasury’s most recent Quarterly Refunding Report) reflects the deliberate choices of policymakers rather than anything else:

Reality is a little more complicated. Just look at the footnote accompanying the chart to explain the forecast embedded in the green line:

This scenario does not represent any particular course of action that Treasury is expected to follow. Instead, it is intended to demonstrate the basic trajectory of average maturity absent changes to the mix of securities issued by Treasury.You might think that the weighted average maturity has risen so much — and is expected to keep rising — because the new debt the Treasury has been issuing since 2009 has a longer average maturity than the existing debt. You would be wrong....MORE