1) I have to convince you these beans are indeed magic andI'll probably approach this task by some combination of bloviation on the merits and insults directed at those too slow to understand.

2) That the asking price is low enough to appear to be a bargain.

And a spreadsheet. I'll show you a spreadsheet.

From FT Alphaville:

The curious case of capital gain-like profit

Iren Levina, economics lecturer at Kingston University, brings to our attention a fascinating, if under-appreciated, phenomenon in finance.

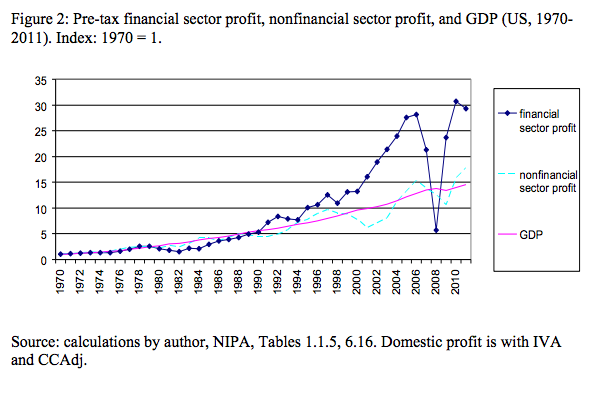

She describes this as the “puzzling rise in financial profits and the role of capital gain-like revenues” throughout most of the 2000s, which were totally delinked from real economic growth during the period.

Okay. Why so puzzling you ask? Don’t we know these profits were the result of too much risk taking? And haven’t there been hundreds of papers about this sort of thing?

Well, yes. But this isn’t quite Levina’s argument.

In a paper published in April this year, she argues the reason financial profits became disassociated from real economic growth was because of the way in which they were created and the way they were transferred through the financial system.

More to the point, because they were enabled by the phenomenon of capital-gain like revenues.

In her eyes the monetary assets which facilitated these revenues, meanwhile, have been incorrectly understood by the financial system. They were not, as many believed, borrower liabilities matched by real assets at financial institutions, but rather borrower liabilities matched by something altogether different.

As she explained it to us:

“These assets are neither debt nor equity for these financial institutions, they are liabilities of the ultimate borrowers”This echoes our own point that the double-entry accounting system is not always well equipped to measure modern-day financial assets.

So what are capital gain-like revenues? At their heart, Levina says, they are monetized expected future gains locked in as current profits, hence the lack of a counterpart in current GDP.

Before we analyse the profound implications of that statement, here’s how financial profits delinked from real economy profits in the period she refers to look like:

So how does the financial system reconcile the discrepancy?

According to Levina, economists have traditionally explained this in two ways....MUCH MORE