Again, we hope all of our US readers are staying safe.See also Professor Pielke, Jr's "Top 10 Damaging Hurricanes Within 50 Miles of Sandy's Landfall"

Estimating the economic impact of a storm is always imprecise, even after the storm has passed. With that caveat in mind, we’ve come across a few early forecasts and thought we’d pass them along.

First from catastrophe risk modeller Eqecat, this landed in our inbox about an hour ago:

Sandy is a large storm, impacting 20 percent of the U.S. population. Economic damages are expected to be $10-20 billion dollars, insured losses are expected to be between $5-10 billion.From RBC Capital, which looks at the varying impacts of previous storm seasons:

By comparison, the estimated economic damages for large-scale storms similar to Sandy were: Hurricane Irene at $10 billion, and Hurricane Ike in 2008, $20 billion.

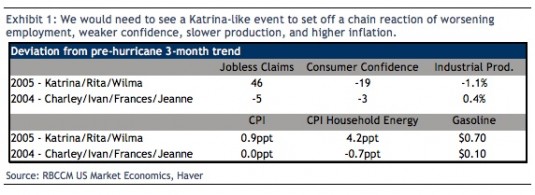

Hurricane Sandy is obviously still a very fluid situation, meaning the economic impact is impossible to determine at this point. However, as we have seen in the recent past, it typically takes a storm on the scale of hurricane Katrina to move the needle in terms of economic data. But the subsequent bounce back in the hi-frequency data typically occurs in short order.

There is also the question of rebuilding, which most think of as a boon for GDP. The problem here is that while rebuilding efforts in aggregate can easily become a significant percentage of GDP, the impact is generally spread out over multiple quarters or even years, thereby diminishing the economic impact in the short-term.

Back in 2010 we looked at the impact on key economic data during two of the busier hurricane seasons of the last decade (2004 and 2005). The results were quite interesting and for your convenience we have summarized the original piece below....MUCH MORE

and last week's

Estimating U.S. Property Damage from Hurricane Sandy (CB; ALL; TRV)