A bear retires, unbowed and growling

The final report from Smithers & Co has landed, as the septuagenarian scourge of “stockbroker economics” eases into retirement.

We are assured that he’ll still be blogging for the FT, but the regular research output will cease. The valedictory note is, as you might expect, on the bearish side of things:

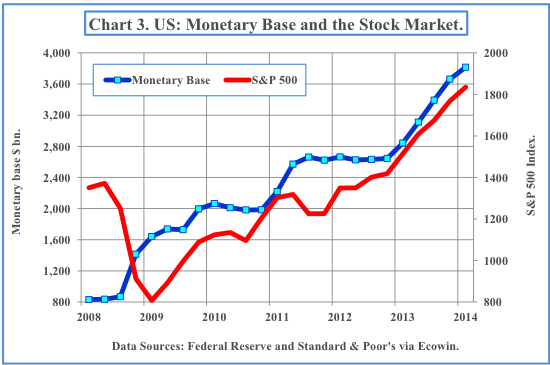

The US equity market is overvalued to an extent only experienced five times before in the past 212 years. On two occasions, however, it has risen well above the current degree of overvaluation.That analysis doesn’t mean the market can’t go higher. Andrew Smithers expects quantitative easing and corporate buying to continue to provide support. However,

QE is due to end in October and we see any further progress thereafter as being dependent on corporate buying. As corporate leverage is increasing rapidly, equity buying represents a steady fall in the liquidity preference of companies....MUCH MORE including charts and selfies.

Here's the picture they used for his "Lunch with the FT" back in February: