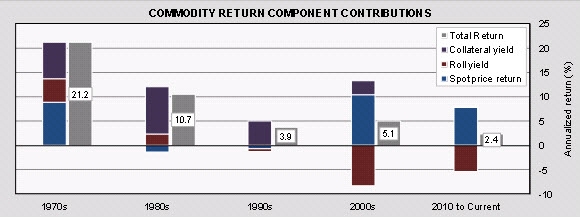

There are only three components to a profit in futures:

1) The interest earned on the collateral you deposit

2) The price movement of the physical commodity

3) The yield from rolling the contract forward in time.

That's it, and right now high quality collateral is paying ~zip, zilch, nada.

So what's left? How bout this little beauty:

The Credit Suisse Commodity Rotation Exchange Traded Notes (the "ETNs") are senior, unsecured debt securities issued by Credit Suisse AG ("Credit Suisse"), acting through its Nassau Branch, that are linked to the Credit Suisse Commodity Backwardation Total Return Index (the "Index"). The Index is a long-only commodity index that follows a rules-based strategy to select 8 out of 24 eligible commodities based on the price of the commodity futures contracts of various terms. The Index provides exposure to the commodities for which the prices of futures contracts that are nearer to expiration are highest relative to the prices of futures contracts for the same commodity that are longer to expiration. The Index is equally weighted and rebalanced monthly. The ETNs do not guarantee any return of principal. Any payment on the ETNs is subject to our ability to pay our obligations as they become due.As I said, creative.

See also April's "Fancy Finance: Credit Suisse Rolls Out Silver-linked ETN (SLVO)".

And it just might beat directional bets which quickly teach you that trading price movements is very, very tough and is more about risk management than it is about forecasting supply and demand.

Anyhoo, a 0.85% annual fee may be a bit steep or it may be just the ticket if you find yourself in need of a senior unsecured obligation of Credit Suisse's Nassau branch.

Zacks has more info and here is the CSCR fact sheet.

And here's Northern Trust's graphic presentation of the components of return: