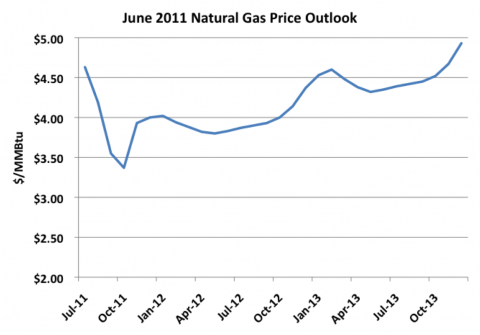

On the other hand who can look upon this chart of a decline during the air conditioning season and not think "down/up/down...":

$3.819 last down 5.8 cents.

From RBN Energy:

Two years ago in June 2011 the forward curve for NYMEX natural gas pointed to $5/MMBtu for gas in 2012 – rising to $8/MMBtu by 2022. This week (June 2013) the forward curve structure looks much the same except that expected prices in 2022 are down two bucks at $6/MMBtu. In between those forward curves, spot prices for natural gas plunged to less than $2/MMBtu in April 2012 and climbed back up to $4/MMBtu a few weeks ago. Today we consder how changing production and new patterns of demand look set to change gas market price structures for good.

This is the fifth and final episode in a series based on Rusty’s keynote presentation at Benposium on May 14, 2013 titled “Why What We Thought We Knew About the North American Hydrocarbon Market No Longer Matters”. Despite the complicated title, it boiled down to a simple premise. If we look back to see what folk were forecasting for North American energy markets two years ago in 2011 and then compare that to today’s actual data and forecast, what would that tell us about the changing pace of North American energy production?

Looking at the data from Bentek – produced as always at the time in good faith based on what the market was telling them – we see that the scale of change going on in North American energy production exceeded everyone’s expectations. We looked at crude oil production forecasts in the Williston Basin and the Eagle Ford, the natural gas production forecast in the Marcellus and the US NGL production forecast from Bentek around the time of the June 2011 Benposium. What we found was that in every case – crude oil, natural gas and NGLs - today’s forecast numbers for what we expect by 2016 are way higher than they were back in 2011.

In the first episode in the series (see Too Wrong for Too Long? – How 2011 Bakken Crude Forecasts Compare to Today) we looked at surging crude production in the Bakken. In the second episode in the series we looked at how rapid growth in the Marcellus natural gas production forecast is going to have dramatic consequences for traditional natural gas flows into the northeast in the coming years (see How Marcellus Forecasts Changed the World Sooner Than We Thought). Episode 3 looked at how the Eagle Ford crude and condensate production forecast nearly doubled in just two years. Along the way a lot more of that crude production turned out to be condensate than anyone had guessed or planned for (see Too Wrong for Too Long – The Eagle Ford Crude Condensate Challenge). In Episode 4 we looked at the consequences of higher than expected NGL supplies on traditional demand for these products and the resultant increase in exports (see The NGL Surge We Didn’t Expect).

Today we finish up the series by reflecting on the impact of unexpected changes in natural gas pricing over the past two years.

We talked earlier in this series about the recent dramatic increase in US natural gas production. Dry gas production in the Lower 48 increased by 17 percent from 56 Bcf/d in January 2010 to 66 Bcf/d in December 2011 (data from the Energy Information Administration - EIA). Since then production has leveled off – except in the Marcellus where it continues to increase – reaching almost 12 Bcf/d this year. Back in June 2011 Bentek made a pretty accurate call on gas – projecting that the supercharged rate of natural gas growth happening two years ago would slow down to a crawl. What they didn’t see coming – and to be fair no-one else did- was the dramatic change in natural gas price outlook that came in early 2012.

The chart below shows the Bentek forecast in June 2011. Increased production was expected to dampen prices through the start of the winter season in October 2011. Then prices were expected to increase steadily through 2012 and 2013 to reach nearly $5/MMBtu in October 2013. For June 2013 – Bentek forecast prices at $4.35/MMBtu – about 50 cents above where the NYMEX settled today ($3.877 – June 20, 2013).

Source: CME Futures Data from Morningstar (Click to Enlarge)The next chart (below) shows what actually happened to prices between June 2011 and today with futures prices added out to October 2013 (green box). Instead of drifting lower and then rising again in response to winter demand, prices dropped like a stone from June 2011 through April 2012. The price crash took the NYMEX Henry Hub futures price below $2/MMBtu for a short period. Since then low prices have steadily recovered although not quite to the levels anticipated back in 2011. You have hardly heard $5/MMBtu from any analysts in 2013 and the forward prices through the end of this year (NYMEX futures – in the green box) are currently flat at around $4/MMBtu.What threw everybody off and caused prices to nosedive in 2011 was the weather. Specifically warm weather – the mildest winter on record. The weather played havoc with the natural gas seasonal supply balance. As we explained recently in Eric Penner’s ongoing blog series about natural gas storage (see Come on Feel The Noise) the normal expectation is that higher demand for space heating in the winter increases natural gas consumption. That demand exceeds the capacity of pipelines to deliver the gas – hence most local gas delivery companies in consuming regions such as the northeast and the Midwest use storage to balance supplies. Storage is typically filled during the summer months when production exceeds demand. What happened in 2011-2012 was that it did not get cold enough to withdraw a whole lot of gas from storage. That left record storage levels at the end of the winter. With supplies piling up in storage and production still at record levels, prices went into free fall....MORE