From FT Alphaville:

Most of the discussion about quantitative easing and the housing market in the last few years has naturally focused on how the appeal of lower rates is helpful, but does nothing about the more structural impairments in mortgage markets.....MUCH MORE

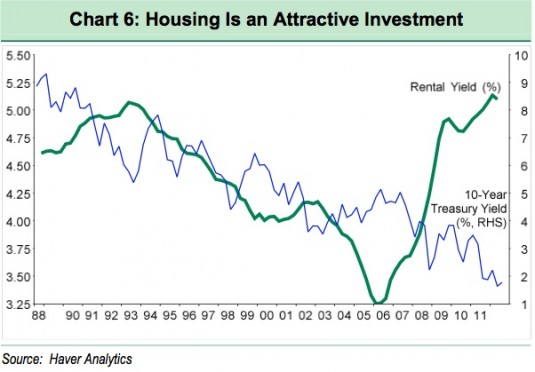

But monetary policy functions in numerous ways, one of which is the portfolio balance channel — whereby investors are incentivised to invest in riskier asset classes because the yields on safe assets have pushed down. BNP Paribas have an interesting note arguing that this too is having an impact on housing, specifically via the rental market:

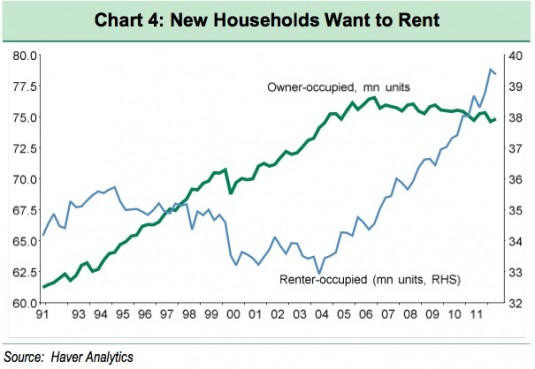

Virtually all new household formation is going to rental housing. The number of owner-occupied housing units is still more than 2% below its peak and appears still to be on a downward drift. Meanwhile, renter-occupied housing units have been increasing by an average 900k per year over the past three years. Demand for rental units has revived the multifamily construction sector, and now appears to be clearing the owner-occupied market, too, as investors seek to shift the existing stock of owner-occupied housing to the rental market.

Rents have continued to rise as increased demand has met with limited supply. The supply mismatch has led to continued downward pressure on home prices. We now appear to have reached the point where investors see value in buying real estate for conversion to rental units. Gross rental yields, calculated as annual rent divided by home prices, have now reached their highest levels as far back as we have data, even as yields on other assets have been declining steadily.

QE has been quite successful driving down yields on safe assets and forcing investors into riskier assets, such as corporate bonds and equities. It appears that housing is becoming an important beneficiary as investors are driven toward the now relatively much more attractive investment of rental housing. The fact that home prices have stopped falling should also help boost investor demand as the risk of capital losses offsetting the higher yields is reduced.